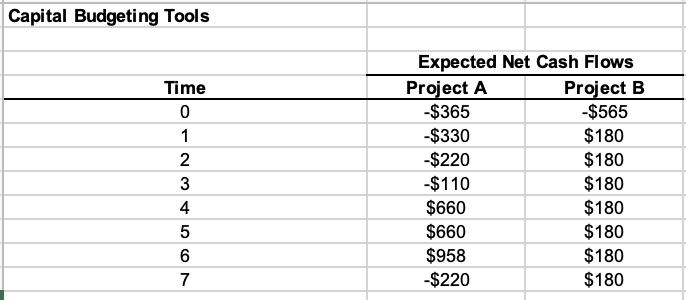

Question: This does not need to be completed in excel if you would not like Capital Budgeting Tools Time 0 1 2 3 4 5 6

This does not need to be completed in excel if you would not like

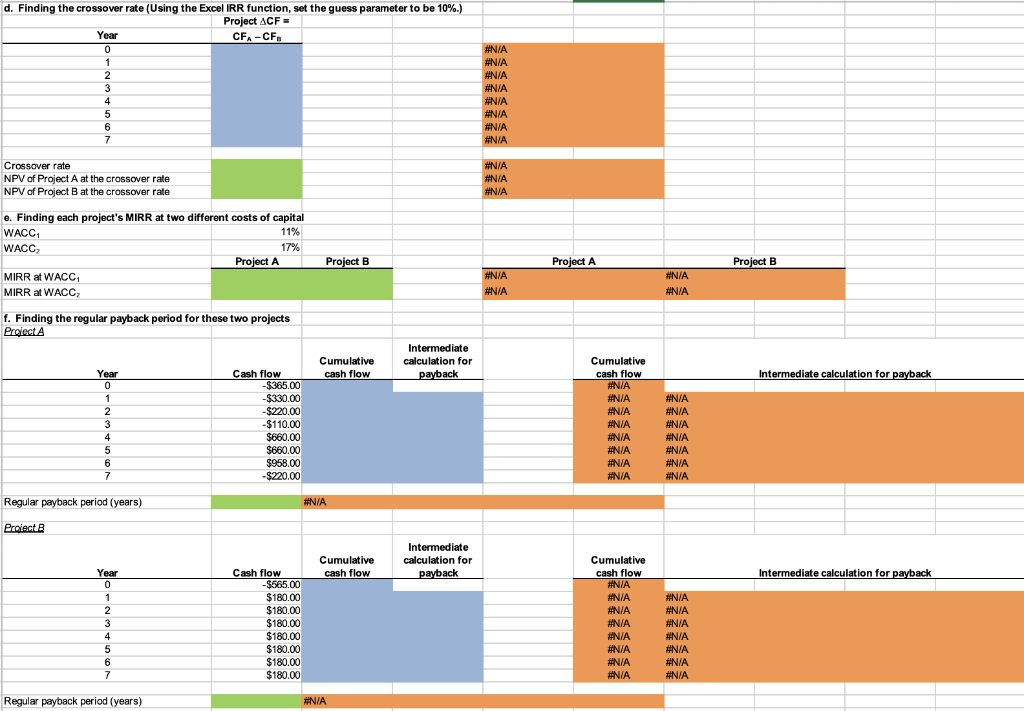

Capital Budgeting Tools Time 0 1 2 3 4 5 6 7 Expected Net Cash Flows Project A Project B -$365 $565 -$330 $180 -$220 $180 $110 $180 $660 $180 $660 $180 $958 $180 -$220 $180 LON d. Finding the crossover rate (Using the Excel IRR function, set the guess parameter to be 10%.) Project ACF = Year CFA-CF 0 1 2 3 4 5 6 7 #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A Crossover rate NPV of Project A at the crossover rate NPV of Project B at the crossover rate #N/A #N/A #N/A e. Finding each project's MIRR at two different costs of capital WACC 11% WACC 17% % Project A A MIRR at WACC1 MIRR at WACC) Project B Project A Project B #N/A #N/A #N/A #N/A f. Finding the regular payback period for these two projects Pralect Cumulative cash flow Intermediate calculation for payback Intermediate calculation for payback TANIA Year 0 1 2 3 3 4 5 6 7 Cash flow -$365.00 $330.00 -$220.00 -$110.00 $660.00 $660.00 $958.00 -$220.00 Cumulative cash flow # #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A Regular payback period (years) #N/A Proiecte Cumulative cash flow Intermediate calculation for payback Intermediate calculation for payback Year 0 1 2 3 4 5 6 7 Cash flow -$565.00 $180.00 $180.00 $180.00 $180.00 $180.00 $180.00 $180.00 Cumulative cash flow #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N/A #N #N/A #N/A #N/A #N/A #N/A #N/A Regular payback period (years) #N/A #N/A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts