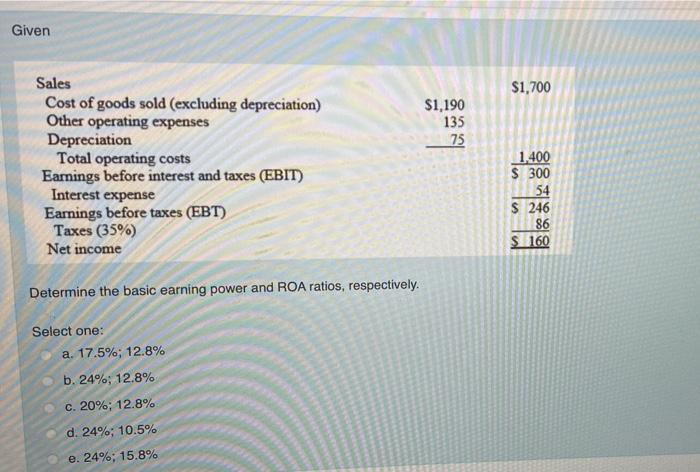

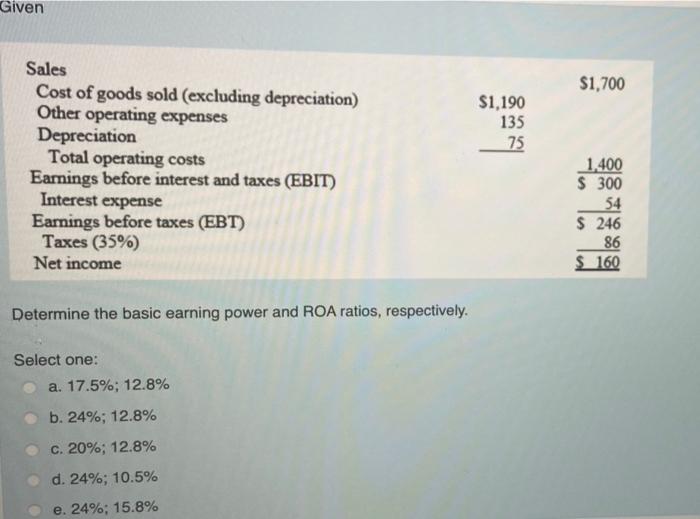

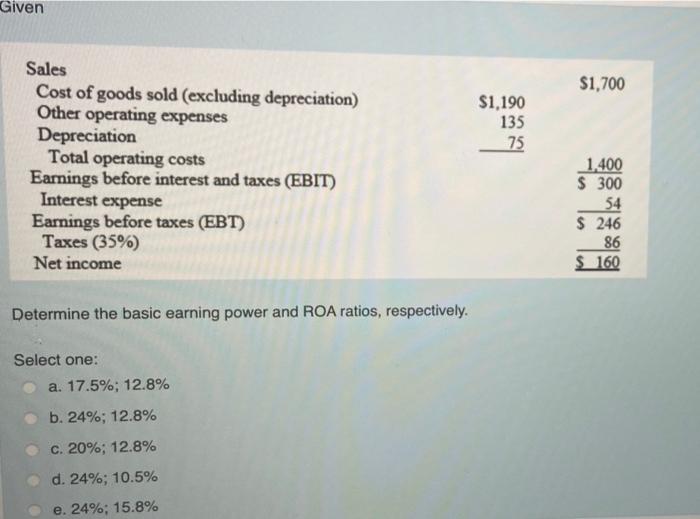

Question: This is all that is given for this question Given Sales Cost of goods sold (excluding depreciation) Other operating expenses Depreciation Total operating costs Earnings

Given Sales Cost of goods sold (excluding depreciation) Other operating expenses Depreciation Total operating costs Earnings before interest and taxes (EBIT) Interest expense Earnings before taxes (EBT) Taxes (35%) Net income Determine the basic earning power and ROA ratios, respectively. Select one: a. 17.5%; 12.8% b. 24%; 12.8% c. 20%; 12.8% d. 24%; 10.5% e. 24%; 15.8% $1,190 135 75 $1,700 1.400 $ 300 54 $ 246 86 $ 160 Given Sales Cost of goods sold (excluding depreciation) Other operating expenses Depreciation Total operating costs Earnings before interest and taxes (EBIT) Interest expense Earnings before taxes (EBT) Taxes (35%) Net income Determine the basic earning power and ROA ratios, respectively. Select one: a. 17.5%; 12.8% b. 24%; 12.8% c. 20%; 12.8% d. 24%; 10.5% e. 24%; 15.8% $1,190 135 75 $1,700 1,400 $ 300 54 $ 246 86 $ 160 Given Sales Cost of goods sold (excluding depreciation) Other operating expenses Depreciation Total operating costs Earnings before interest and taxes (EBIT) Interest expense Earnings before taxes (EBT) Taxes (35%) Net income Determine the basic earning power and ROA ratios, respectively. Select one: a. 17.5%; 12.8% b. 24%; 12.8% c. 20%; 12.8% d. 24%; 10.5% e. 24%; 15.8% $1,190 135 75 $1,700 1,400 $ 300 54 $ 246 86 $ 160 Given Sales Cost of goods sold (excluding depreciation) Other operating expenses Depreciation Total operating costs Earnings before interest and taxes (EBIT) Interest expense Earnings before taxes (EBT) Taxes (35%) Net income Determine the basic earning power and ROA ratios, respectively. Select one: a. 17.5%; 12.8% b. 24%; 12.8% c. 20%; 12.8% d. 24%; 10.5% e. 24%; 15.8% $1,190 135 75 $1,700 1.400 $ 300 54 $ 246 86 $ 160 Given Sales Cost of goods sold (excluding depreciation) Other operating expenses Depreciation Total operating costs Earnings before interest and taxes (EBIT) Interest expense Earnings before taxes (EBT) Taxes (35%) Net income Determine the basic earning power and ROA ratios, respectively. Select one: a. 17.5%; 12.8% b. 24%; 12.8% c. 20%; 12.8% d. 24%; 10.5% e. 24%; 15.8% $1,190 135 75 $1,700 1,400 $ 300 54 $ 246 86 $ 160 Given Sales Cost of goods sold (excluding depreciation) Other operating expenses Depreciation Total operating costs Earnings before interest and taxes (EBIT) Interest expense Earnings before taxes (EBT) Taxes (35%) Net income Determine the basic earning power and ROA ratios, respectively. Select one: a. 17.5%; 12.8% b. 24%; 12.8% c. 20%; 12.8% d. 24%; 10.5% e. 24%; 15.8% $1,190 135 75 $1,700 1,400 $ 300 54 $ 246 86 $ 160

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts