Question: This is a two-part question, each part worth 5 points. PART 1: A firm is considering an unusual project represented by the selling of a

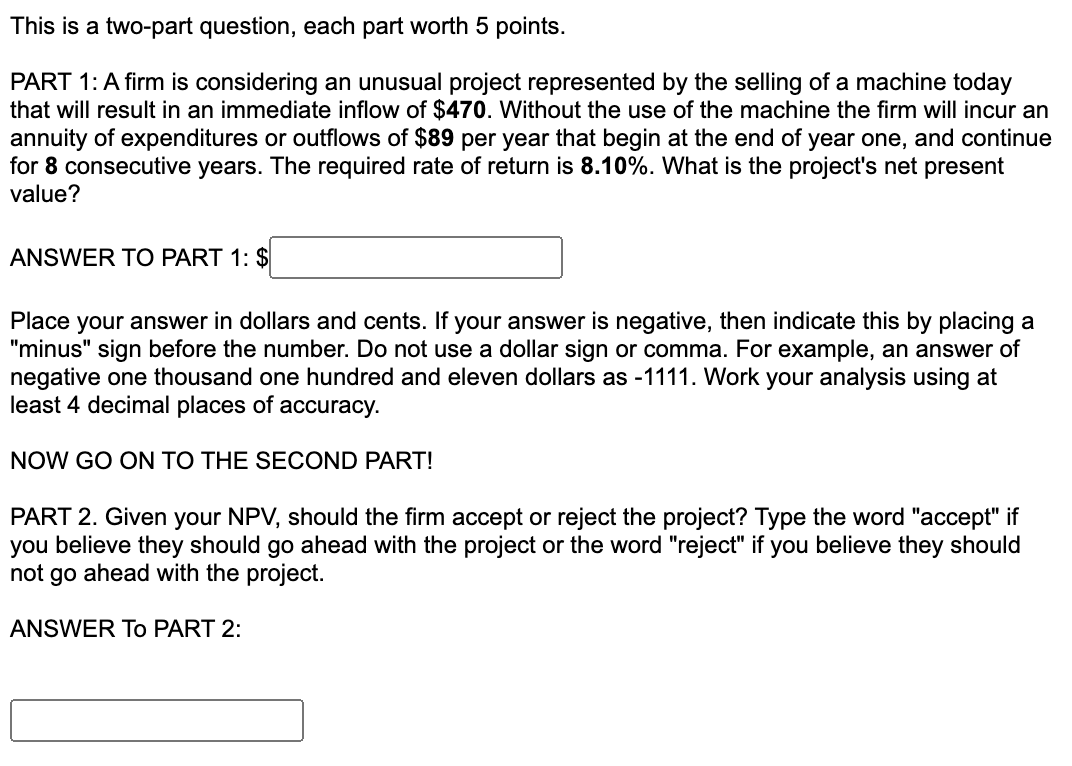

This is a two-part question, each part worth 5 points. PART 1: A firm is considering an unusual project represented by the selling of a machine today that will result in an immediate inflow of $470. Without the use of the machine the firm will incur an annuity of expenditures or outflows of $89 per year that begin at the end of year one, and continue for 8 consecutive years. The required rate of return is 8.10%. What is the project's net present value? ANSWER TO PART 1: \$ Place your answer in dollars and cents. If your answer is negative, then indicate this by placing a "minus" sign before the number. Do not use a dollar sign or comma. For example, an answer of negative one thousand one hundred and eleven dollars as 1111. Work your analysis using at least 4 decimal places of accuracy. NOW GO ON TO THE SECOND PART! PART 2. Given your NPV, should the firm accept or reject the project? Type the word "accept" if you believe they should go ahead with the project or the word "reject" if you believe they should not go ahead with the project. ANSWER To PART 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts