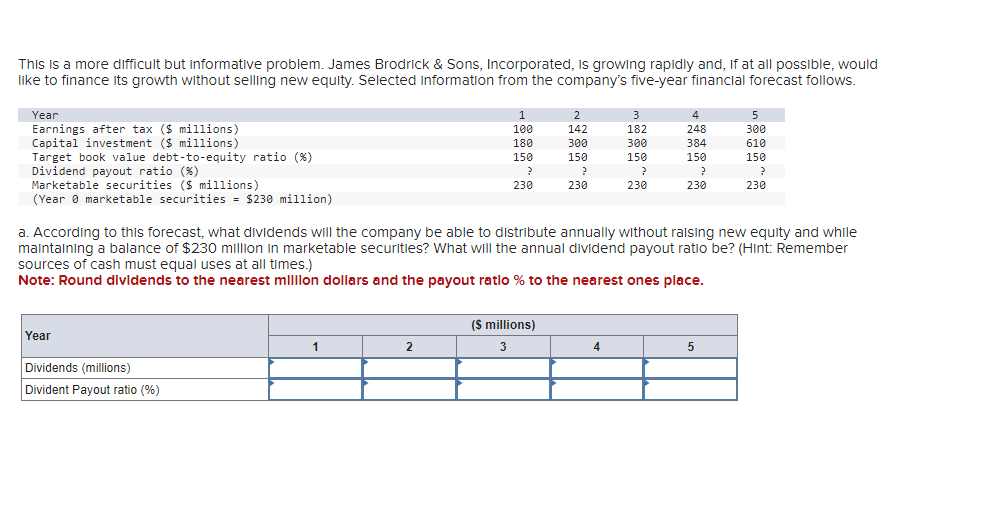

Question: This is a more difficult but informative problem. James Brodrick 8: Sons, Incorporated, is growing rapidly and. Ifat all possible, would like to finance its

This is a more difficult but informative problem. James Brodrick 8: Sons, Incorporated, is growing rapidly and. Ifat all possible, would like to finance its growth Withoutseiiing new equity. Selected information from the company's five-year financial forecast follows. Year 1 2 3 4 5 Earnings aFter tax ($ millions) 188 142 132 248 388 Capital investment ($ millions) 188 388 388 384 518 Target book value debt-toeduity ratio (x) 158 158 158 158 158 Dividend payout ratio (%) ? 9 P P ? Marketable securities (5 millions) 238 238 238 238 238 (Year 8 marketable securities = $238 million] a. according to this forecast, what dividends will the company be able to distribute annually Without raising new equity.f and while maintaining a balance of $230 million in marketable securities? What Will the annual dividend payout ratio be? (Hint: Remember sources of cash must equal uses at all times} Note: Round dividends to the nearest million dollars and the payout ratio 93 to the nearest ones place. [i millions] 1 2 3 4 5 YEar Dividends {millions) Divident Payout ratio {8%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts