Question: This is a multi-period capital budgeting linear programming problem (where the solution will contain variables, objective function, constraints then an optimal solution). This problem will

This is a multi-period capital budgeting linear programming problem (where the solution will contain variables, objective function, constraints then an optimal solution). This problem will be solved via AMPL/Gurobi or a mathematical modeling language (not excel)

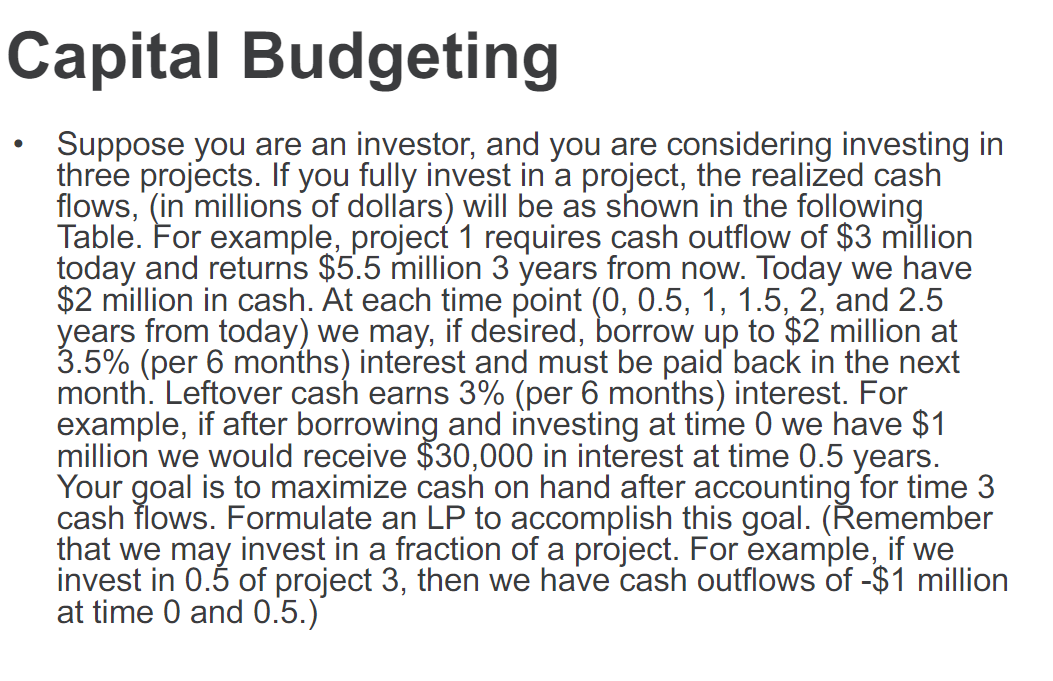

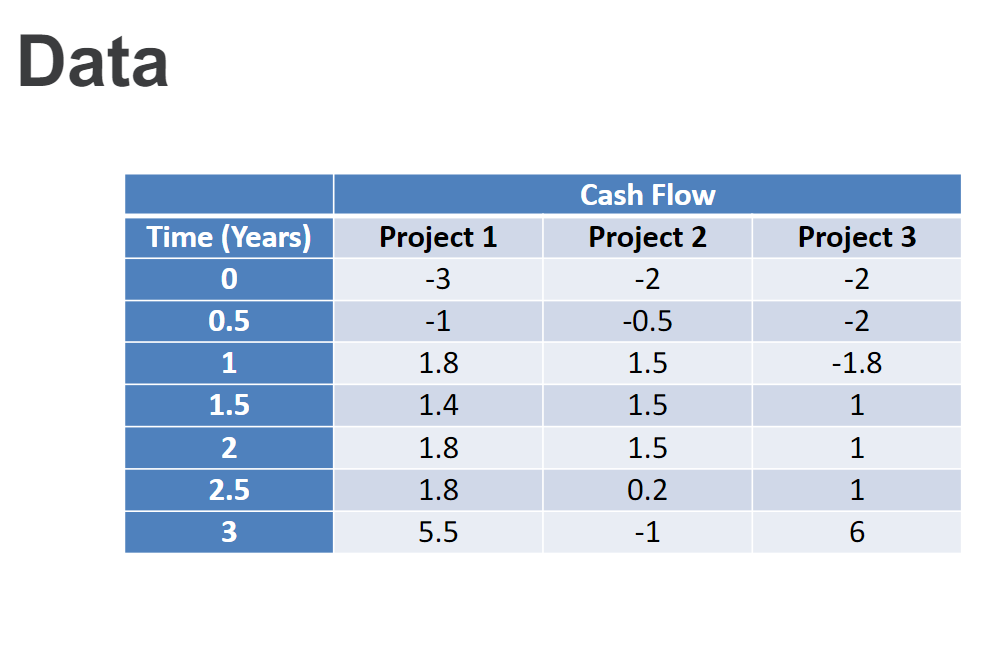

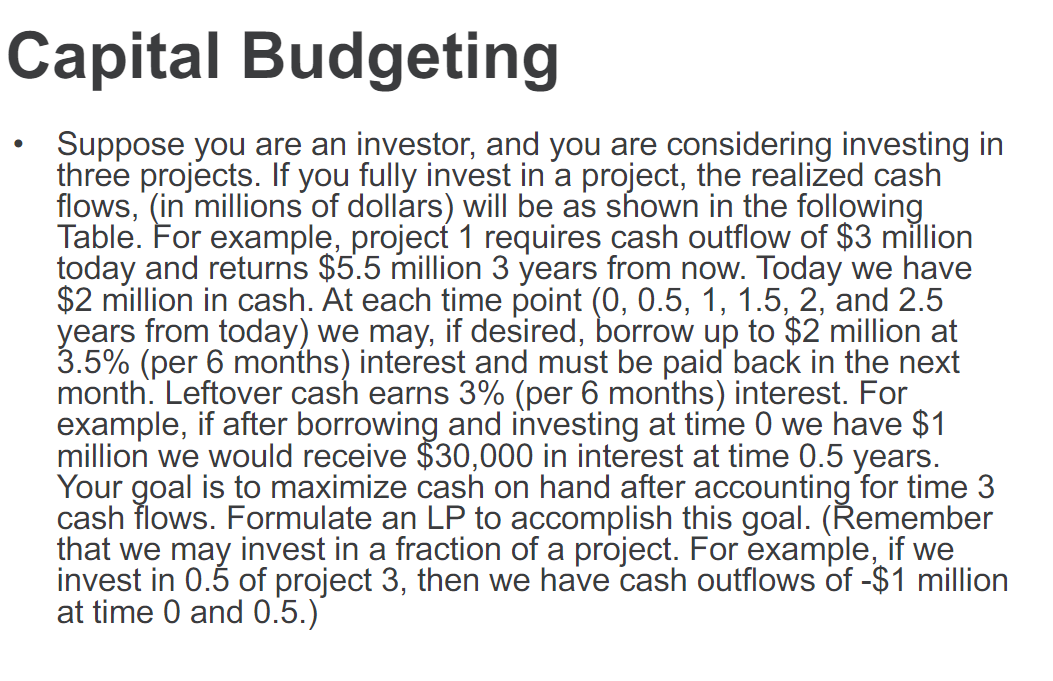

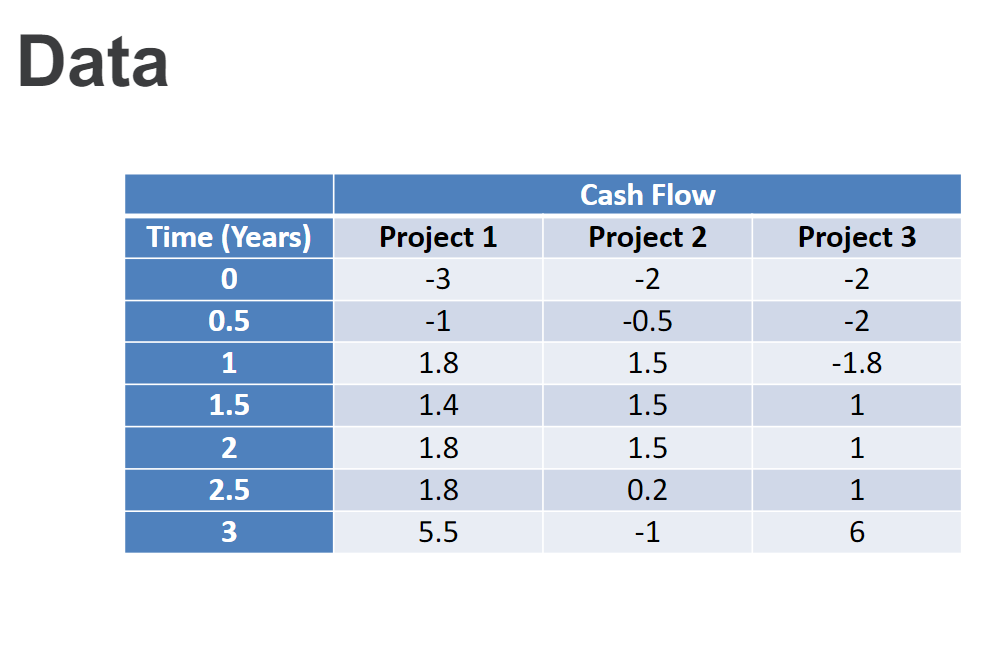

Capital Budgeting Suppose you are an investor, and you are considering investing in three projects. If you fully invest in a project, the realized cash flows, (in millions of dollars) will be as shown in the following Table. For example, project 1 requires cash outflow of $3 million today and returns $5.5 million 3 years from now. Today we have $2 million in cash. At each time point (0, 0.5, 1, 1.5, 2, and 2.5 years from today) we may, if desired, borrow up to $2 million at 3.5% (per 6 months) interest and must be paid back in the next month. Leftover cash earns 3% (per 6 months) interest. For example, if after borrowing and investing at time 0 we have $1 million we would receive $30,000 in interest at time 0.5 years. Your goal is to maximize cash on hand after accounting for time 3 cash flows. Formulate an LP to accomplish this goal. (emember that we may invest in a fraction of a project. For example, if we invest in 0.5 of project 3, then we have cash outflows of $1 million at time 0 and 0.5.) Data Time (Years) 0 0.5 1 Project 1 -3 -1 1.8 1.4 1.8 1.8 5.5 Cash Flow Project 2 -2 -0.5 1.5 1.5 1.5 0.2 -1 Project 3 -2 -2 -1.8 1 1 1 6 1.5 2 2.5 3