Question: This is a case study 4.1 from Global Marketing, 8th Edition book pages 135-138. Case Study 4.1 William Demant hearing aids: different threats appear on

This is a case study 4.1 from Global Marketing, 8th Edition book pages 135-138.

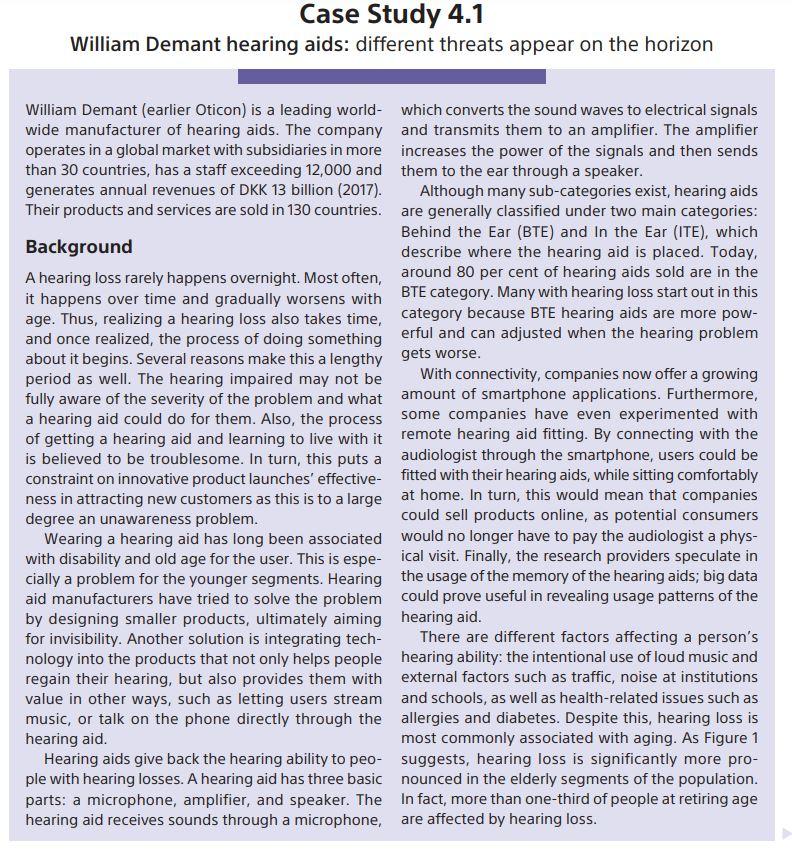

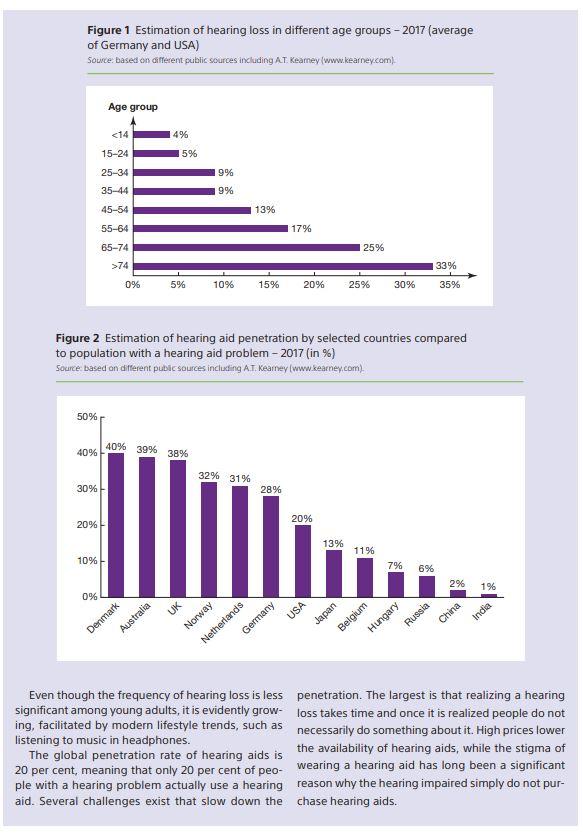

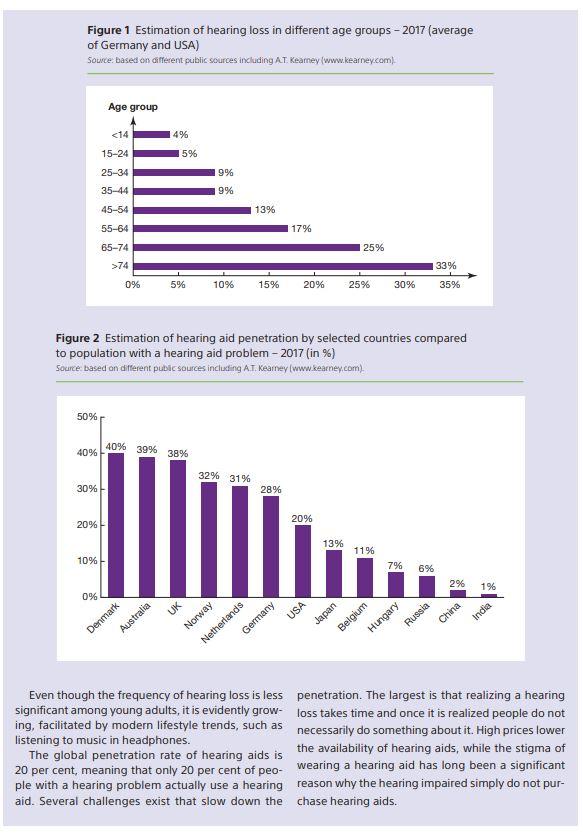

Case Study 4.1 William Demant hearing aids: different threats appear on the horizon William Demant (earlier Oticon) is a leading world- which converts the sound waves to electrical signals wide manufacturer of hearing aids. The company and transmits them to an amplifier. The amplifier operates in a global market with subsidiaries in more increases the power of the signals and then sends than 30 countries, has a staff exceeding 12,000 and them to the ear through a speaker. generates annual revenues of DKK 13 billion (2017). Although many sub-categories exist, hearing aids Their products and services are sold in 130 countries. are generally classified under two main categories: Behind the Ear (BTE) and in the Ear (ITE), which Background describe where the hearing aid is placed. Today, A hearing loss rarely happens overnight. Most often, around 80 per cent of hearing aids sold are in the it happens over time and gradually worsens with BTE category. Many with hearing loss start out in this age. Thus, realizing a hearing loss also takes time, category because BTE hearing aids are more pow- and once realized, the process of doing something erful and can adjusted when the hearing problem about it begins. Several reasons make this a lengthy gets worse. period as well. The hearing impaired may not be With connectivity, companies now offer a growing fully aware of the severity of the problem and what amount of smartphone applications. Furthermore, a hearing aid could do for them. Also, the process some companies have even experimented with of getting a hearing aid and learning to live with it remote hearing aid fitting. By connecting with the is believed to be troublesome. In turn, this puts a audiologist through the smartphone, users could be constraint on innovative product launches' effective- fitted with their hearing aids, while sitting comfortably ness in attracting new customers as this is to a large at home. In turn, this would mean that companies degree an unawareness problem. could sell products online, as potential consumers Wearing a hearing aid has long been associated would no longer have to pay the audiologist a phys- with disability and old age for the user. This is espe- ical visit. Finally, the research providers speculate in cially a problem for the younger segments. Hearing the usage of the memory of the hearing aids; big data aid manufacturers have tried to solve the problem could prove useful in revealing usage patterns of the by designing smaller products, ultimately aiming hearing aid. for invisibility. Another solution is integrating tech- There are different factors affecting a person's nology into the products that not only helps people hearing ability: the intentional use of loud music and regain their hearing, but also provides them with external factors such as traffic, noise at institutions value in other ways, such as letting users stream and schools, as well as health-related issues such as music, or talk on the phone directly through the allergies and diabetes. Despite this, hearing loss is hearing aid. most commonly associated with aging. As Figure 1 Hearing aids give back the hearing ability to peo- suggests, hearing loss is significantly more pro- ple with hearing losses. A hearing aid has three basic nounced in the elderly segments of the population. parts: a microphone, amplifier, and speaker. The In fact, more than one-third of people at retiring age hearing aid receives sounds through a microphone, are affected by hearing loss. Figure 1 Estimation of hearing loss in different age groups - 2017 (average of Germany and USA) Source: based on different public sources including AT Kearney (www.kearney.com). Age group 74 33% 0% 5% 10% 15% 20% 25% 30% 35% Figure 2 Estimation of hearing aid penetration by selected countries compared to population with a hearing aid problem - 2017 (in %) Source based on different public sources including AT Kearney (www.kearney.com) 50% 40% 39% 40% 38% 32% 31% 30% 28% 20% 20% 13% 11% 10% 7% 6% 2% 1% 0% Belgium India Denmark Australia UK Norway Netherlands Germany USA Japan Hungary Russia China Even though the frequency of hearing loss is less penetration. The largest is that realizing a hearing significant among young adults, it is evidently grow- loss takes time and once it is realized people do not ing, facilitated by modern lifestyle trends, such as necessarily do something about it. High prices lower listening to music in headphones. The global penetration rate of hearing aids is the availability of hearing aids, while the stigma of 20 per cent, meaning that only 20 per cent of peo- wearing a hearing aid has long been a significant ple with a hearing problem actually use a hearing reason why the hearing impaired simply do not pur- aid. Several challenges exist that slow down the chase hearing aids. 17 18 23 23 17 14 16 USA 11 on 9 9 9 8 N 100 100 Compared to other developed countries, such as Table 1 Global market share development in Denmark or Australia, the penetration rate of hear- hearing aids (%) ing aids is low in countries like the US market (see Figure 2). The main drivers here are the differences in Manufacturer health insurance, and the fact that reimbursements country) Home country 2007(%) 2017 (%) in the large non-public market are very low, like in the US market Sonova (earlier Switzerland 24 Phonak) The hearing aid industry William Demant Denmark The global hearing aid industry has been through a fearlier Oticon) heavy consolidation process. Back in 1995, the six Siemens Germany largest players made up 45 per cent of the market. Today they control around 98 per cent. Also, no new GN ReSound Denmark players have entered the market in the last three Starkey decades. All the six largest players are present in all the important world markets. The industry enjoys Widex Denmark significant margins; however, similarities in products Other mean that competition puts an increased pressure on prices. Total Through recent years, the publicly listed compa- nies have been outgrowing the industry. In global source based on different public sources including A.T. Kearney ( market shares, Sonova has gained the most, increas- ing from 17 per cent in 2007 to 24 per cent in 2017 (see Table 1). William Demant has done nearly as well. GN ReSound has also grown its share, while Siemens has been the biggest loser. The general pattern for all manufacturers is that new products are first launched in the premium segment, and then gradually move down over time to become basic products. In effect, all the six largest manufacturers are present on all key segments. In 2017, the worldwide sale of hearing aids was 14 million units, representing a total revenue of US$5.5 billion. The world's biggest market is the USA which makes up 26 per cent of the world market. Source: Cineberg/Shutterstock. Different opportunities and threats for William Demant in the horizon 2. Partnership with Philips In August 2018, William Demant and Philips Health 1. Distribution of hearing aids care announced a licensing agreement to bring The Italian company, Amplifon, is the owner of 3,500 Philips branded hearing healthcare solutions to the hearing aid stores and is the world's largest retailer market. In this cooperation William Demant whould of hearing aids, which it buys from manufacturers bring the hearing aid technology (as licensor) and like William Demant. Over the years, William Demant Philips should be able to use this technology (as has also built up a position in the retail sector with licensee) and sell the hearing aids under the Philips now more than 1,000 stores worldwide. Sonova brand. Back in the 1990s, Philips was a well-known owns twice that amount. hearing aid brand, but it made an exit from the In November 2017, Amplifon announced that it industry when Beltone purchased Philips hearing was planning to build up their own private label line, aid technology in 1999. along with the current six players' brands in all their Today Philips is divided into three units: Philips stores. Consumer Life which includes consumer electronics, amplifon BOSE Better sound through research appliances, and personal care, Philips Healthcare, and Signify N.V. (formerly Philips Lighting, the larg- est supplier of lighting products in the world). 3. Bose is introducing a new hearing aid In October 2018, the audio and loudspeaker specialist, Bose, announced that FDA (the US Food and Drug Administration) had approved their new 'Bose Hearing Aid'. Unlike most hearing aids, which are fitted and sold by audiologists or other hearing professionals, the new Bose hearing aids may be sold directly to the consumer without a medical intermediary. The Bose Hearing Aid is a user-fitted wireless hear- ing aid. Patients can adjust the hearing aid through a source. Jonathan Weiss/Shutterstock mobile application on their smartphone. This technol- ogy enables users to fit the hearing aid settings them- selves, in real-time and in real-world environments Questions without the assistance of a healthcare professional. In the United States, hearing aids normally must 1. Explain consumer buying behaviour in connection be approved by the FDA as Class 1 medical devices, with the purchase of hearing aids. but companies like MD Hearing Aid and iHear Med- 2. Prepare a SWOT analysis for William Demant. ical have for nearly a decade successfully sold FDA- 3. How should William Demant utilize the partner- approved hearing aids online directly to consumer ship with Philips in a value net' perspective? at prices far lower than consumers pay audiologists. 4. Which of the threats are most serious for However until now, global consumer brands such William Demant and how should they react to as Apple, Samsung and Bose, which all have active them? hearing aid R&D programs, have not entered the hearing aid market