Question: This exercise let you practice your accounting and Excel knowledge/skill. You have recently taken a position in a bank. Your first client would like assistance

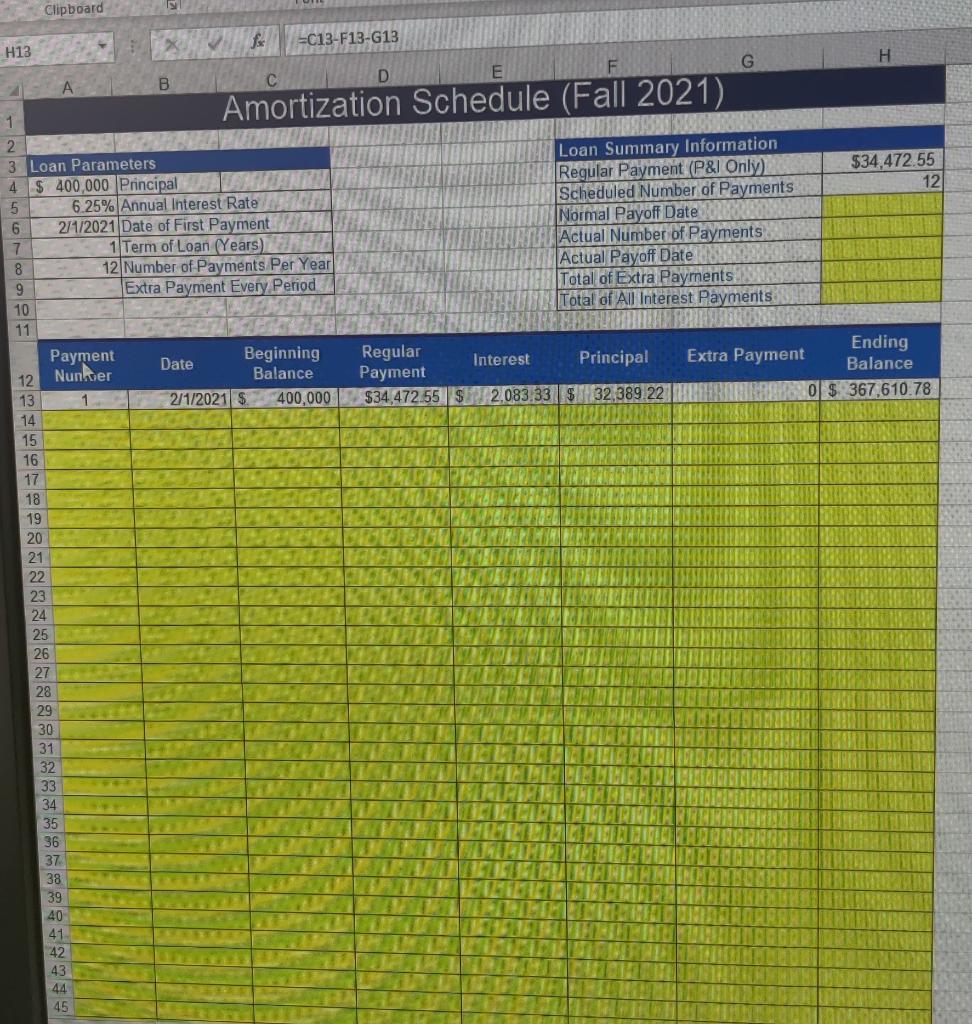

This exercise let you practice your accounting and Excel knowledge/skill. You have recently taken a position in a bank. Your first client would like assistance planning for a loan. You want to set up a detailed loan amortization table. Open the attached Excel file LoanAmortizationFall2021.xlsx. This file contains a worksheet with a loan parameters area (i.e., input section), a summary section, and an amortization table with column labels. You must use this template to complete a detailed loan amortization table and the summary section. Any other format of your amortization schedule will not be acceptable. You amortization table should be able to display the data for a loan up to 30 years. The data in the Summary section should be automatically changed when a user changes any value in the Input section. You should hide zeros from displaying if your client takes out a shorter-term loan or pay it off early. The Ending Balance cannot be negative values.

Clipboard fo -C13-F13-G13 H13 G H D E BUF A B Amortization Schedule (Fall 2021) $34,472.55 12 HERS Loan Summary Information Regular Payment (P& Only) Scheduled Number of Payments Normal Payoff Date Actual Number of Payments Actual Payoff Date Total of Extra Payments Total of All Interest Payments Interest Principal Ending Extra Payment Balance 0 $ 367,610.78 BANNERS 2.083.33 $ 32,389.22 1 2 3 Loan Parameters 4 $ 400,000 Principal 5 6.25% Annual Interest Rate : 6. 2/1/2021 Date of First Payment 7 1 Term of Loan (Years) 8 12 Number of Payments Per Year 9 Extra Payment Every Period 10 11 Payment Beginning Regular Date 12 Nunker Balance Payment 13 2/1/2021 $ 400,000 $34.472.55 $ 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 MALTA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts