Question: This is a simulation and risk analysis problem. X-Craft, Inc. is considering a new addition to their product line. The new product will require building

This is a simulation and risk analysis problem.

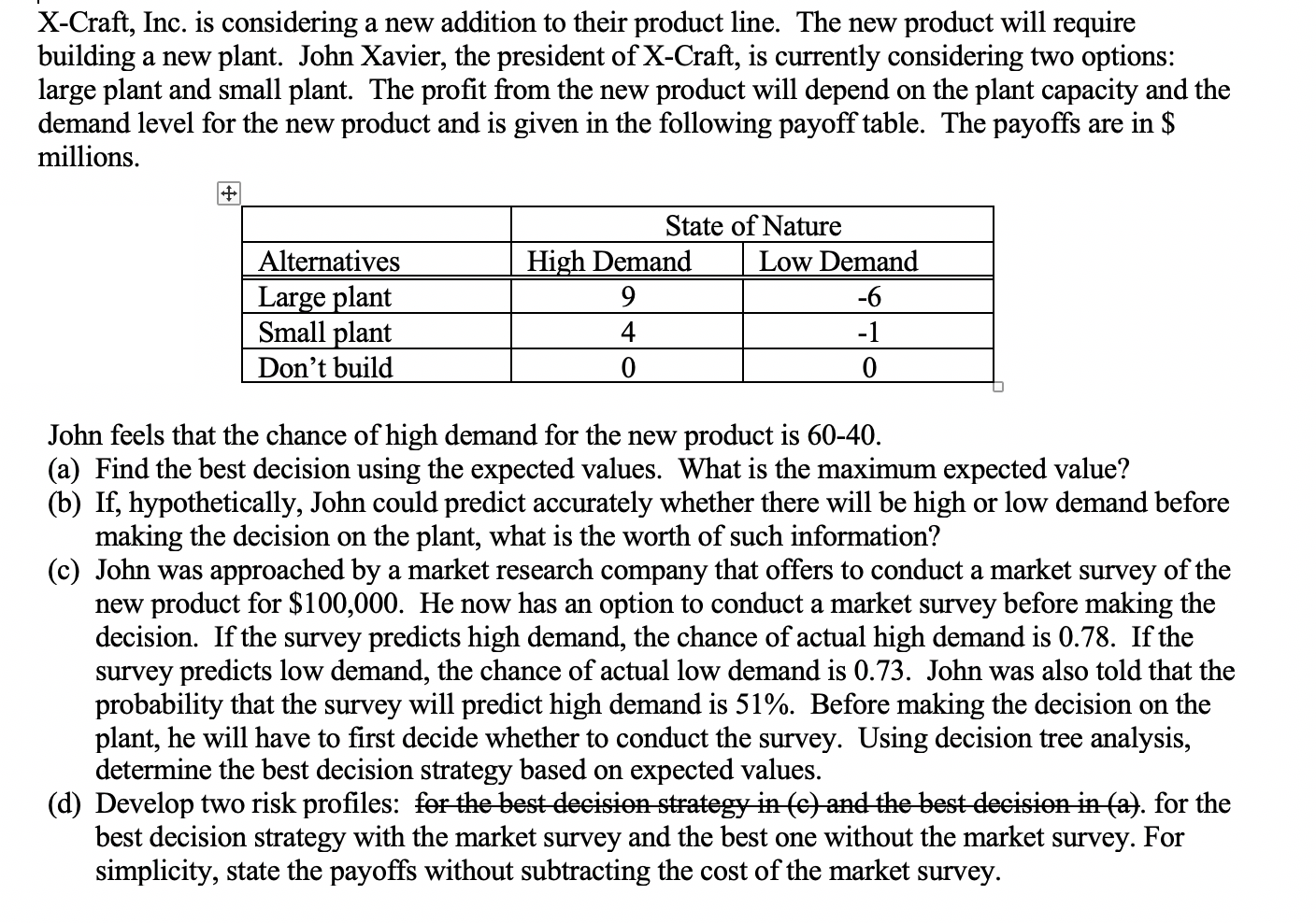

X-Craft, Inc. is considering a new addition to their product line. The new product will require building a new plant. John Xavier, the president of X-Craft, is currently considering two options: large plant and small plant. The profit from the new product will depend on the plant capacity and the demand level for the new product and is given in the following payoff table. The payoffs are in $ millions. + Alternatives Large plant Small plant Don't build State of Nature High Demand Low Demand 9 -6 4 -1 0 0 John feels that the chance of high demand for the new product is 60-40. (a) Find the best decision using the expected values. What is the maximum expected value? (b) If, hypothetically, John could predict accurately whether there will be high or low demand before making the decision on the plant, what is the worth of such information? (c) John was approached by a market research company that offers to conduct a market survey of the new product for $100,000. He now has an option to conduct a market survey before making the decision. If the survey predicts high demand, the chance of actual high demand is 0.78. If the survey predicts low demand, the chance of actual low demand is 0.73. John was also told that the probability that the survey will predict high demand is 51%. Before making the decision on the plant, he will have to first decide whether to conduct the survey. Using decision tree analysis, determine the best decision strategy based on expected values. (d) Develop two risk profiles: for the best decision strategy in (C) and the best decision in (a). for the best decision strategy with the market survey and the best one without the market survey. For simplicity, state the payoffs without subtracting the cost of the market survey

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts