Question: this is all the information given for the question and as clear as its going to get. Required information Complete the last four columns of

this is all the information given for the question and as clear as its going to get.

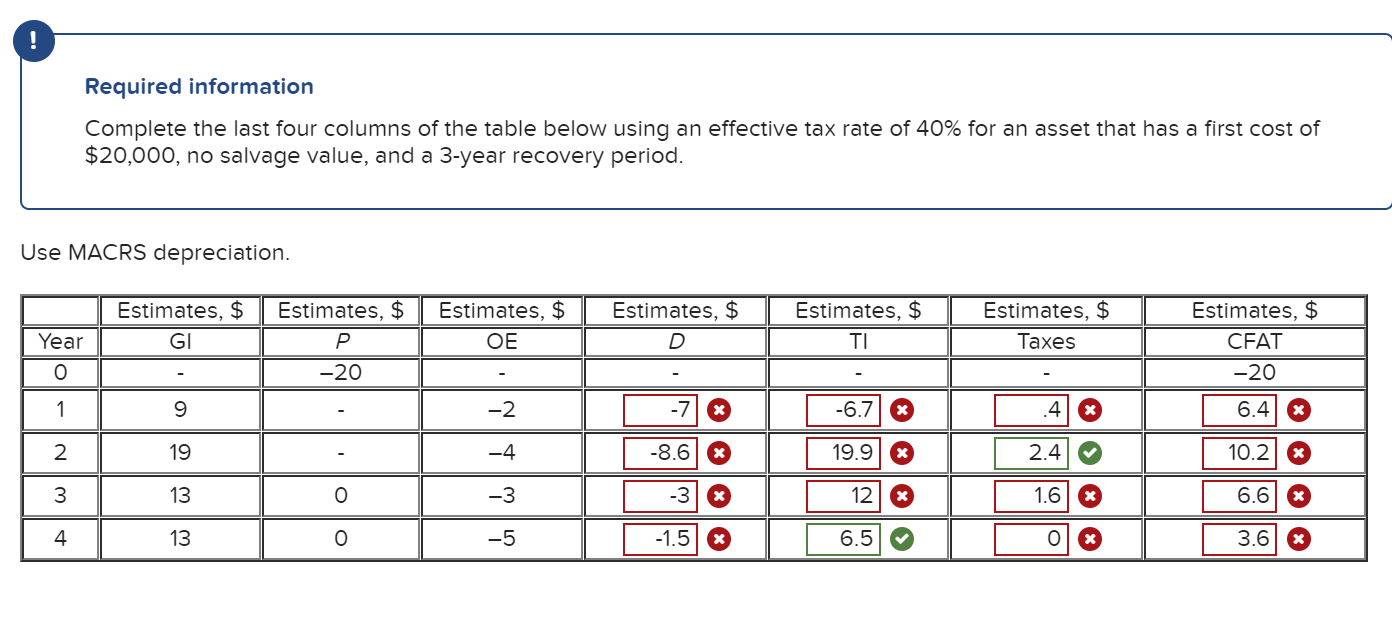

Required information Complete the last four columns of the table below using an effective tax rate of 40% for an asset that has a first cost of $20,000, no salvage value, and a 3-year recovery period. Use MACRS depreciation. Estimates, $ Estimates, $ GIA Estimates, $ P T -20 Estimates, $ OE Year | l -71 -8.6 * 1 | 2 19 DOT-3 | 4T 130 -5 Estimates, $ Estimates, $ Estimates, $ Taxes CFAT -20 -6.7 6.4 19.9 * 2.4 | 10.2 % 12 * | 1.6 * 6.6 X | 6.5 TD0L 3.6 NIM 3 -1.5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts