Question: this is all one question, please send back in excel format if possible. All the information needed for the problem is in the general info

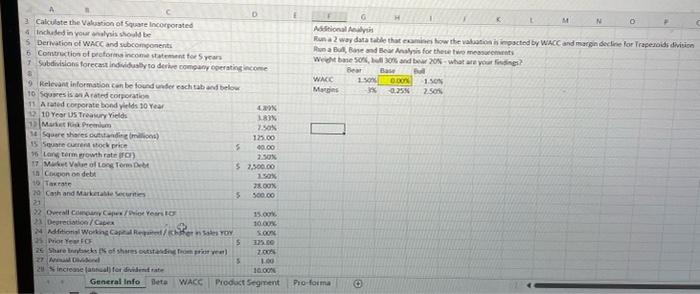

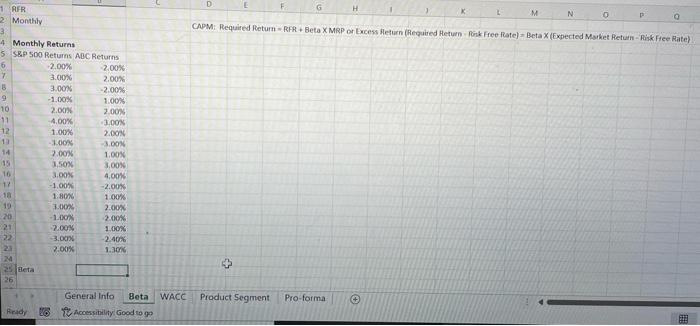

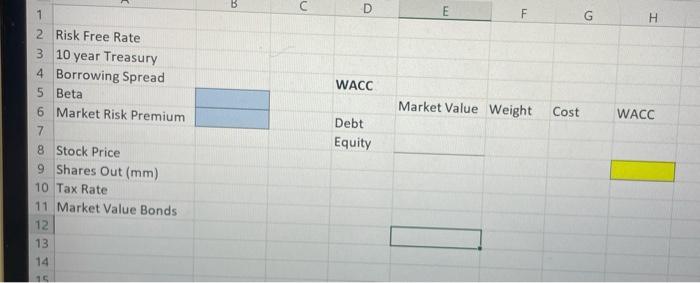

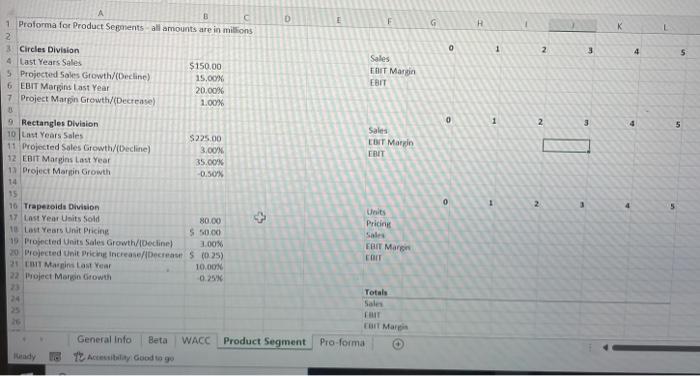

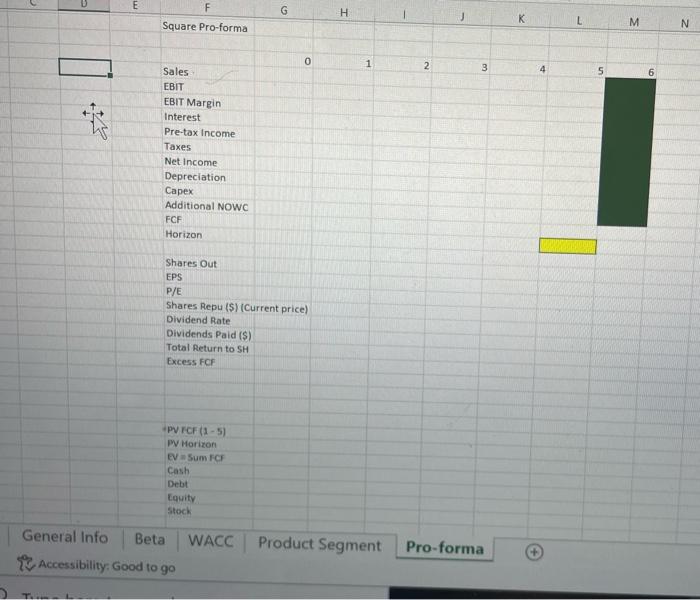

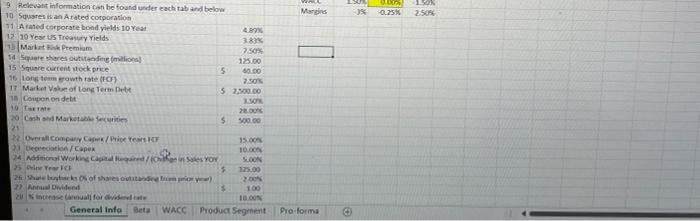

Aritional Merepis Run a 2 woy data table that examiner tow the valuatina in ingacted by WACC and margin docline for Trapejoids division CADM: Required Return = RFA + Beta MRP of Lacess Meturn (Requited Hetum fork Free Rate) = Beta x (Expected Maket Retuan - Risk.Ftee Rate) 310 year Treasury 4 Borrowing Spread 5 Beta 6 Market Risk Premium WACC \begin{tabular}{l|l|l|l|} \hline & Market Value Weight Cost WACC \\ Debt Equity & & & \\ \hline \end{tabular} 10 Tax Rate 11 Market Value Bonds 12 13 14 \begin{tabular}{ll} Square Pro-forma \\ \hline \end{tabular} Aritional Merepis Run a 2 woy data table that examiner tow the valuatina in ingacted by WACC and margin docline for Trapejoids division CADM: Required Return = RFA + Beta MRP of Lacess Meturn (Requited Hetum fork Free Rate) = Beta x (Expected Maket Retuan - Risk.Ftee Rate) 310 year Treasury 4 Borrowing Spread 5 Beta 6 Market Risk Premium WACC \begin{tabular}{l|l|l|l|} \hline & Market Value Weight Cost WACC \\ Debt Equity & & & \\ \hline \end{tabular} 10 Tax Rate 11 Market Value Bonds 12 13 14 \begin{tabular}{ll} Square Pro-forma \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts