Question: this is all the information given in the problem Ling U of L Windows, inc is considering making a change in the material the firm

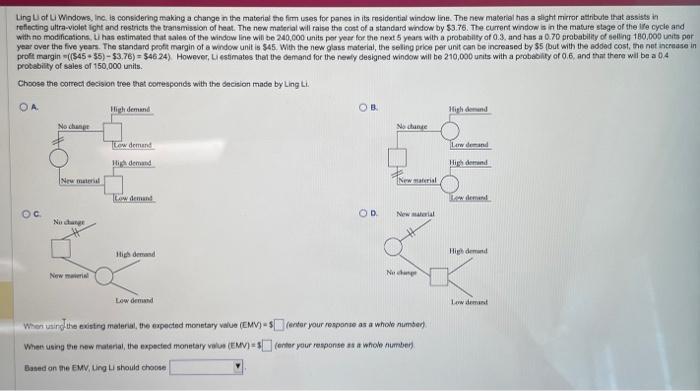

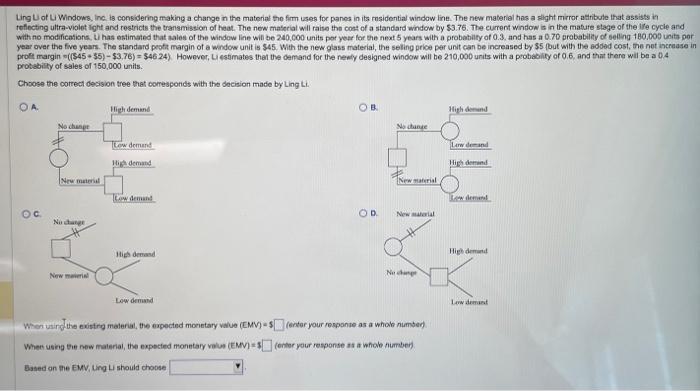

Ling U of L Windows, inc is considering making a change in the material the firm vaes for panes in its rosidential window line. The new material hes a sight mirror attribule that assists in teflecting ultra-violet ight and restricts the transmission of heat. The new material will raise the coat of a standard window by $3.76. The curent wintow is in the mature stage of the ife cycle and with no modifications, ti has estimsted that aales of the window line will be 240,000 units por year for the next 5 years with a probabilty of 0.3, and has a 0.70 prebability of belling 180.005 units por year over the five years. The standard peotat margin of a window unit is $45. With the new gass material, the seling price per unit can be increased by $5. fbut with the added cost, the not increase in prolt margin ((545+55)$3,76)=$46.24. However, Li sstimates that the damand for the newly designed window will be 210,000 units with a probabilty of 0.6, and that there wil be a 0.4 protsbing of sales of 150,000 units. Choose the cotrect decision tree that conesponds with the decision made by Ling Li. A. When usirgt the existrg malerial, the expected monetary vilue (CMV) =f (entar your mesponse as a whob nimber). When using the now material, the expected monetary valas (EMV) = 3 (onter your response as a whobe number). Based on the EMV, Ung Li should chobse Ling U of L Windows, inc is considering making a change in the material the firm vaes for panes in its rosidential window line. The new material hes a sight mirror attribule that assists in teflecting ultra-violet ight and restricts the transmission of heat. The new material will raise the coat of a standard window by $3.76. The curent wintow is in the mature stage of the ife cycle and with no modifications, ti has estimsted that aales of the window line will be 240,000 units por year for the next 5 years with a probabilty of 0.3, and has a 0.70 prebability of belling 180.005 units por year over the five years. The standard peotat margin of a window unit is $45. With the new gass material, the seling price per unit can be increased by $5. fbut with the added cost, the not increase in prolt margin ((545+55)$3,76)=$46.24. However, Li sstimates that the damand for the newly designed window will be 210,000 units with a probabilty of 0.6, and that there wil be a 0.4 protsbing of sales of 150,000 units. Choose the cotrect decision tree that conesponds with the decision made by Ling Li. A. When usirgt the existrg malerial, the expected monetary vilue (CMV) =f (entar your mesponse as a whob nimber). When using the now material, the expected monetary valas (EMV) = 3 (onter your response as a whobe number). Based on the EMV, Ung Li should chobse Ling U of L Windows, inc is considering making a change in the material the firm vaes for panes in its rosidential window line. The new material hes a sight mirror attribule that assists in teflecting ultra-violet ight and restricts the transmission of heat. The new material will raise the coat of a standard window by $3.76. The curent wintow is in the mature stage of the ife cycle and with no modifications, ti has estimsted that aales of the window line will be 240,000 units por year for the next 5 years with a probabilty of 0.3, and has a 0.70 prebability of belling 180.005 units por year over the five years. The standard peotat margin of a window unit is $45. With the new gass material, the seling price per unit can be increased by $5. fbut with the added cost, the not increase in prolt margin ((545+55)$3,76)=$46.24. However, Li sstimates that the damand for the newly designed window will be 210,000 units with a probabilty of 0.6, and that there wil be a 0.4 protsbing of sales of 150,000 units. Choose the cotrect decision tree that conesponds with the decision made by Ling Li. A. When usirgt the existrg malerial, the expected monetary vilue (CMV) =f (entar your mesponse as a whob nimber). When using the now material, the expected monetary valas (EMV) = 3 (onter your response as a whobe number). Based on the EMV, Ung Li should chobse Ling U of L Windows, inc is considering making a change in the material the firm vaes for panes in its rosidential window line. The new material hes a sight mirror attribule that assists in teflecting ultra-violet ight and restricts the transmission of heat. The new material will raise the coat of a standard window by $3.76. The curent wintow is in the mature stage of the ife cycle and with no modifications, ti has estimsted that aales of the window line will be 240,000 units por year for the next 5 years with a probabilty of 0.3, and has a 0.70 prebability of belling 180.005 units por year over the five years. The standard peotat margin of a window unit is $45. With the new gass material, the seling price per unit can be increased by $5. fbut with the added cost, the not increase in prolt margin ((545+55)$3,76)=$46.24. However, Li sstimates that the damand for the newly designed window will be 210,000 units with a probabilty of 0.6, and that there wil be a 0.4 protsbing of sales of 150,000 units. Choose the cotrect decision tree that conesponds with the decision made by Ling Li. A. When usirgt the existrg malerial, the expected monetary vilue (CMV) =f (entar your mesponse as a whob nimber). When using the now material, the expected monetary valas (EMV) = 3 (onter your response as a whobe number). Based on the EMV, Ung Li should chobse

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts