Question: This is all that is provided from the question. Sorry, there is no market interest rate. Hence, I'm not sure how to go about answering

This is all that is provided from the question. Sorry, there is no market interest rate. Hence, I'm not sure how to go about answering this one.

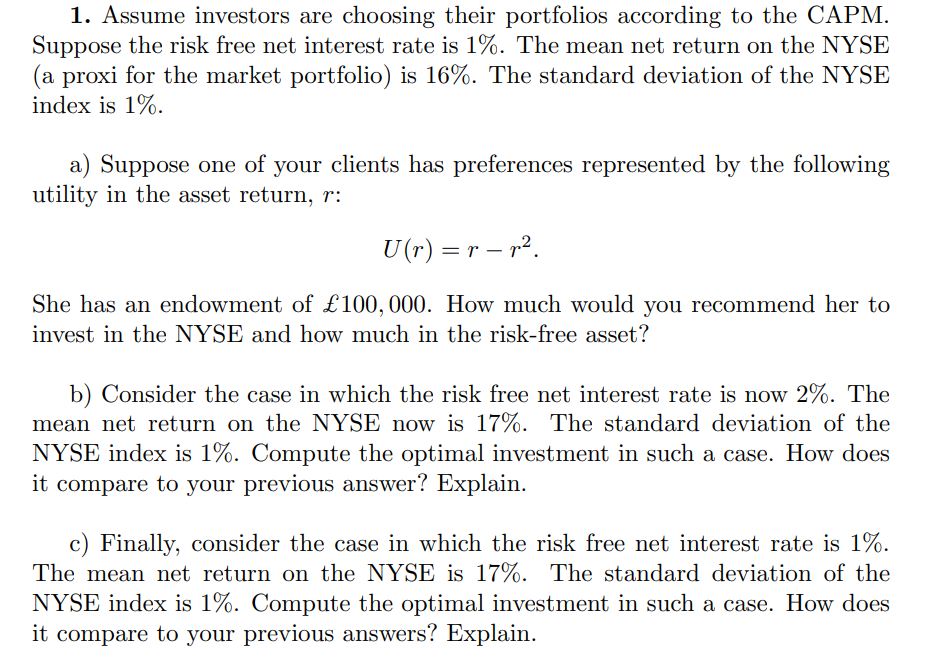

1. Assume investors are choosing their portfolios according to the CAPM. Suppose the risk free net interest rate is 1%. The mean net return on the NYSE (a proxi for the market portfolio) is 16%. The standard deviation of the NYSE index is 1%. a) Suppose one of your clients has preferences represented by the following utility in the asset return, r: U(r) =s p2. She has an endowment of 100,000. How much would you recommend her to invest in the NYSE and how much in the risk-free asset? b) Consider the case in which the risk free net interest rate is now 2%. The mean net return on the NYSE now is 17%. The standard deviation of the NYSE index is 1%. Compute the optimal investment in such a case. How does it compare to your previous answer? Explain. c) Finally, consider the case in which the risk free net interest rate is 1%. The mean net return on the NYSE is 17%. The standard deviation of the NYSE index is 1%. Compute the optimal investment in such a case. How does it compare to your previous answers? Explain. 1. Assume investors are choosing their portfolios according to the CAPM. Suppose the risk free net interest rate is 1%. The mean net return on the NYSE (a proxi for the market portfolio) is 16%. The standard deviation of the NYSE index is 1%. a) Suppose one of your clients has preferences represented by the following utility in the asset return, r: U(r) =s p2. She has an endowment of 100,000. How much would you recommend her to invest in the NYSE and how much in the risk-free asset? b) Consider the case in which the risk free net interest rate is now 2%. The mean net return on the NYSE now is 17%. The standard deviation of the NYSE index is 1%. Compute the optimal investment in such a case. How does it compare to your previous answer? Explain. c) Finally, consider the case in which the risk free net interest rate is 1%. The mean net return on the NYSE is 17%. The standard deviation of the NYSE index is 1%. Compute the optimal investment in such a case. How does it compare to your previous answers? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts