Question: this is all that i am given Problem 21-48 Suppose that JPMorgan Chase sells call options on $1.40 million worth of a stock portfolio with

this is all that i am given

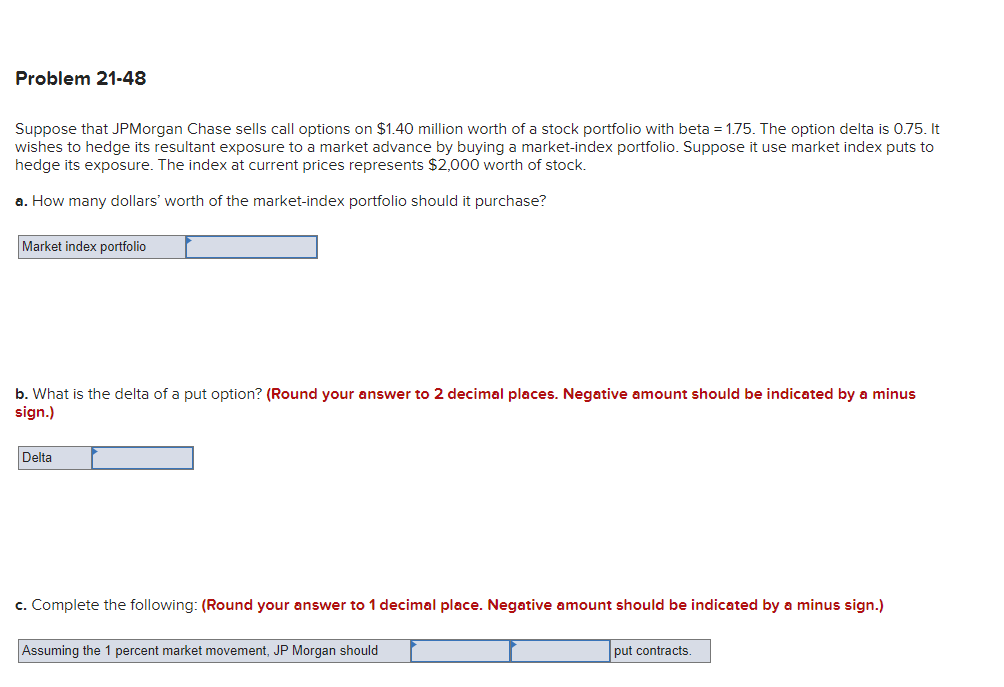

Problem 21-48 Suppose that JPMorgan Chase sells call options on $1.40 million worth of a stock portfolio with beta = 1.75. The option delta is 0.75. It wishes to hedge its resultant exposure to a market advance by buying a market-index portfolio. Suppose it use market index puts to hedge its exposure. The index at current prices represents $2,000 worth of stock. a. How many dollars' worth of the market-index portfolio should it purchase? Market index portfolio b. What is the delta of a put option? (Round your answer to 2 decimal places. Negative amount should be indicated by a minus sign.) Delta c. Complete the following: (Round your answer to 1 decimal place. Negative amount should be indicated by a minus sign.) Assuming the 1 percent market movement, JP Morgan should put contracts Problem 21-48 Suppose that JPMorgan Chase sells call options on $1.40 million worth of a stock portfolio with beta = 1.75. The option delta is 0.75. It wishes to hedge its resultant exposure to a market advance by buying a market-index portfolio. Suppose it use market index puts to hedge its exposure. The index at current prices represents $2,000 worth of stock. a. How many dollars' worth of the market-index portfolio should it purchase? Market index portfolio b. What is the delta of a put option? (Round your answer to 2 decimal places. Negative amount should be indicated by a minus sign.) Delta c. Complete the following: (Round your answer to 1 decimal place. Negative amount should be indicated by a minus sign.) Assuming the 1 percent market movement, JP Morgan should put contracts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts