Question: this is all one problem thankyou so much Ch 9: Homework Saved HO 3 QS 9-4 Interest-bearing note transactions LO P1 8.33 points On November

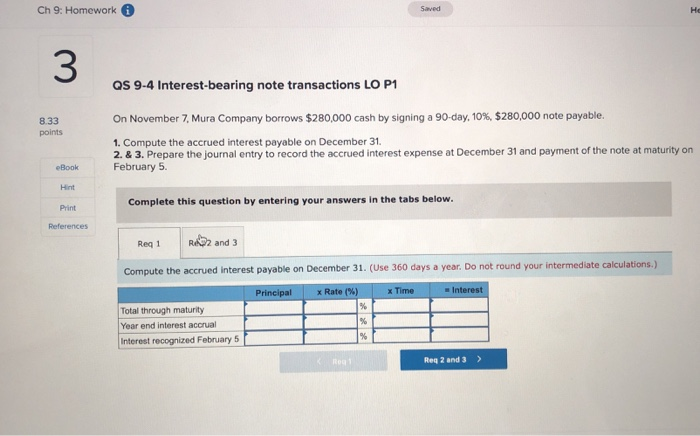

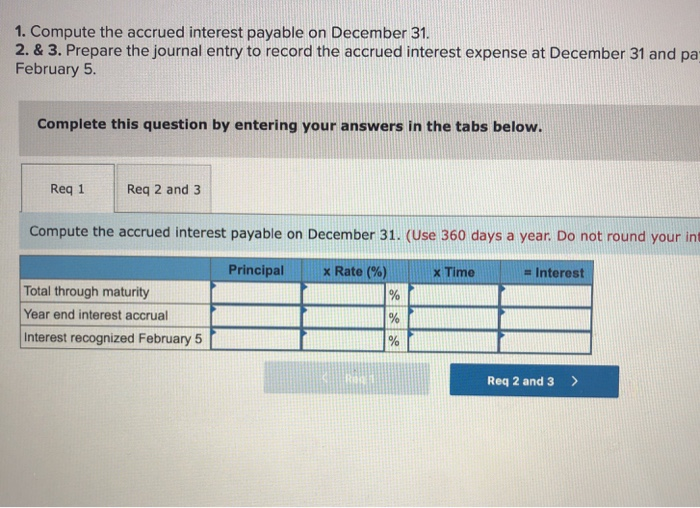

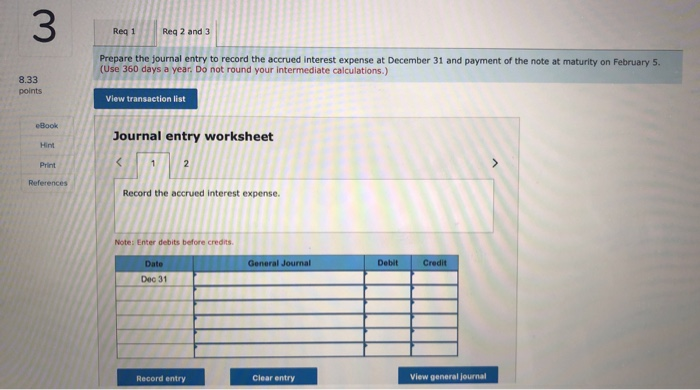

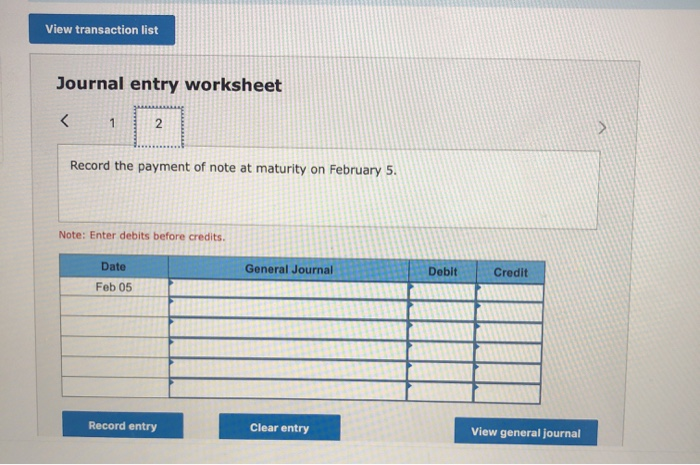

Ch 9: Homework Saved HO 3 QS 9-4 Interest-bearing note transactions LO P1 8.33 points On November 7, Mura Company borrows $280,000 cash by signing a 90-day, 10%, $280,000 note payable. 1. Compute the accrued interest payable on December 31. 2. & 3. Prepare the journal entry to record the accrued interest expense at December 31 and payment of the note at maturity on February 5. eBook Hint Complete this question by entering your answers in the tabs below. Print References Reg 1 R2 and 3 Compute the accrued Interest payable on December 31. (Use 360 days a year. Do not round your intermediate calculations.) Principal * Time Interest Total through maturity Year end interest accrual Interest recognized February 5 x Rate (%) % % % Reg 2 and 3 > 1. Compute the accrued interest payable on December 31. 2. & 3. Prepare the journal entry to record the accrued interest expense at December 31 and pa February 5. Complete this question by entering your answers in the tabs below. Req 1 Reg 2 and 3 Compute the accrued interest payable on December 31. (Use 360 days a year. Do not round your int Principal * Rate (%) X Time = Interest % Total through maturity Year end interest accrual Interest recognized February 5 % % Req 2 and 3 > 3 Reg 1 Reg 2 and 3 Prepare the journal entry to record the accrued interest expense at December 31 and payment of the note at maturity on February 5. (Use 360 days a year. Do not round your intermediate calculations.) 8.33 points View transaction list eBook Journal entry worksheet Hint Print 1 2 > References Record the accrued interest expense. Note: Enter debits before credits General Journal Debit Credit Date Dec 31 Record entry Clear entry View general Journal View transaction list Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts