Question: This is a vertical analysis. I need a detailed analysis to write a report. This is a vertical analysis. I need a detailed analysis to

This is a vertical analysis. I need a detailed analysis to write a report.

This is a vertical analysis. I need a detailed analysis to write a report.

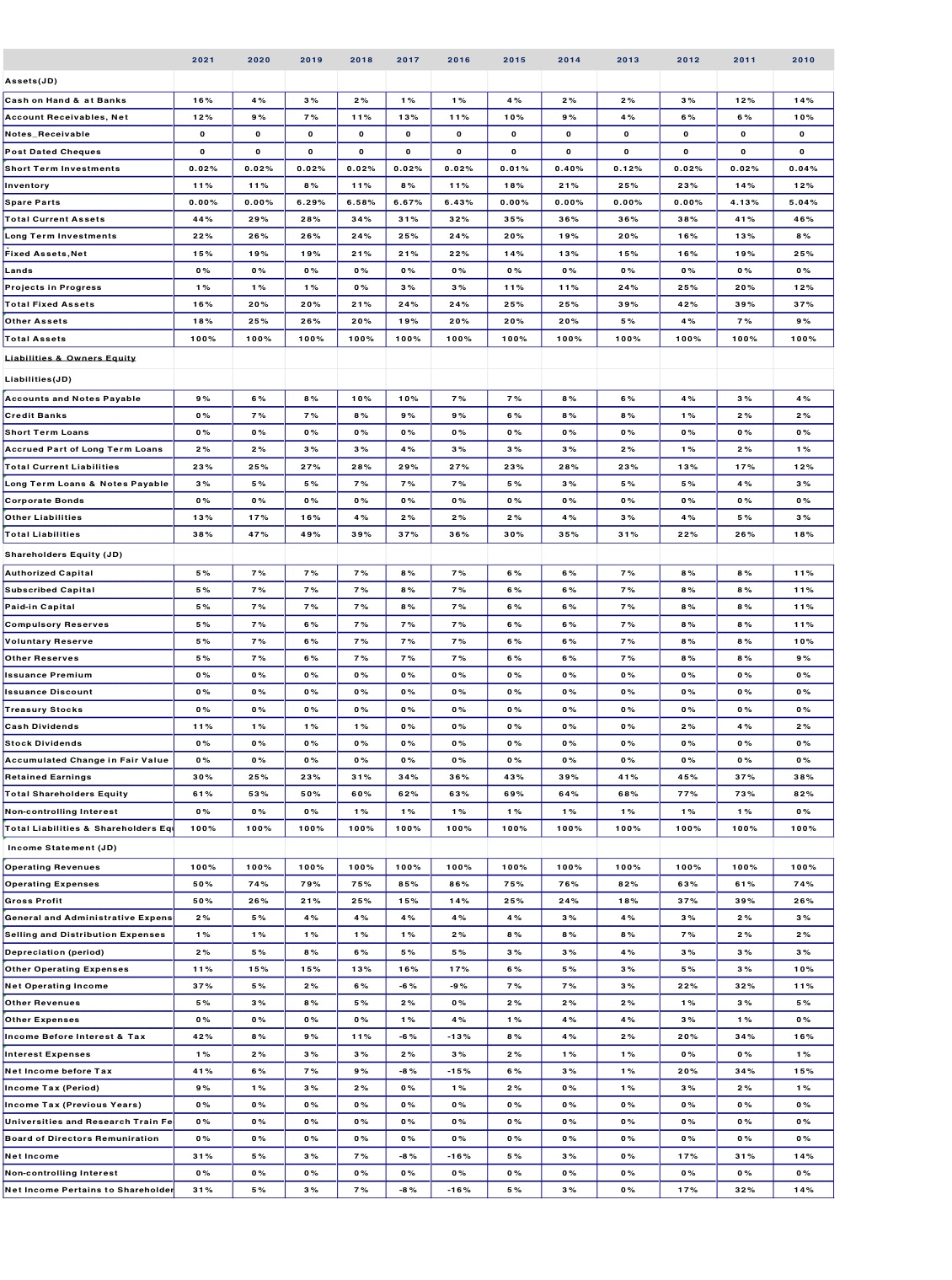

2021 2020 2019 2018 2017 2016 Assets(JD) 2015 2014 2013 2012 2011 2010 Cash on Hand & at Banks 16% 4% 3% 2% Account Receivables, Net 1% 1% 4% 12% 9% 7% 2% 11% 2% 13% 3% 12% 11% 14% Notes_Receivable 10% 9% 4% 6% 6% 10% Post Dated Cheques Short Term Investments 0. 02% 0.02% o 0.02% Inventory 0.02% 0.02% 0.02% 11% 0.01% 11% 0.40% 8% 0.12% Spare Parts 11% 0.02% 8% 11% 0.02% 0.04% 0.00% 18% 0.00% 21% Total Current Assets 6.29% 25% 6.58% 6.67% 23% 6.43% 12% 44% 29% 0.00% 0.00%% 28% 0.00% 34% 31% 0.00% 4.13% 32% 5.04% Long Term Investments 22% 26% 35% 36% 26% 36% 38% Fixed Assets, Ne 24% 25% 24% 15% 20% 46% 19% 19% 19% 20% -and: 21% 16% 21% 13% 0% 22% 0% 0% 15% 0% Projects in Progress 0% 0% 25% 1% 1% 0% 1% 0% 0% 0% 3% 3% 0% 11% 0% Total Fixed Assets 16% 20% 11% 20% 21% 24% 24% 25% 24% 20% 12% Other Asset 18% 25% 25% 26% 25% 39% 42% 39% 37% Total Assets 20% 19% 100 %% 20% 100% 20% 20% 100% 5% 100% 4% 100% 100% 7% 9% Liabilities & Owners Equity 100% 100% 100% 100% 100% 100% Liabilities(JD) Accounts and Notes Payable 9% 6% 8% Credit Banks 10% 10% 7% 0% 7% 7% 7% 8% 8% 9% 9% 6 % 4% Short Term Loans 0% 0% 6% 3% 4% 0% 0% 8%% 8% 1% 2% 2% Accrued Part of Long Term Loans 2% 0% 0% 2% 0 % 3% 0% 3% 0% 0% Total Current Liabilities 4% 3% 0% 23% 25% 3% 27% 3% 0% 28% 29% 2% 1 % Long Term Loans & Notes Payable 27% 2% 3% 23% 5% 5% 7% 28% 1% 23% 13% 17% Corporate Bonds 0% 7% 0% 0% 7% 5% 0% 3% 12% 5% 5% Other Liabilities 0% 13% 0 9% 4 9% 16% 0% 3% 17% 4% 2% 0 % 0% 2% 0% 47% 2% 0% Total Liabilities 38% 49% 39% 4 % 37% 36% 3 % 4 % 5 % 3% Shareholders Equity (JD) 30% 35% 31 % 22% 26 % 18% Authorized Capital 5% 7% Subscribed Capital 7 % 5% 7% 7 % 7% 11% Paid-in Capital 5 % 7% 7% 11% Compulsory Reserves 5% 7% 11% Voluntary Reserve 59% 6% 7% 6% Other Reserves 1 1% 5% 7 % 7% 6% Issuance Premium 7% 7% 10% 0% 7 % 0% 0 9% Issuance Discount 0 9% 0% 0% 0% 0% 0% Treasury Stocks 0% 0 9% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0 % 0% 0 % Cash Dividends 11% 1% 1% 1% 0 9% 0 % 0% 0% Stock Dividends 0% 0% 0% 0 % 0% 0 % 0 9% 0 9% 0 9% 2% 4 9% 2% Accumulated Change in Fair Value 0% 0% 0% Retained Earnings 0 % 0% 0% 0 9% 30% 0% 25% 23% 31% 34 % 36 % 43% 0% 0 % 0 % Total Shareholders Equity 61% 53% 50% 60% 62% 63% 45 % 69% 37 % 38 % Non-controlling Interest 0% 0% 64 9% 0% 1% 77% 1% Total Liabilities & Shareholders Eq 1 % 100% 1 % 73% 100% 1 % 82% 100% 100% 1 % 100% 100% 1 % 100% 0% Income Statement (JD) 100% 1009% 100%% 100% 100% Operating Revenues 100% 100% 100% Operating Expenses 100% 100% 100% 50% 100% 74% 100% 79% 100% 75% 85% 100% 86% 100% 100% Gross Profit 50% 75% 26% 76% 21% 82% 25% 63% 15% 14% 61% General and Administrative Expens 2% 5% 25% 74% 4% 24% 4% 18% Selling and Distribution Exp 4% 4% 37% 39% 26% 1% 4 % 1% 1% 1% 3 % 4% 1% 3% 2% 2% 3% Depreciation (period) 2% 5% 8% 8% Other Operating Expenses 6% 5% 5% 3% 7% 2% 2% 11% 15% 15% 13% 16% 3% 3% 3% Net Operating Income 17% 37% 6 9% 5% 2% 5% 3% 5% 3% 10% Other Revenue 6% -6% 5% -9% 3% 8% 7% Other Expenses 5% 2% 0% 22%% 0% 2% 32% 11% 0% 0% 0% 1% 1% 3% 4% 1% 5% Income Before Interest & Tax 42% 8% 9% 11% -6 % -13% 3% 1% 0% Interest Expenses 1% 2% 3% 20% 34 % 16% Net Income before Tax 3% 41% 2% 3% 6% 7% 0 % 0 % 1% Income Tax (Period) 9% 1% 3 % 15% Tax (Previous Years) 0% 0% 0% 1 %% Universities and Research Train Fe 0% 0 % 0% 0 % Board of Directors Remuniration 0% 0% 0 % 0 % Net Income 31% 5% 3% Non-controlling Interest 0% 0 % 14 % Net Income Pertains to Shareholder 31% 5% 3 % 0 % 17% 329 14%

2021 2020 2019 2018 2017 2016 Assets(JD) 2015 2014 2013 2012 2011 2010 Cash on Hand & at Banks 16% 4% 3% 2% Account Receivables, Net 1% 1% 4% 12% 9% 7% 2% 11% 2% 13% 3% 12% 11% 14% Notes_Receivable 10% 9% 4% 6% 6% 10% Post Dated Cheques Short Term Investments 0. 02% 0.02% o 0.02% Inventory 0.02% 0.02% 0.02% 11% 0.01% 11% 0.40% 8% 0.12% Spare Parts 11% 0.02% 8% 11% 0.02% 0.04% 0.00% 18% 0.00% 21% Total Current Assets 6.29% 25% 6.58% 6.67% 23% 6.43% 12% 44% 29% 0.00% 0.00%% 28% 0.00% 34% 31% 0.00% 4.13% 32% 5.04% Long Term Investments 22% 26% 35% 36% 26% 36% 38% Fixed Assets, Ne 24% 25% 24% 15% 20% 46% 19% 19% 19% 20% -and: 21% 16% 21% 13% 0% 22% 0% 0% 15% 0% Projects in Progress 0% 0% 25% 1% 1% 0% 1% 0% 0% 0% 3% 3% 0% 11% 0% Total Fixed Assets 16% 20% 11% 20% 21% 24% 24% 25% 24% 20% 12% Other Asset 18% 25% 25% 26% 25% 39% 42% 39% 37% Total Assets 20% 19% 100 %% 20% 100% 20% 20% 100% 5% 100% 4% 100% 100% 7% 9% Liabilities & Owners Equity 100% 100% 100% 100% 100% 100% Liabilities(JD) Accounts and Notes Payable 9% 6% 8% Credit Banks 10% 10% 7% 0% 7% 7% 7% 8% 8% 9% 9% 6 % 4% Short Term Loans 0% 0% 6% 3% 4% 0% 0% 8%% 8% 1% 2% 2% Accrued Part of Long Term Loans 2% 0% 0% 2% 0 % 3% 0% 3% 0% 0% Total Current Liabilities 4% 3% 0% 23% 25% 3% 27% 3% 0% 28% 29% 2% 1 % Long Term Loans & Notes Payable 27% 2% 3% 23% 5% 5% 7% 28% 1% 23% 13% 17% Corporate Bonds 0% 7% 0% 0% 7% 5% 0% 3% 12% 5% 5% Other Liabilities 0% 13% 0 9% 4 9% 16% 0% 3% 17% 4% 2% 0 % 0% 2% 0% 47% 2% 0% Total Liabilities 38% 49% 39% 4 % 37% 36% 3 % 4 % 5 % 3% Shareholders Equity (JD) 30% 35% 31 % 22% 26 % 18% Authorized Capital 5% 7% Subscribed Capital 7 % 5% 7% 7 % 7% 11% Paid-in Capital 5 % 7% 7% 11% Compulsory Reserves 5% 7% 11% Voluntary Reserve 59% 6% 7% 6% Other Reserves 1 1% 5% 7 % 7% 6% Issuance Premium 7% 7% 10% 0% 7 % 0% 0 9% Issuance Discount 0 9% 0% 0% 0% 0% 0% Treasury Stocks 0% 0 9% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0 % 0% 0 % Cash Dividends 11% 1% 1% 1% 0 9% 0 % 0% 0% Stock Dividends 0% 0% 0% 0 % 0% 0 % 0 9% 0 9% 0 9% 2% 4 9% 2% Accumulated Change in Fair Value 0% 0% 0% Retained Earnings 0 % 0% 0% 0 9% 30% 0% 25% 23% 31% 34 % 36 % 43% 0% 0 % 0 % Total Shareholders Equity 61% 53% 50% 60% 62% 63% 45 % 69% 37 % 38 % Non-controlling Interest 0% 0% 64 9% 0% 1% 77% 1% Total Liabilities & Shareholders Eq 1 % 100% 1 % 73% 100% 1 % 82% 100% 100% 1 % 100% 100% 1 % 100% 0% Income Statement (JD) 100% 1009% 100%% 100% 100% Operating Revenues 100% 100% 100% Operating Expenses 100% 100% 100% 50% 100% 74% 100% 79% 100% 75% 85% 100% 86% 100% 100% Gross Profit 50% 75% 26% 76% 21% 82% 25% 63% 15% 14% 61% General and Administrative Expens 2% 5% 25% 74% 4% 24% 4% 18% Selling and Distribution Exp 4% 4% 37% 39% 26% 1% 4 % 1% 1% 1% 3 % 4% 1% 3% 2% 2% 3% Depreciation (period) 2% 5% 8% 8% Other Operating Expenses 6% 5% 5% 3% 7% 2% 2% 11% 15% 15% 13% 16% 3% 3% 3% Net Operating Income 17% 37% 6 9% 5% 2% 5% 3% 5% 3% 10% Other Revenue 6% -6% 5% -9% 3% 8% 7% Other Expenses 5% 2% 0% 22%% 0% 2% 32% 11% 0% 0% 0% 1% 1% 3% 4% 1% 5% Income Before Interest & Tax 42% 8% 9% 11% -6 % -13% 3% 1% 0% Interest Expenses 1% 2% 3% 20% 34 % 16% Net Income before Tax 3% 41% 2% 3% 6% 7% 0 % 0 % 1% Income Tax (Period) 9% 1% 3 % 15% Tax (Previous Years) 0% 0% 0% 1 %% Universities and Research Train Fe 0% 0 % 0% 0 % Board of Directors Remuniration 0% 0% 0 % 0 % Net Income 31% 5% 3% Non-controlling Interest 0% 0 % 14 % Net Income Pertains to Shareholder 31% 5% 3 % 0 % 17% 329 14% Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts