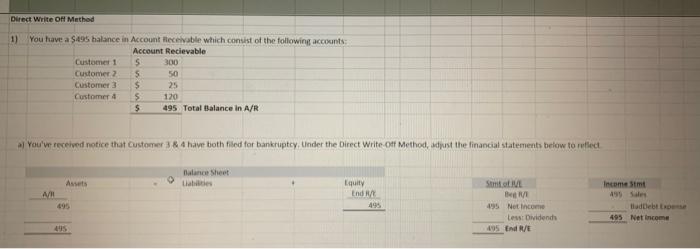

Question: This is account receivable work that has the allowance method and direct write off method. Please answer question 1 and question 2. THANK YOU Direct

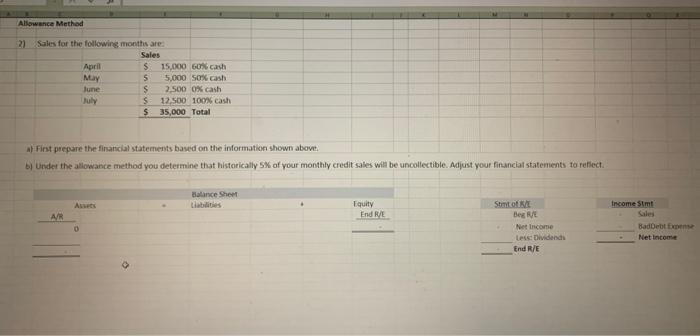

Direct Write Off Method 1) You have a $495 balance in Account Receivable which consist of the following accounts: Account Recievable Customer 1 5 300 Customer 5 50 Customer 3 $ 25 Customer 5 $ 495 Total Balance in A/R 120 You've received notice that customer 3 & 4 have both filed for bankruptcy, Linder the Direct Write Off Method, adjust the financial statements below to reflect Balance Sheet Lates Assets Equity End R AH Income tmt 499 SVE Bee 495 Net Income Les Dividends 05 End R/E 495 Net Income Allowance Method 21 Sales for the following months are Sales April $ 15.000 60% cash May 5 5,000 SX cash June S 2.500 O% cash July $ 12,500 100% cash $ 35,000 Total a) First prepare the financial statements based on the information shown above. by Under the allowance method you determine that historically SX of your monthly credit sales will be uncollectible. Adjust your financial statements to reflect Balance Shem Equity End R/E AR Stmtof BegVE Net Income Less Dividendi End R/E Income Simt Sales Bad Debten Net Income 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts