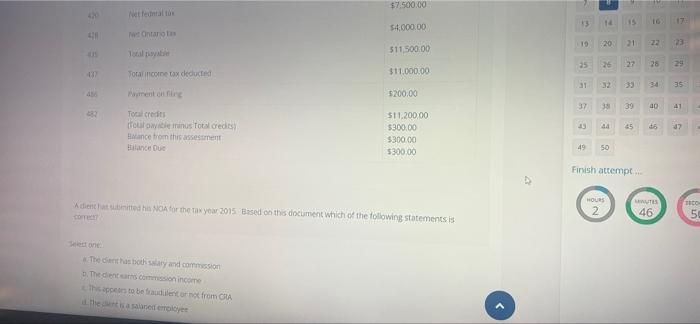

Question: This is a case study two part question 9 JU 13 14 15 T451 E0B) 16 17 Cirada feverency NOTICE OF ASSESSMENT Agence devenue du

9 JU 13 14 15 T451 E0B) 16 17 Cirada feverency NOTICE OF ASSESSMENT Agence devenue du Canada 19 20 21 22 2 Die Name Sodal insurance no 26 25 Tax Centre Tax Year 30 28 M6, 2012 MORTGAGE CLIENE 000 000 000 31 2015 33 32 34 35 Sudbury ON P3A 5C1 37 38 39 10 41 44 46 -37 Summary 49 50 Samount Finish attempt Como encome $65.000.00 Deductions for complete con S10.500,00 TE 46 58 355.000.00 = To non refundable tax credits $55,000.00 15 Tuotete te credits 52.000.00 $650 00 $7.500.00 Netent to 13 14 15 $4,000.00 Ontaro 19 20 21 -22 23 311 500.00 25 26 27 29 Total income tax deducted $11,000.00 34 35 5200,00 38 39 00 41 2 15 84 25 Toalet folow us Totalced ance to this assessment Bilanced 15 37 $11,200.00 $300.00 $300.00 5300.00 49 50 Finish attempt TE Adiente NOA for the tax year 2015 Based on this document which of the following statements is HOURS 2 TO ~ 46 50 The Bethabosrand common The dension income This acces to be for morom these yet You are arranging a mortgage for your borrower through your private investor. In preparing the commitment letter your investor informs you that he wishes to make the mortgage's term one year, and that he doesn't want the borrower to be able to repay the mortgage in full during this term. He tells you that because he doesn't know how to word this he needs your help. Given this scenario what type of clause will you tell the private investor to include in the commitment letter? Select one a. Closed clause b. Extended amortization clause c. Partially open clause d. Fully open clause

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts