Question: This is all 1 question and Im completely lost please help (80 percent) Assume that you are an investment analyst preparing an analysis of an

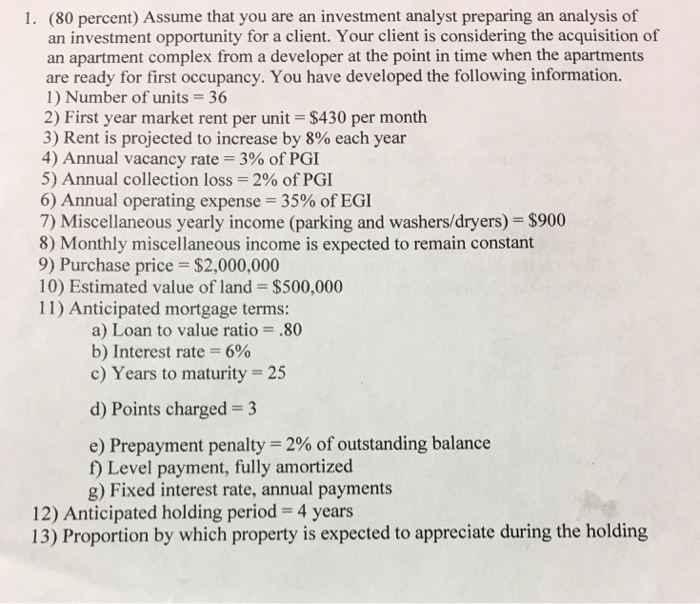

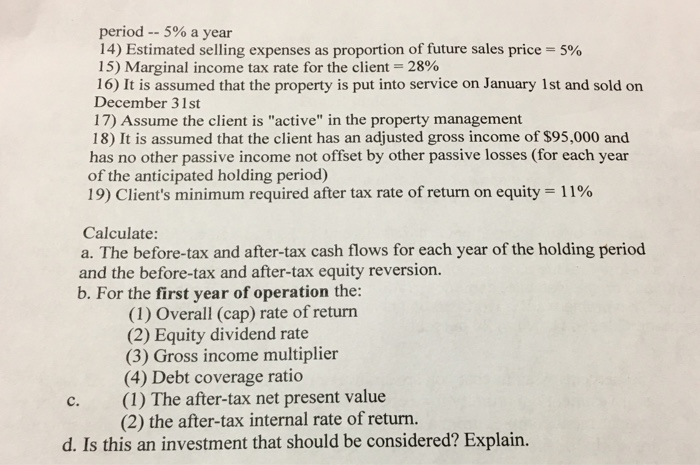

(80 percent) Assume that you are an investment analyst preparing an analysis of an investment opportunity for a client. Your client is considering the acquisition of an apartment complex from a developer at the point in time when the apartments are ready for first occupancy. You have developed the following information. 1) Number of units 36 2) First year market rent per unit- $430 per month 3) Rent is projected to increase by 8% each year 4) Annual vacancy rate 300 of PGI 5) Annual collection loss 2% of PGI 6) Annual operating expense-35% of EGI 7) Miscellaneous yearly income (parking and washers/dryers) $900 8) Monthly miscellaneous income is expected to remain constant 9) Purchase price $2,000,000 10) Estimated value of land $500,000 11) Anticipated mortgage terms: 1. a) Loan to value ratio = .80 b) Interest rate-6% c) Years to maturity 25 d) Points charged 3 e) Prepayment penalty 2% of outstanding balance f) Level payment, fully amortized g) Fixed interest rate, annual payments 12) Anticipated holding period 4 years 13) Proportion by which property is expected to appreciate during the holding

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts