Question: This is all one question that's supposed to be on a tax form. Can you show me how it's supposed to be done please? This

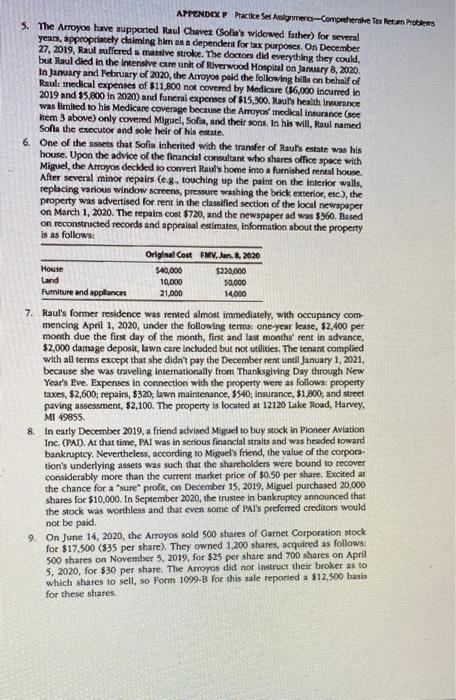

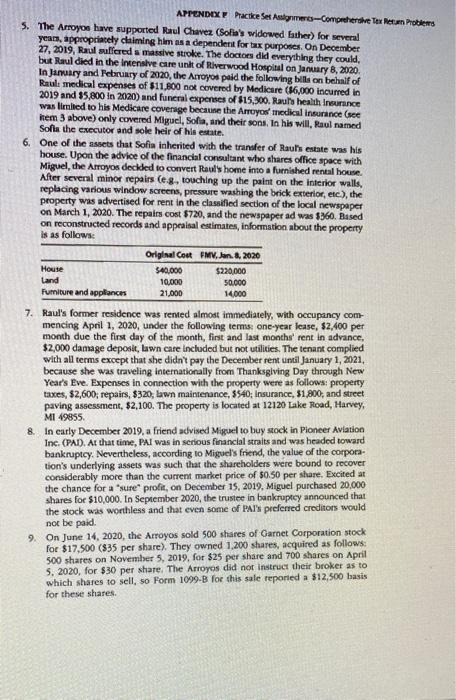

5. The Arroyou have supported Roul Chavez (Sofla's ordomed Easher) for several yeam, approptiately chaiming him as a dependent for trx purposes. On December 27,2019 , Raul sulfered a massive strolse. The doctoes did everything they could. bot Raul died in the intenshe care unit of Riverwood Hotpital on January 8,2020 . In January and Fetacuity of 2020 , the Arroyos paid the following bills on behaif of Ranult inedical expenses of $11,500 noe oovered by Modicare ( 6,000 incurred in 2019 and $5,800 in 2020) and funeral expenses of 415,300 . Raula healh inaurance Was liralied to his Medicare coverage becaune the Arroyos' medical insurance (see fiem 3 above) only covered Migucl, Sofa, and their sons, In his will. Paul named Sofla the evecutor and sole heir of his estate. 6. One of the assets that Sofia iaherited with the transfer of Zauls eatate was his bouse. Upon the advice of the financial consultant who shares office space writh Miguel, the Arroyos dockded to corvert Pauki's home into a furnished rental house. After several minor repairs (e.g, touching up the paint on the interior walls, replacing various windos screcns, pressure washing the brick exterior, etc), the property was advertised for rent in the classified section of the local newrepaper on March 1,2020 . The repairs cost $720, and the newspaper ad was $360. Pased on reconstracted reconds and appealsal estimates, infoernation about the property is as followac 7. Raul's former residence was rened almodt immediately, with occupancy commencing April 1, 2020, under the following temss one-year lease, $2,400 per month due the first day of the month, first and last monchs' rent in advance, $2,000 damage deposit, lawn case included but not utilities. The tenant complied with all terms except that she didn't pay the December rent until January 1, 2021, because she was traveling internationally from Thanksgiving Day through New Year's Eve. Expenses in connection with the property were as follows: property taxes, $2,600; repairs, $320, lawn mainterance, \$540; insurance, $1,800, and street paving assessment, $2,100. The property is located at 12120 Lake Moad, Harvey, M1 49855. 8. In early December 2019, a friend ackised Miguel to buy stock in Pioneer Aviation Inc. (PAD), At that time, PAI was in serious financlal straits and was headed toward bankruptcy. Nevertheless, according to Miguel's friend, the value of the corporation's underlying assets was such that the shareholders were bound to recover considerably more than the current market price of $0.50 per share. Excited at the chance for a "sure" profie, on Decenber 15, 2019, Miguel purchased 20,000 shares foe $10,000. In Seprember 2020, the trustee in bankruptcy announced that the stock was worthless and that even some of PA's peeferred creditors would noc be paid. 9. On June 14, 2020, the Arroyos sold 500 shares of Carnet Corporation stock for $17,500 ( $35 per share). They owned 1,200 shares, acquired as follows: 500 shares on November 5, 2019, for $25 per share and 700 shares on April 5. 2020, for $30 per share, The Arroyes did not instruer their broker as to which shares to sell, so Form 1099-B foe this sale reporied a \$12,500 basis for these shares. 2. On January 2, 2020, Miguel pald 831,000 (including sales tax) to purchase a gendy used Toyoti Camry that fie uses 92+6 of the time lor bualness. No trade-in Was Imolved In this purchase, and he did not claim any $179 expensing M gacl uses the actial operiating coet incthod to cornpute hls tax dodoction. He elects to use the 20046 dedining.balance MACFS depteciation method with t halfyear convention. His expenses relating to the Camry for 2020 ane 25 followit. In connecton with his business use of the Camry, Miguel paid 3510 for tolls and $350 in fines for traffic violations. In 2020, Miguel drowe the Camry 14,352 miles for business and 1,248 miles for personal use (which includes his daily, roundtrip commute to work). 3. Miguel handles most claim applications locally, but on occasion he must travel out of town. Fxpenses in connection with these business trips during 2020 were $930 for lodging and $1,140 for meals. He also paid $610 for business dinners he had with several vising executives of Insurance companies with whom he does business. Migsel's other business-related expenses for 2020 are listed below. 4. Sofia eams $32,000 woeking 15 a tegistered dietitian for the Marguette Public School District. The job she holds as manager of the school lunch program is not chassified as full time. Consefuently, she is not elighle to participate in the teacher retirement or health insurance programs. Sofia's expenses for 2020 are summarized as follows: To vork full time and earn a larger salary. Sofia applied for a position as chief dietitian for a chain of nursing homes. According to the director of the recruiting service she hired, the position has not yet been filled, and Sofia is one of the leading candidates. The continuing cducation program was sponsored by the National Association of Dietitians and consisted of a one-day seminar on special diets for seniors. Solia drave the family Chevsolet Malibu: 930 miles on jobrelated use and 5,200 miles in commuting to work, out of a total of 8,670 miles driven for the year. The Arroyos purchased the cat on July 11. 2018, for $23,400. 10. One month before the died oe hpri 14, 2010, Meria Charex (Sofir's another) gave Sofla a coin collection. Bascd on cacrial mocots that Marla kept, the collection had a cont basis of $9,000 and a fale market vise of $18,000 an the time Marit passed away, On Februty 12, 2am0, the Arroyo reaidenco was barglartaed, and the coin collecton was stolen. The Arroyos fled a clain whth the carrice of dyeir homoowner's ineurance policy for $2,1000 (the current value of the collection). Wniortanately, they were ocly able to collect $10,000, whlch was the masiman payout allowed for vahnbles (eg., fewelr, antiques) whithout a special rider attacived to the insurance policy. 11. In her will. Maria Chavea (soe Anm 10) left Sofla a vacant bot on Whight Street. Marla had paid $15,000 for the properry, and it had a value of $19,000 when she died. Maria had purchased the loc bocause it aras adiacent to Northern Michigan Univenity property and she expectied the school to eventally expand the campus. By 2020, it has becorne dese that the unlversicy did not have the funds to expand the campus. Consequenth, or jaly 1, 2020, Sofin soid the loe foe 319,000 . Mot included in this price are ungald property tases (and interest on the ungaid taxes) of $700 on the lox, which the perchaser assumed and later paid. Sofia received a Fartm 1099.8 as docurneniaton for this transaction which did not report the bases of this properig. 12. Every year asound Christmas, Migael receives cands from various car repair factities and car dealerships that exprest thariss for his business referals during the year. Many of these cands indude cash. Miguel has no arrangement, coniractual or otherwise, that requires any compensation for the refernals he makes. Concerned about the legality of such "gifu, "Mguel consulied an attoney about the matter a Few years ago. Without passing judgrent on the status of the payors, the atiorney found that Miguclis acceptance of the payments does not violale state or local law. Miguel sincerely betieves that the pwyments he receives have no effect on the refermls he malces. During Decernber 20120 , Miguel received cards containing \$7,200. One additional card containing $900 mas delayed in the mail, and Miguel did not receive lit untill lanuary 4, 2021. 13. During a sunny weekend in June, the Arroyos beid a garnge sale to dispose of unwanted furniture, applances, bocks, birycles, dothes, and one boat (including trailer). Procects from the tale sotalod 99,200 . The escimated basis of the iterns sold is 325,500 . All sold assess had been used by the Arroyos for personal purpaser 14. In addition to the reccipts previously noted, the Arroyos received the following amounts during 2020- APPLNDIX y PraciceSet Aswigrenerts-Comprehensive Tax Retisn Problens 15. Payments made for 2080 expenditures not mentioned elsewhere are as follows: The Amoyos' medical insurance does not cower dental services. They pledge \$1,200 per year to their church, The Waters Edge Church in Marquette, ML. In 2020 , they paid the pledges for 2018 throngh 2020 . During 2020, the Arroyas clrove the Malilot 270 miles for medical purposes (e g., trips to the horpital, doctor and dentist offices) and 320 miles delivering roeals to the poor for Meals-onWheels, a qualified charity. 16. The Arroyos have rwo sons who tive with then Enrique and Jorke. Berh are fulltime stuclenas. Enrique is an accomplished singer and eamed \$4.200 during the sear performing at speclal events (e.g-, wedkingx, annivenaries, civic functions). Enrique depoeits his earrings is a stvings account and intends to wse this for future college expenses. Jorge does not have a joh. 17. Sofia's Form W-2 reflects wages of $32,000. Appropriate amounts for Social. Secuirity and Medicare taxes were dedieted, Income tax withboldinpe were $1.320 for Fedenal and $1,656 for state. The Arroyos made quarteny tax payments of $1.900 for Federal and 5600 for sate on eudi of the follerring dates Apnt 10. 2020; June 12, 2020; Septermler 11, 2020, and Decemlker 28, 2020. The Amopos do? not hodd any forcign financial accoints oxir do they have any dealingh in virtaal carrencies. Helevan $ onfal sectarity numbcrs are noted below: Requirements Tor 3020 following these guddines. complete the scturn. for the vear. 51, eor wis for tiate and koul income is 5. The Arroyou have supported Roul Chavez (Sofla's ordomed Easher) for several yeam, approptiately chaiming him as a dependent for trx purposes. On December 27,2019 , Raul sulfered a massive strolse. The doctoes did everything they could. bot Raul died in the intenshe care unit of Riverwood Hotpital on January 8,2020 . In January and Fetacuity of 2020 , the Arroyos paid the following bills on behaif of Ranult inedical expenses of $11,500 noe oovered by Modicare ( 6,000 incurred in 2019 and $5,800 in 2020) and funeral expenses of 415,300 . Raula healh inaurance Was liralied to his Medicare coverage becaune the Arroyos' medical insurance (see fiem 3 above) only covered Migucl, Sofa, and their sons, In his will. Paul named Sofla the evecutor and sole heir of his estate. 6. One of the assets that Sofia iaherited with the transfer of Zauls eatate was his bouse. Upon the advice of the financial consultant who shares office space writh Miguel, the Arroyos dockded to corvert Pauki's home into a furnished rental house. After several minor repairs (e.g, touching up the paint on the interior walls, replacing various windos screcns, pressure washing the brick exterior, etc), the property was advertised for rent in the classified section of the local newrepaper on March 1,2020 . The repairs cost $720, and the newspaper ad was $360. Pased on reconstracted reconds and appealsal estimates, infoernation about the property is as followac 7. Raul's former residence was rened almodt immediately, with occupancy commencing April 1, 2020, under the following temss one-year lease, $2,400 per month due the first day of the month, first and last monchs' rent in advance, $2,000 damage deposit, lawn case included but not utilities. The tenant complied with all terms except that she didn't pay the December rent until January 1, 2021, because she was traveling internationally from Thanksgiving Day through New Year's Eve. Expenses in connection with the property were as follows: property taxes, $2,600; repairs, $320, lawn mainterance, \$540; insurance, $1,800, and street paving assessment, $2,100. The property is located at 12120 Lake Moad, Harvey, M1 49855. 8. In early December 2019, a friend ackised Miguel to buy stock in Pioneer Aviation Inc. (PAD), At that time, PAI was in serious financlal straits and was headed toward bankruptcy. Nevertheless, according to Miguel's friend, the value of the corporation's underlying assets was such that the shareholders were bound to recover considerably more than the current market price of $0.50 per share. Excited at the chance for a "sure" profie, on Decenber 15, 2019, Miguel purchased 20,000 shares foe $10,000. In Seprember 2020, the trustee in bankruptcy announced that the stock was worthless and that even some of PA's peeferred creditors would noc be paid. 9. On June 14, 2020, the Arroyos sold 500 shares of Carnet Corporation stock for $17,500 ( $35 per share). They owned 1,200 shares, acquired as follows: 500 shares on November 5, 2019, for $25 per share and 700 shares on April 5. 2020, for $30 per share, The Arroyes did not instruer their broker as to which shares to sell, so Form 1099-B foe this sale reporied a \$12,500 basis for these shares. 2. On January 2, 2020, Miguel pald 831,000 (including sales tax) to purchase a gendy used Toyoti Camry that fie uses 92+6 of the time lor bualness. No trade-in Was Imolved In this purchase, and he did not claim any $179 expensing M gacl uses the actial operiating coet incthod to cornpute hls tax dodoction. He elects to use the 20046 dedining.balance MACFS depteciation method with t halfyear convention. His expenses relating to the Camry for 2020 ane 25 followit. In connecton with his business use of the Camry, Miguel paid 3510 for tolls and $350 in fines for traffic violations. In 2020, Miguel drowe the Camry 14,352 miles for business and 1,248 miles for personal use (which includes his daily, roundtrip commute to work). 3. Miguel handles most claim applications locally, but on occasion he must travel out of town. Fxpenses in connection with these business trips during 2020 were $930 for lodging and $1,140 for meals. He also paid $610 for business dinners he had with several vising executives of Insurance companies with whom he does business. Migsel's other business-related expenses for 2020 are listed below. 4. Sofia eams $32,000 woeking 15 a tegistered dietitian for the Marguette Public School District. The job she holds as manager of the school lunch program is not chassified as full time. Consefuently, she is not elighle to participate in the teacher retirement or health insurance programs. Sofia's expenses for 2020 are summarized as follows: To vork full time and earn a larger salary. Sofia applied for a position as chief dietitian for a chain of nursing homes. According to the director of the recruiting service she hired, the position has not yet been filled, and Sofia is one of the leading candidates. The continuing cducation program was sponsored by the National Association of Dietitians and consisted of a one-day seminar on special diets for seniors. Solia drave the family Chevsolet Malibu: 930 miles on jobrelated use and 5,200 miles in commuting to work, out of a total of 8,670 miles driven for the year. The Arroyos purchased the cat on July 11. 2018, for $23,400. 10. One month before the died oe hpri 14, 2010, Meria Charex (Sofir's another) gave Sofla a coin collection. Bascd on cacrial mocots that Marla kept, the collection had a cont basis of $9,000 and a fale market vise of $18,000 an the time Marit passed away, On Februty 12, 2am0, the Arroyo reaidenco was barglartaed, and the coin collecton was stolen. The Arroyos fled a clain whth the carrice of dyeir homoowner's ineurance policy for $2,1000 (the current value of the collection). Wniortanately, they were ocly able to collect $10,000, whlch was the masiman payout allowed for vahnbles (eg., fewelr, antiques) whithout a special rider attacived to the insurance policy. 11. In her will. Maria Chavea (soe Anm 10) left Sofla a vacant bot on Whight Street. Marla had paid $15,000 for the properry, and it had a value of $19,000 when she died. Maria had purchased the loc bocause it aras adiacent to Northern Michigan Univenity property and she expectied the school to eventally expand the campus. By 2020, it has becorne dese that the unlversicy did not have the funds to expand the campus. Consequenth, or jaly 1, 2020, Sofin soid the loe foe 319,000 . Mot included in this price are ungald property tases (and interest on the ungaid taxes) of $700 on the lox, which the perchaser assumed and later paid. Sofia received a Fartm 1099.8 as docurneniaton for this transaction which did not report the bases of this properig. 12. Every year asound Christmas, Migael receives cands from various car repair factities and car dealerships that exprest thariss for his business referals during the year. Many of these cands indude cash. Miguel has no arrangement, coniractual or otherwise, that requires any compensation for the refernals he makes. Concerned about the legality of such "gifu, "Mguel consulied an attoney about the matter a Few years ago. Without passing judgrent on the status of the payors, the atiorney found that Miguclis acceptance of the payments does not violale state or local law. Miguel sincerely betieves that the pwyments he receives have no effect on the refermls he malces. During Decernber 20120 , Miguel received cards containing \$7,200. One additional card containing $900 mas delayed in the mail, and Miguel did not receive lit untill lanuary 4, 2021. 13. During a sunny weekend in June, the Arroyos beid a garnge sale to dispose of unwanted furniture, applances, bocks, birycles, dothes, and one boat (including trailer). Procects from the tale sotalod 99,200 . The escimated basis of the iterns sold is 325,500 . All sold assess had been used by the Arroyos for personal purpaser 14. In addition to the reccipts previously noted, the Arroyos received the following amounts during 2020- APPLNDIX y PraciceSet Aswigrenerts-Comprehensive Tax Retisn Problens 15. Payments made for 2080 expenditures not mentioned elsewhere are as follows: The Amoyos' medical insurance does not cower dental services. They pledge \$1,200 per year to their church, The Waters Edge Church in Marquette, ML. In 2020 , they paid the pledges for 2018 throngh 2020 . During 2020, the Arroyas clrove the Malilot 270 miles for medical purposes (e g., trips to the horpital, doctor and dentist offices) and 320 miles delivering roeals to the poor for Meals-onWheels, a qualified charity. 16. The Arroyos have rwo sons who tive with then Enrique and Jorke. Berh are fulltime stuclenas. Enrique is an accomplished singer and eamed \$4.200 during the sear performing at speclal events (e.g-, wedkingx, annivenaries, civic functions). Enrique depoeits his earrings is a stvings account and intends to wse this for future college expenses. Jorge does not have a joh. 17. Sofia's Form W-2 reflects wages of $32,000. Appropriate amounts for Social. Secuirity and Medicare taxes were dedieted, Income tax withboldinpe were $1.320 for Fedenal and $1,656 for state. The Arroyos made quarteny tax payments of $1.900 for Federal and 5600 for sate on eudi of the follerring dates Apnt 10. 2020; June 12, 2020; Septermler 11, 2020, and Decemlker 28, 2020. The Amopos do? not hodd any forcign financial accoints oxir do they have any dealingh in virtaal carrencies. Helevan $ onfal sectarity numbcrs are noted below: Requirements Tor 3020 following these guddines. complete the scturn. for the vear. 51, eor wis for tiate and koul income is

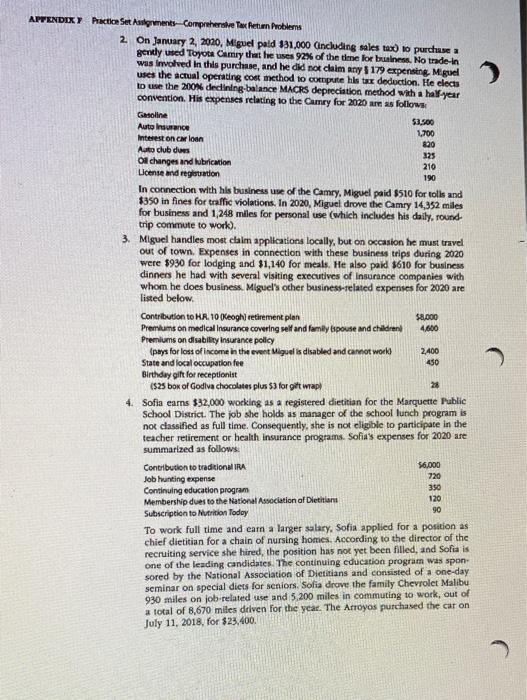

Step by Step Solution

There are 3 Steps involved in it

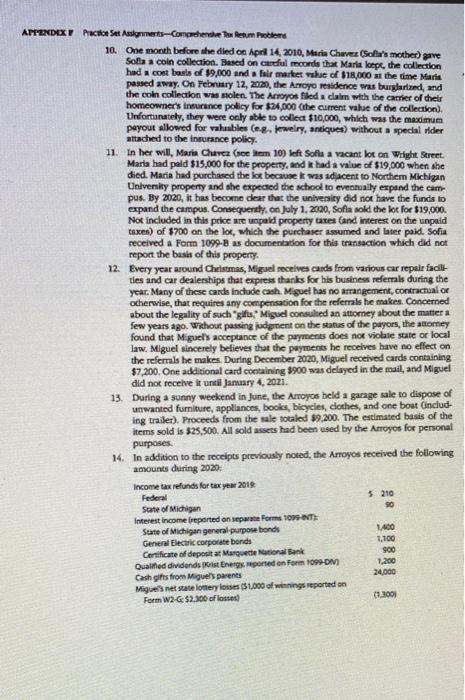

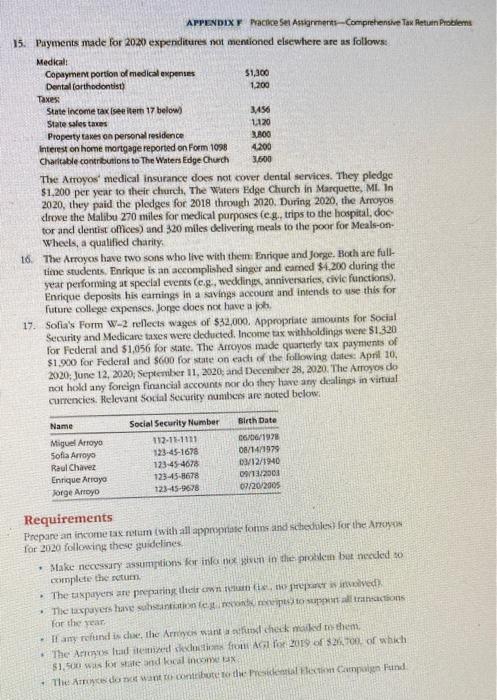

Get step-by-step solutions from verified subject matter experts