Question: this is about finance i keep trying to solve this but my answer dont mach the book answer can someone explain how to get same

this is about finance i keep trying to solve this but my answer dont mach the book answer

can someone explain how to get same as book answer ? thank you

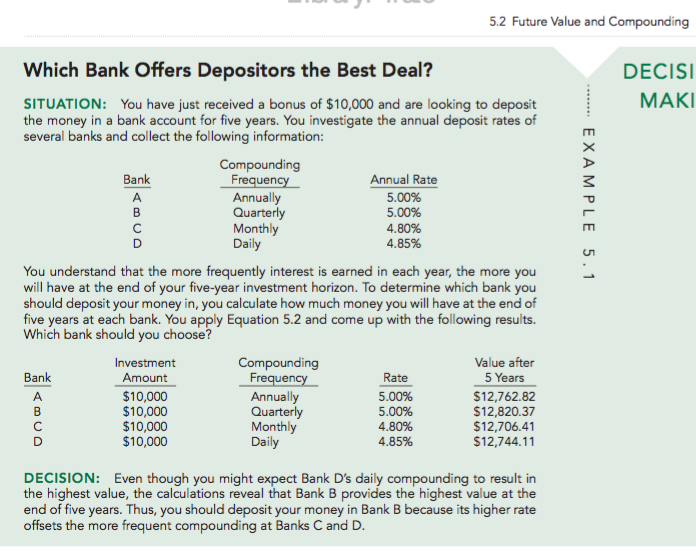

5.2 Future Value and Compounding Which Bank Offers Depositors the Best Deal? DECISI MAKI SITUATION You have just received a bonus of $10,000 and are looking to deposit the money in a bank account for five years. You investigate the annual deposit rates of several banks and collect the following information: Compounding Bank Frequen Annual Rate Annually 5.00% Quarterly 5.00% Monthly 4.80% Daily 4.85% You understand that the more frequently interest is earned in each year, the more you will have at the end of your five-year investment horizon. To determine which bank you should deposit your money in, you calculate how much money you will have at the end of five years at each bank. You apply Equation 5.2 and come up with the following results. Which bank should you choose? Compounding Value after Investment Bank 5 Years Amount Frequen Rate $10,000 Annually 5.00% $12,762.82 $10,000 5.00% Quarterly $12,820.37 $12,706.41 $10,000 Monthly 4.80% $10,000 4.85% $12,744.11 Daily DECISION Even though you might expect Bank D's daily compounding to result in the highest value, the calculations reveal that Bank B provides the highest value at the end of five years. Thus, you should deposit your money in Bank B because its higher rate offsets the more frequent compounding at Banks C and D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts