Question: This is a pricing optimization question of linear programming. Plz solve the 2 parts and provide a screenshot of excel. An automobile firm wishes to

This is a pricing optimization question of linear programming. Plz solve the 2 parts and provide a screenshot of excel.

This is a pricing optimization question of linear programming. Plz solve the 2 parts and provide a screenshot of excel.

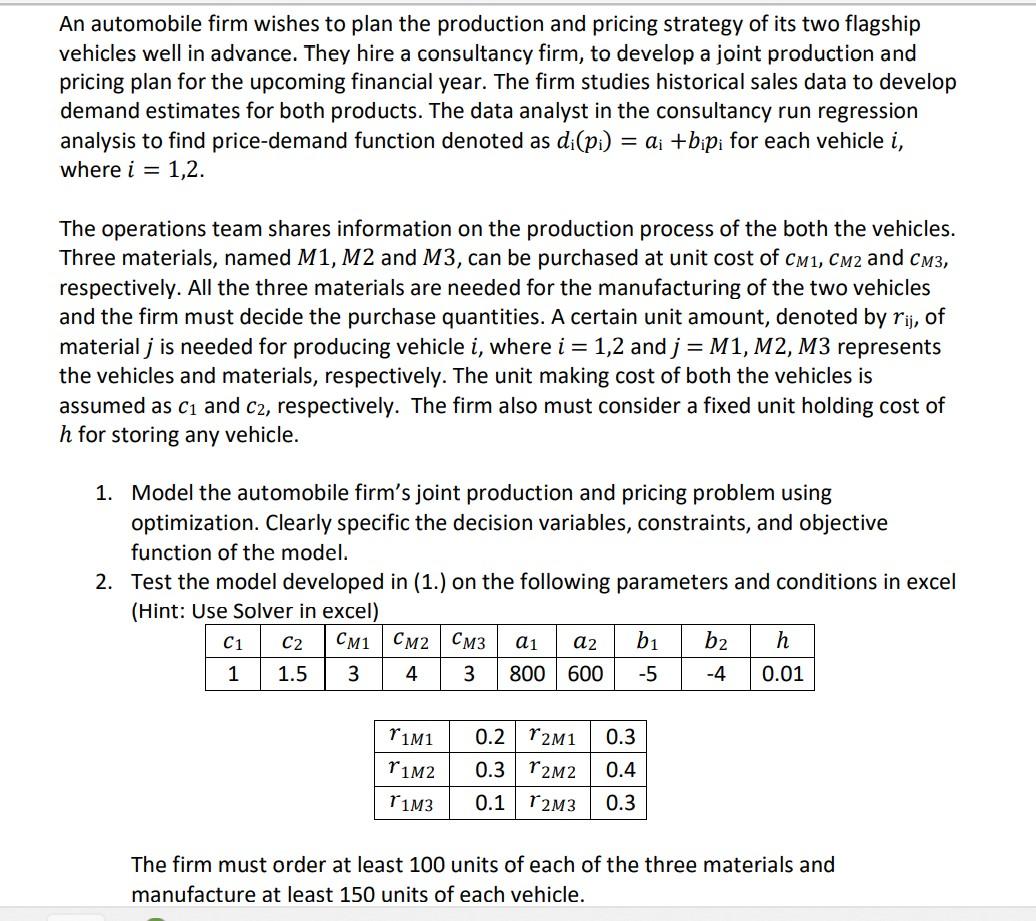

An automobile firm wishes to plan the production and pricing strategy of its two flagship vehicles well in advance. They hire a consultancy firm, to develop a joint production and pricing plan for the upcoming financial year. The firm studies historical sales data to develop demand estimates for both products. The data analyst in the consultancy run regression analysis to find price-demand function denoted as di(pi) = di +bipi for each vehicle i, where i = 1,2. = The operations team shares information on the production process of the both the vehicles. Three materials, named M1, M2 and M3, can be purchased at unit cost of CM1, CM2 and CM3, respectively. All the three materials are needed for the manufacturing of the two vehicles and the firm must decide the purchase quantities. A certain unit amount, denoted by rij, of material j is needed for producing vehicle i, where i = 1,2 and j = M1, M2, M3 represents the vehicles and materials, respectively. The unit making cost of both the vehicles is assumed as C1 and C2, respectively. The firm also must consider a fixed unit holding cost of h for storing any vehicle. 1. Model the automobile firm's joint production and pricing problem using optimization. Clearly specific the decision variables, constraints, and objective function of the model. 2. Test the model developed in (1.) on the following parameters and conditions in excel (Hint: Use Solver in excel) C1 | 2 | ai a2 bi b2 h 1 1.5 3 4 3 800 600 -5 -4 0.01 C2 0.2 r2M1 0.3 rimi T1M2 T1M3 0.3 r 2M2 0.4 0.1 r2M3 0.3 The firm must order at least 100 units of each of the three materials and manufacture at least 150 units of each vehicle. An automobile firm wishes to plan the production and pricing strategy of its two flagship vehicles well in advance. They hire a consultancy firm, to develop a joint production and pricing plan for the upcoming financial year. The firm studies historical sales data to develop demand estimates for both products. The data analyst in the consultancy run regression analysis to find price-demand function denoted as di(pi) = di +bipi for each vehicle i, where i = 1,2. = The operations team shares information on the production process of the both the vehicles. Three materials, named M1, M2 and M3, can be purchased at unit cost of CM1, CM2 and CM3, respectively. All the three materials are needed for the manufacturing of the two vehicles and the firm must decide the purchase quantities. A certain unit amount, denoted by rij, of material j is needed for producing vehicle i, where i = 1,2 and j = M1, M2, M3 represents the vehicles and materials, respectively. The unit making cost of both the vehicles is assumed as C1 and C2, respectively. The firm also must consider a fixed unit holding cost of h for storing any vehicle. 1. Model the automobile firm's joint production and pricing problem using optimization. Clearly specific the decision variables, constraints, and objective function of the model. 2. Test the model developed in (1.) on the following parameters and conditions in excel (Hint: Use Solver in excel) C1 | 2 | ai a2 bi b2 h 1 1.5 3 4 3 800 600 -5 -4 0.01 C2 0.2 r2M1 0.3 rimi T1M2 T1M3 0.3 r 2M2 0.4 0.1 r2M3 0.3 The firm must order at least 100 units of each of the three materials and manufacture at least 150 units of each vehicle

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts