Question: This document contains ink, s... In this task you have to use the transactions from table 1 in order to: 1. Journalize the July transactions,

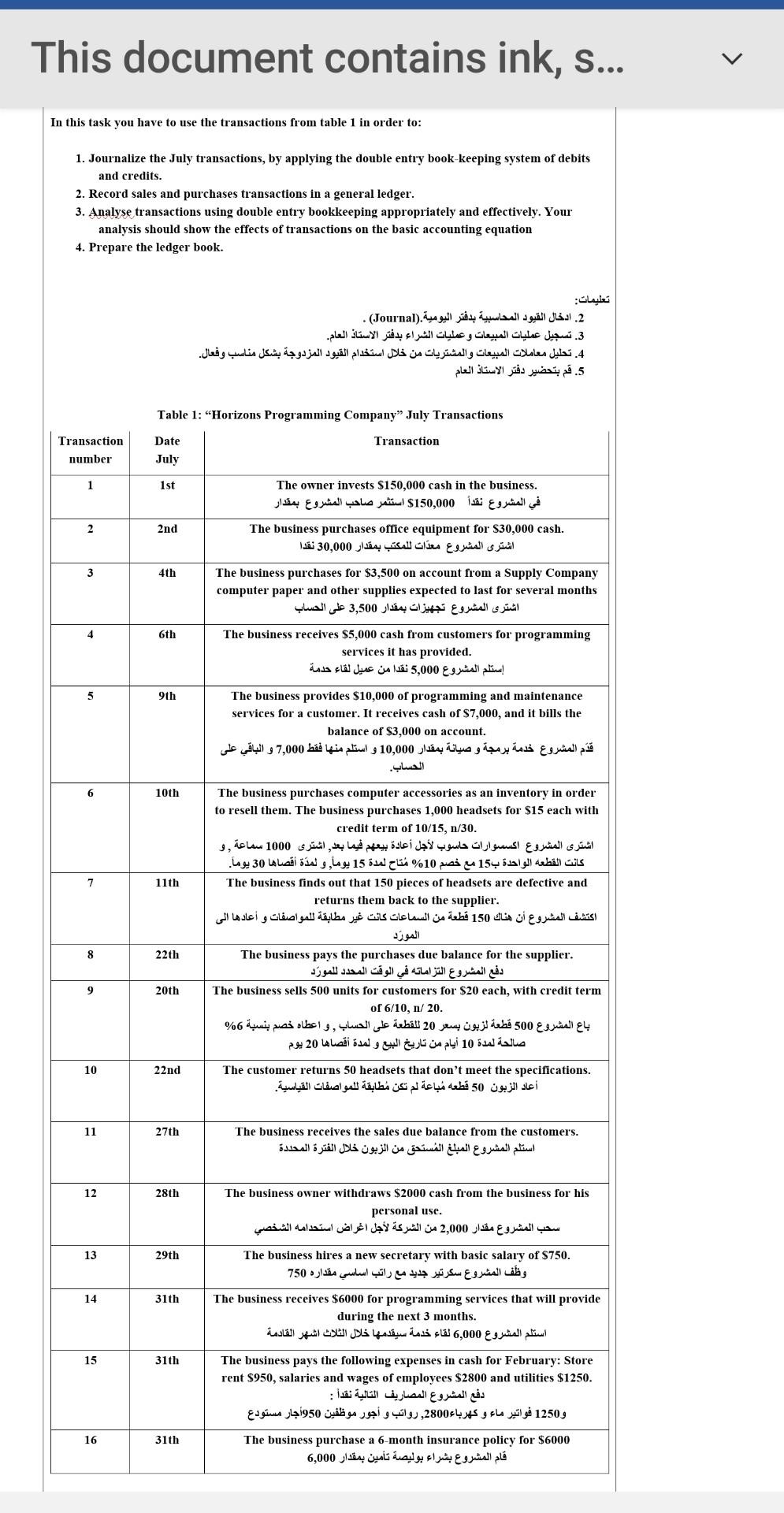

This document contains ink, s... In this task you have to use the transactions from table 1 in order to: 1. Journalize the July transactions, by applying the double entry book-keeping system of debits and credits. 2. Record sales and purchases transactions in a general ledger. 3. Analyse transactions using double entry bookkeeping appropriately and effectively. Your analysis should show the effects of transactions on the basic accounting equation 4. Prepare the ledger book. : 2. .(Journal) . 3. . 4. 5. Table 1: "Horizons Programming Company" July Transactions Date Transaction Transaction number July 1 1st The owner invests $150,000 cash in the business. 150,000$ 2 2nd The business purchases office equipment for $30,000 cash. 30,000 3 4th The business purchases for $3,500 on account from a Supply Company computer paper and other supplies expected to last for several months 3,500 4 6th The business receives $5,000 cash from customers for programming services it has provided. 5,000 5 9th The business provides $10,000 of programming and maintenance services for a customer. It receives cash of $7,000, and it bills the balance of $3,000 on account. 10,000 7,000 6 10th The business purchases computer accessories as an inventory in order to resell them. The business purchases 1,000 headsets for $15 each with credit term of 10/15, n/30. , 1000 , 15 10% 15 , 30 . 7 11th The business finds out that 150 pieces of headsets are defective and returns them back to the supplier. 150 8 22th The business pays the purchases due balance for the supplier. 9 20th The business sells 500 units for customers for $20 each, with credit term of 6/10, 1/ 20. 500 20 , 96 10 20 10 22nd The customer returns 50 headsets that don't meet the specifications. 50 11 27th The business receives the sales due balance from the customers. | 12 28th The business owner withdraws $2000 cash from the business for his personal use. 2,000 13 | 29th The business hires a new secretary with basic salary of $750. 750 14 31th The business receives $6000 for programming services that will provide during the next 3 months. 6,000 15 31th The business pays the following expenses in cash for February: Store rent $950, salaries and wages of employees $2800 and utilities $1250. : 1250 2800, 950 16 31tli The business purchase a 6-month insurance policy for $6000 6,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts