Question: This is a multi part question it follows cheggs rules Assume a par value of $1,000. Caspian Sea plans to issue a 14.00 year, semi-annual

This is a multi part question it follows cheggs rules

Assume a par value of $1,000. Caspian Sea plans to issue a 14.00 year, semi-annual pay bond that has a coupon rate of 8.15%. If the yield to maturity for the bond is 7.72%, what will the price of the bond be?

Assume a par value of $1,000. Caspian Sea plans to issue a 6.00 year, semi-annual pay bond that has a coupon rate of 7.94%. If the yield to maturity for the bond is 8.33%, what will the price of the bond be?

Assume a par value of $1,000. Caspian Sea plans to issue a 29.00 year, semi-annual pay bond that has a coupon rate of 6.00%. If the yield to maturity for the bond is 6.0%, what will the price of the bond be?

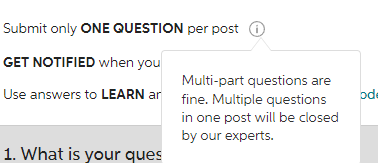

Submit only ONE QUESTION per post GET NOTIFIED when you Multi-part questions are Use answers to LEARN ar fine. Multiple questions in one post will be closed by our experts. 1. What is your ques

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts