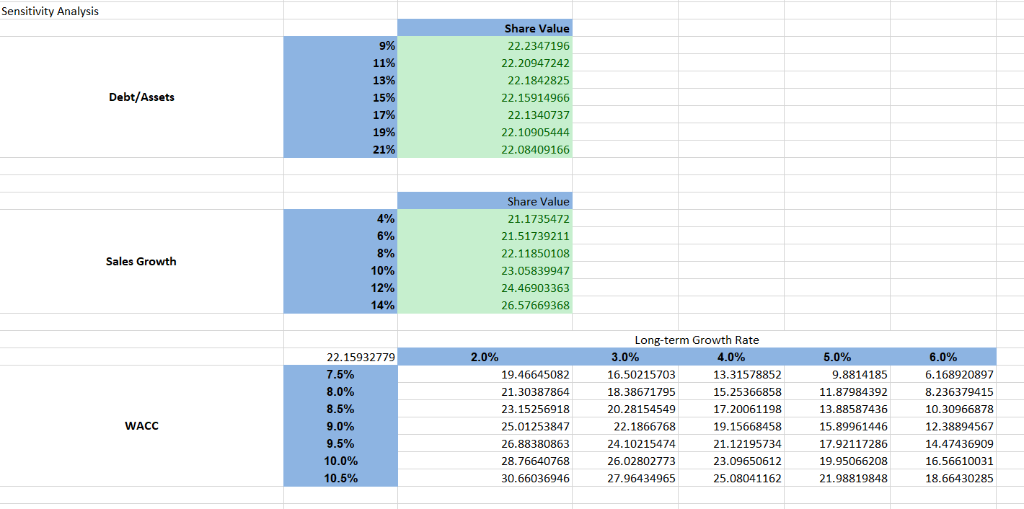

Question: This is a result from the Sensitivity Analysis. Write a paragraph explaining the results for each Debt/Asset, Sales Growth & WACC. Are the results beneficial/positive

This is a result from the Sensitivity Analysis. Write a paragraph explaining the results for each Debt/Asset, Sales Growth & WACC. Are the results beneficial/positive ? What do they mean and whats the influence on the company and future productivity?

Sensitivity Analysis Share Value 22.2347196 22.20947242 22.1842825 22.15914966 22.1340737 22.10905444 22.08409166 Debt/Assets 15% 17% Share Valu 21.1735472 21.51739211 22.11850108 23.05839947 24.46903363 26.57669368 2 Sales Growth 12% Long-term Growth Rate 22.15932779 2.0% 5 19.46645082 21.30387864 23.15256918 25.01253847 26.88380863 28.76640768 30.66036946 16.50215703 18.38671795 20.28154549 22.1866768 24.10215474 26.02802773 27.96434965 13.31578852 15.25366858 17.20061198 19.15668458 21.12195734 23.09650612 25.08041162 9.8814185 11.87984392 13.88587436 15.89961446 17.92117286 19.95066208 21.98819848 6.168920897 8.236379415 10.30966878 12.38894567 14.47436909 16.56610031 18.66430285 2 WACC 2 3 10.5% Sensitivity Analysis Share Value 22.2347196 22.20947242 22.1842825 22.15914966 22.1340737 22.10905444 22.08409166 Debt/Assets 15% 17% Share Valu 21.1735472 21.51739211 22.11850108 23.05839947 24.46903363 26.57669368 2 Sales Growth 12% Long-term Growth Rate 22.15932779 2.0% 5 19.46645082 21.30387864 23.15256918 25.01253847 26.88380863 28.76640768 30.66036946 16.50215703 18.38671795 20.28154549 22.1866768 24.10215474 26.02802773 27.96434965 13.31578852 15.25366858 17.20061198 19.15668458 21.12195734 23.09650612 25.08041162 9.8814185 11.87984392 13.88587436 15.89961446 17.92117286 19.95066208 21.98819848 6.168920897 8.236379415 10.30966878 12.38894567 14.47436909 16.56610031 18.66430285 2 WACC 2 3 10.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts