Question: (This is a three-step problem. In the first part, you will solve the numerical problem. In the second part (multiple dropdown menu type), you will

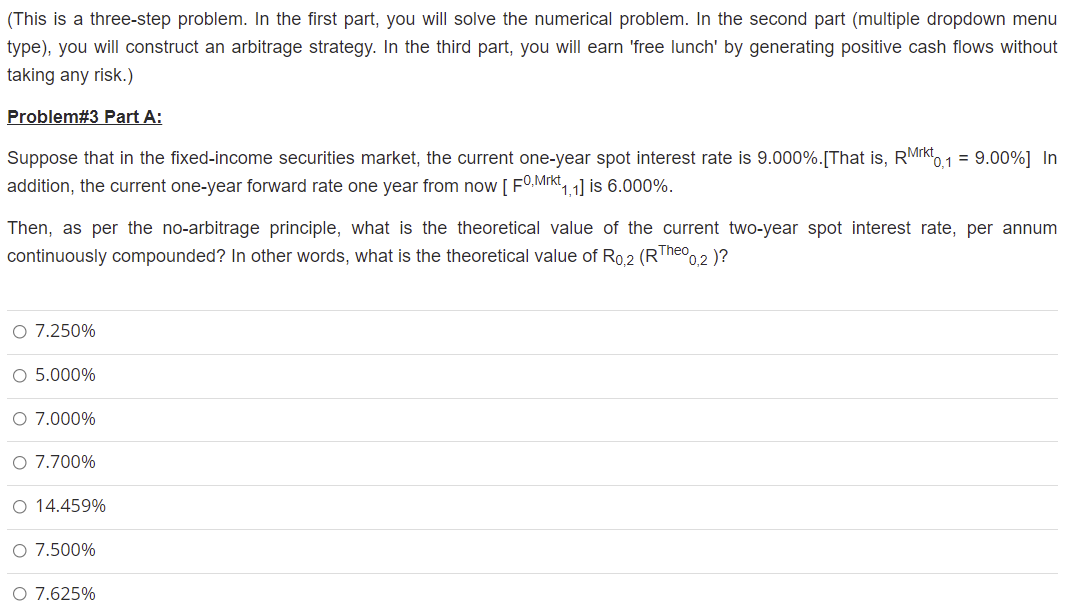

(This is a three-step problem. In the first part, you will solve the numerical problem. In the second part (multiple dropdown menu type), you will construct an arbitrage strategy. In the third part, you will earn 'free lunch' by generating positive cash flows without taking any risk.) Problem#3 Part A: Suppose that in the fixed-income securities market, the current one-year spot interest rate is 9.000%. [That is, RMrkto, 1 = 9.00%] In addition, the current one-year forward rate one year from now [F0. Mrkt,,1] is 6.000%. Then, as per the no-arbitrage principle, what is the theoretical value of the current two-year spot interest rate, per annum continuously compounded? In other words, what is the theoretical value of R0.2 (RTHO..2)? 0 7.250% O 5.000% O 7.000% 0 7.700% O 14.459% 0 7.500% O 7.625%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts