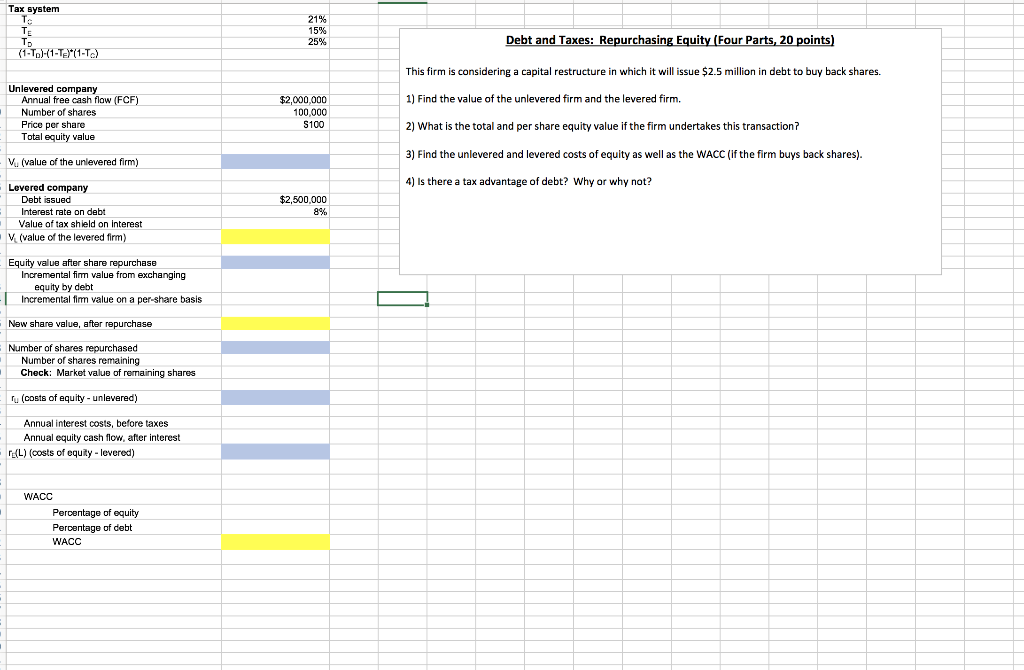

Question: This firm is considering acapital restructure in which it will issue $2.5 millionin debt to buy back shares. 1) Find the value of the unlevered

This firm is considering acapital restructure in which it will issue $2.5 millionin debt to buy back shares.

1) Find the value of the unlevered firmand the levered firm.

2) What is the total and per share equity value if the firm undertakes this transaction?

3) Find the unlevered and levered costs of equity as well as the WACC (if the firm buys back shares).

4) Is there a tax advantage of debt? Why or why not?

Tax system 21% 15% 25% Debt and Taxes: Repurchasing Equity (Four Parts, 20 points) (1-T.)H(1-TEX(1-2) This firm is considering a capital restructure in which it will issue $2.5 million in debt to buy back shares. 1) Find the value of the unlevered firm and the levered firm. Unlevered company Annual free cash flow (FCF) Number of shares Price per share Total equity value $2,000,000 100,000 S100 2) What is the total and per share equity value if the firm undertakes this transaction? 3) Find the unlevered and levered costs of equity as well as the WACC (If the firm buys back shares). Vu (value of the unlevered firm) 4) Is there a tax advantage of debt? Why or why not? Levered company Debt issued Interest rate on debt Value of tax shield on interest V (value of the levered firm) $2,500,000 8% Equity value after share repurchase Incremental firm value from exchanging equity by debt Incremental firm value on a per-share basis - New share value, after repurchase Number of shares repurchased Number of shares remaining Check: Market value of remaining shares ru (costs of equity - unlevered) Annual interest costs, before taxes Annual equity cash flow, after interest (L) (costs of equity - levered) - WACC Percentage of equity Percentage of debt WACC Tax system 21% 15% 25% Debt and Taxes: Repurchasing Equity (Four Parts, 20 points) (1-T.)H(1-TEX(1-2) This firm is considering a capital restructure in which it will issue $2.5 million in debt to buy back shares. 1) Find the value of the unlevered firm and the levered firm. Unlevered company Annual free cash flow (FCF) Number of shares Price per share Total equity value $2,000,000 100,000 S100 2) What is the total and per share equity value if the firm undertakes this transaction? 3) Find the unlevered and levered costs of equity as well as the WACC (If the firm buys back shares). Vu (value of the unlevered firm) 4) Is there a tax advantage of debt? Why or why not? Levered company Debt issued Interest rate on debt Value of tax shield on interest V (value of the levered firm) $2,500,000 8% Equity value after share repurchase Incremental firm value from exchanging equity by debt Incremental firm value on a per-share basis - New share value, after repurchase Number of shares repurchased Number of shares remaining Check: Market value of remaining shares ru (costs of equity - unlevered) Annual interest costs, before taxes Annual equity cash flow, after interest (L) (costs of equity - levered) - WACC Percentage of equity Percentage of debt WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts