Question: This is a forecasting exercise, the target commodity was picked as Wheat. Plan a $ 5M or $ 50M, or $ 500M purchase. It's only

This is a forecasting exercise, the target commodity was picked as Wheat.

Plan a $ 5M or $ 50M, or $ 500M purchase. It's only play money. Can use any price forecasting service like, NYMEX, CME, LME, CBOT, etc.

Answer questions 1-4. Related to question 4, you are going to buy that commodity over the next year for your organization. How would you purchase that volume over the next 12 months considering price movement over the year (or, use longer term depending on commodity selected, like electricity might buy over 5 year term)-buy up front because best price is now, but consider inventory holding costs, buy equal monthly volume because price is not changing over year, defer most purchase to later in year because price forecast is going down, etc.

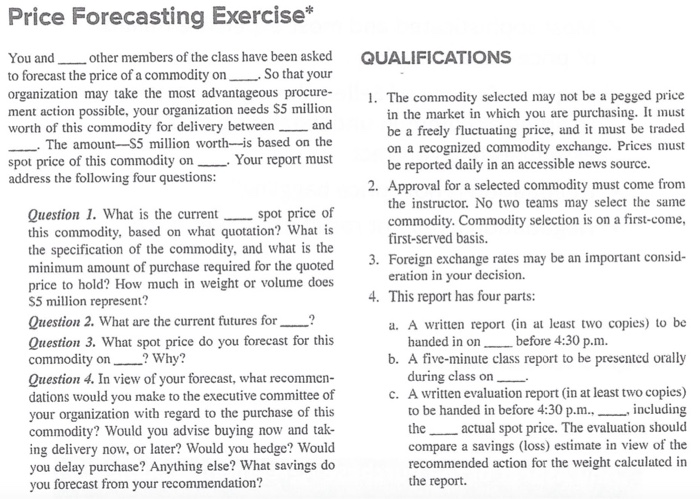

Price Forecasting Exercise* QUALIFICATIONS You and ___other members of the class have been asked to forecast the price of a commodity on- So that your organization may take the most advantageous procure- ment action possible, your organization needs $5 million worth of this commodity for delivery between and - The amount--S5 million worth is based on the spot price of this commodity on Your report must address the following four questions: Question 1. What is the current spot price of this commodity, based on what quotation? What is the specification of the commodity, and what is the minimum amount of purchase required for the quoted price to hold? How much in weight or volume does $5 million represent? Question 2. What are the current futures for ? Question 3. What spot price do you forecast for this commodity on ? Why? Question 4. In view of your forecast, what recommen- dations would you make to the executive committee of your organization with regard to the purchase of this commodity? Would you advise buying now and tak- ing delivery now, or later? Would you hedge? Would you delay purchase? Anything else? What savings do you forecast from your recommendation? 1. The commodity selected may not be a pegged price in the market in which you are purchasing. It must be a freely fluctuating price, and it must be traded on a recognized commodity exchange. Prices must be reported daily in an accessible news source. 2. Approval for a selected commodity must come from the instructor. No two teams may select the same commodity. Commodity selection is on a first-come, first-served basis. 3. Foreign exchange rates may be an important consid- eration in your decision. 4. This report has four parts: a. A written report in at least two copies) to be handed in on before 4:30 p.m. b. A five-minute class report to be presented orally during class on C. A written evaluation report (in at least two copies) to be handed in before 4:30 p.m., including the actual spot price. The evaluation should compare a savings (loss) estimate in view of the recommended action for the weight calculated in the report. Price Forecasting Exercise* QUALIFICATIONS You and ___other members of the class have been asked to forecast the price of a commodity on- So that your organization may take the most advantageous procure- ment action possible, your organization needs $5 million worth of this commodity for delivery between and - The amount--S5 million worth is based on the spot price of this commodity on Your report must address the following four questions: Question 1. What is the current spot price of this commodity, based on what quotation? What is the specification of the commodity, and what is the minimum amount of purchase required for the quoted price to hold? How much in weight or volume does $5 million represent? Question 2. What are the current futures for ? Question 3. What spot price do you forecast for this commodity on ? Why? Question 4. In view of your forecast, what recommen- dations would you make to the executive committee of your organization with regard to the purchase of this commodity? Would you advise buying now and tak- ing delivery now, or later? Would you hedge? Would you delay purchase? Anything else? What savings do you forecast from your recommendation? 1. The commodity selected may not be a pegged price in the market in which you are purchasing. It must be a freely fluctuating price, and it must be traded on a recognized commodity exchange. Prices must be reported daily in an accessible news source. 2. Approval for a selected commodity must come from the instructor. No two teams may select the same commodity. Commodity selection is on a first-come, first-served basis. 3. Foreign exchange rates may be an important consid- eration in your decision. 4. This report has four parts: a. A written report in at least two copies) to be handed in on before 4:30 p.m. b. A five-minute class report to be presented orally during class on C. A written evaluation report (in at least two copies) to be handed in before 4:30 p.m., including the actual spot price. The evaluation should compare a savings (loss) estimate in view of the recommended action for the weight calculated in the report

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts