Question: This is a retirement oriented case that provides an opportunity for students to apply the knowledge they have acquired in their Retirement Planning course ,

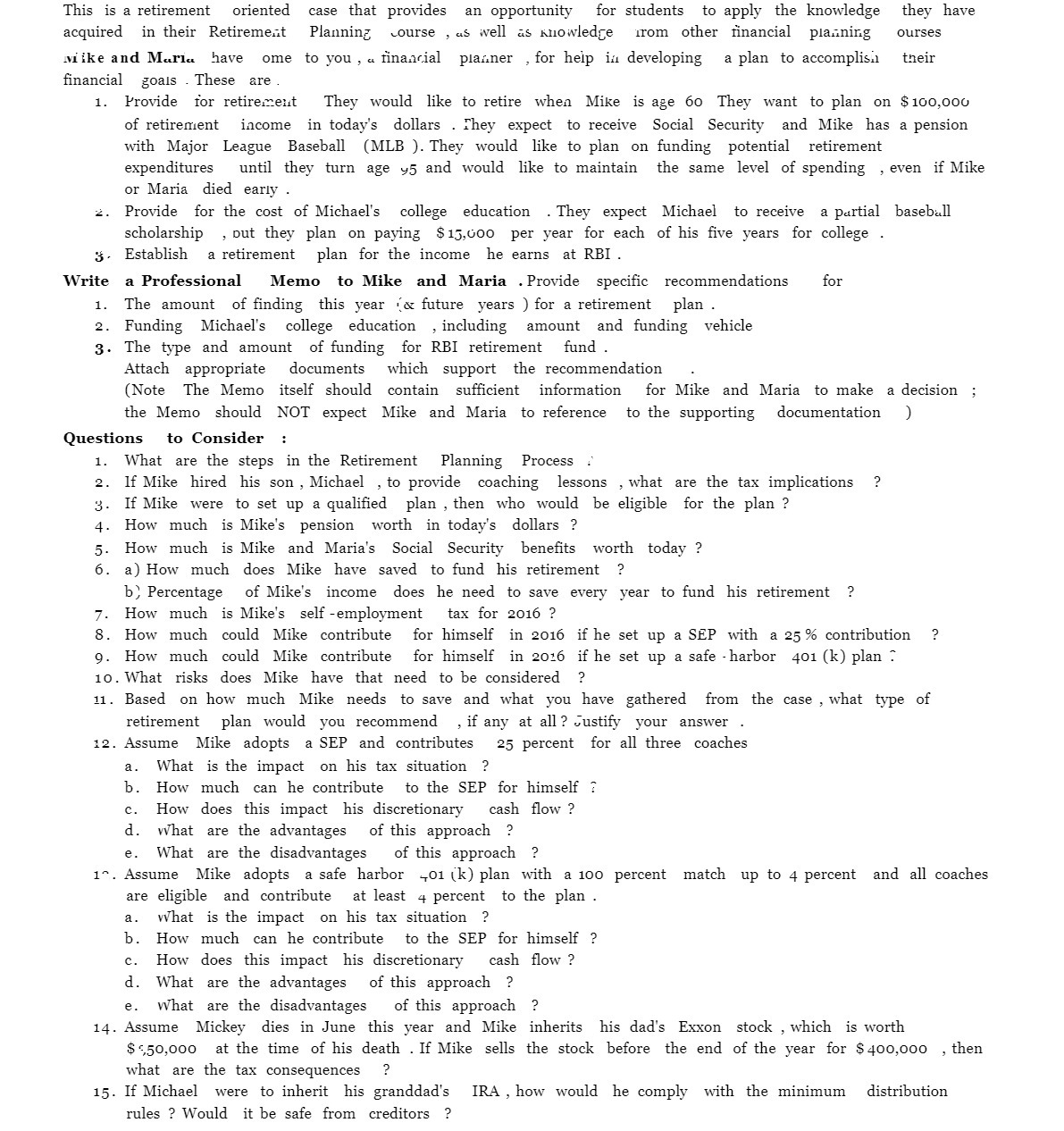

This is a retirement oriented case that provides an opportunity for students to apply the knowledge they have acquired in their Retirement Planning course , us well as knowledge 'l'rom other nancial planning ourses .u'ike and 1\\"Iur1n have ome to you , a nancial planner , for help in developing a plan to accomplish tneir nancial goals .These are. 1. Provide for retirement They would like to retire when Mike is age 60 They want to plan on $100,000 of retirement income in today's dollars .I'hey expect to receive Social Security and Mike has a pension with Major League Baseball [MLB ).They would like to plan on funding potential retirement expenditures until they turn age 95 and would like to maintain the same level of spending , even if Mike or Maria died early . 2. Provide for the cost of Michael's college education . They expect Michael to receive a partial baseball scholarship ,Dut they plan on paying $15,000 per year for each of his ve years for college . 3. Establish a retirement plan for the income he earns at RBI. Write a Professional Memo to Mike and Maria .Provide specic recommendations for 1. The amount of finding this year Its: future years )for a retirement plan . 2. Funding Michael's college education , including amount and funding vehicle 3. The type and amount of funding for RBI retirement fund. Attach appropriate documents which support the recommendation (Note The Memo itself should contain sufcient information for Mike and Maria to make a decision ; the Memo should NOT expect Mike and Maria to reference to the supporting documentation ] Questions to Consider : 1. What are the steps in the Retirement Planning Process 2. 1f Mike hired his son , Michael , to provide coaching lessons , what are the tax implications '2 3. If Mike were to set up a qualied plan , then who would be eligible for the plan ? 4. How much is Mike's pension worth in today's dollars ? 5. How much is Mike and Maria's Social Security benets worth today ? 6. a) How much does Mike have saved to fund his retirement 'P b] Percentage of Mike's income does he need to save every year to fund his retirement ? 7. How much is Mike's self employment tax for 2016 ? 8. How much could Mike contribute for himself in 2016 if he set up a SEP with a 25% contribution ? 9. How much could Mike contribute for himself in 2016 if he set up a safe -harbor 401 (k) plan T 10. What risks does Mike have that need to be considered ? . Based on how much Mike needs to save and what you have gathered from the case , what type of |.d H retirement plan would you recommend , if any at all? Justify your answer . 12. Assume Mike adopts a SEP and contributes 25 percent for all three coaches a. What is the impact on his tax situation ? b. How much can he contribute to the SEP for himself 2' c. How does this impact his discretionary cash ow ? d. What are the advantages of this approach '9 e. What are the disadvantages of this approach '9 1". Assume Mike adopts a safe harbor 401 (k) plan with a 100 percent match up to 4 percent and all coaches are eligible and contribute at least 4 percent to the plan . a. What is the impact on his tax situation ? b. How much can he contribute to the SEP for himself ? c. How does this impact his discretionary cash ow ? d. What are the advantages of this approach ? e. What are the disadvantages of this approach '9 14. Assume Mickey dies in June this year and Mike inherits his dad's Exxon stock ,which is worth $250,000 at the time of his death .If Mike sells the stock before the end of the year for $400,000 , then what are the tax consequences ? 15. If Michael were to inherit his granddad's IRA , how would he comply with the minimum distribution rules ? Would it be safe from creditors

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts