Question: This is a case study two part question Brian owns a high rise condominium valued at $700,000. It has a mortgage with an outstarding balance

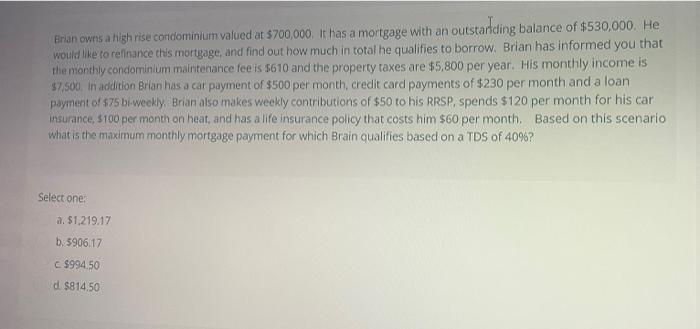

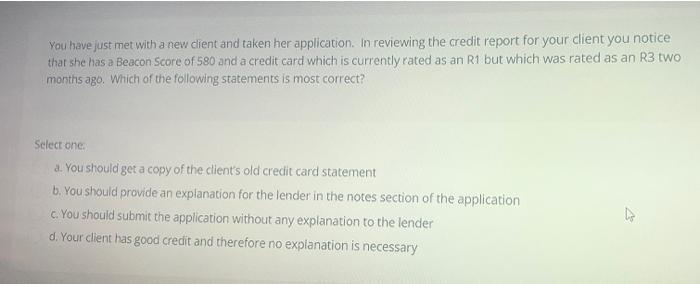

Brian owns a high rise condominium valued at $700,000. It has a mortgage with an outstarding balance of $530,000. He would like to refinance this mortgage, and find out how much in total he qualifies to borrow. Brian has informed you that the monthly condominium maintenance fee is $610 and the property taxes are $5,800 per year. His monthly income is $7.500. In addition Brian has a car payment of $500 per month. credit card payments of $230 per month and a loan payment of 75 biweekly Brian also makes weekly contributions of $50 to his RRSP, spends $120 per month for his car insurance, 5100 per month on heat, and has a life insurance policy that costs him $60 per month. Based on this scenario what is the maximum monthly mortgage payment for which Brain qualifies based on a TDS of 40%? Select one: a. $1,219.17 b. 5906.17 $994.50 d $814,50 You have just met with a new client and taken her application. In reviewing the credit report for your client you notice that she has a Beacon Score of 580 and a credit card which is currently rated as an R1 but which was rated as an R3 two months ago. Which of the following statements is most correct? Select one d. You should get a copy of the client's old credit card statement b. You should provide an explanation for the lender in the notes section of the application c. You should submit the application without any explanation to the lender d. Your client has good credit and therefore no explanation is necessary D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts