Question: This is a 3 part question, please open image to see full question. Specifiy and label answers for part A, B and C The first

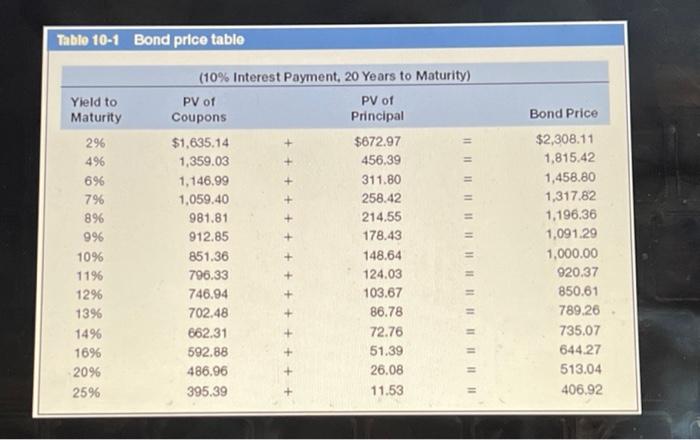

Refer to Table 10.1, which is based on bonds paying 10 percent interest for 20 years. Assume interest rates in the market (yield to maturity increase from 7 to 20 percent a. What is the bond price at 7 percent? Bond price b. What is the bond price at 20 percent? Bond price c. What would be your percentago return on the investment if you bought when rates were 7 percent and sold when rates were 20 percent? (Do not round intermediate calculations, Input your answer as a percent rounded to 2 decimal places.) Return on investment % Tablo 10-1 Bond price table Bond Price (10% Interest Payment, 20 Years to Maturity) PV of PV of Coupons Principal $1,635.14 $672.97 1,359.03 456.39 1,146.99 311.80 1,059.40 258.42 981.81 214.55 912.85 178.43 851.36 148.64 796.33 124.03 746.94 103.67 702.48 86.78 662.31 72.76 592.88 51.39 486.96 26.08 395.39 11.53 Yield to Maturity 296 496 696 7% 896 996 10% 1196 1296 13% 14% 1696 2096 2596 + + + $2,308.11 1,815.42 1,458.80 1,317.82 1,196.36 1,091.29 1,000.00 920.37 850.61 789.26 735.07 644.27 513.04 406.92 + + + + + Refer to Table 10-1, which is based on bonds paying 10 percent interest for 20 years. Assume interest rates in the market yleld to maturity increase from 7 to 20 percent a. What is the bond price at 7 percent? Bond price b. What is the bond price at 20 percent? Bond price c. What would be your percentage return on the investment if you bought when rates were 7 percent and sold when rates were 20 percent? (Do not round intermediate calculations. Input your answer as a percent rounded to 2 decimal places.) Return on investment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts