Question: This is all the information given QUESTION 1 A strong believer in the Efficient Market Hypothesis would deduce that: O a because professional money managers

This is all the information given

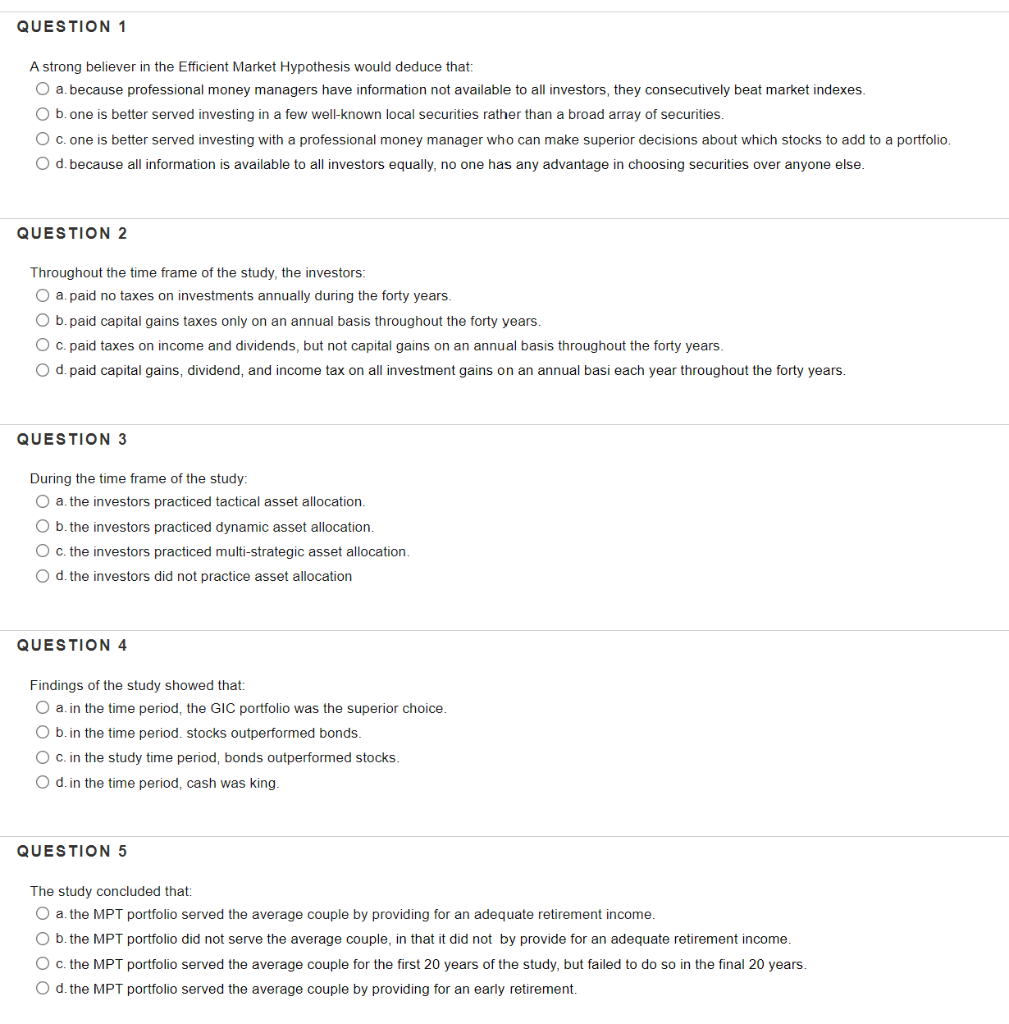

QUESTION 1 A strong believer in the Efficient Market Hypothesis would deduce that: O a because professional money managers have information not available to all investors, they consecutively beat market indexes. O b.one is better served investing in a few well-known local securities rather than a broad array of securities. O c. one is better served investing with a professional money manager who can make superior decisions about which stocks to add to a portfolio O d. because all information is available to all investors equally, no one has any advantage in choosing securities over anyone else. QUESTION 2 Throughout the time frame of the study, the investors: O a. paid no taxes on investments annually during the forty years. O b.paid capital gains taxes only on an annual basis throughout the forty years. O c. paid taxes on income and dividends, but not capital gains on an annual basis throughout the forty years. O d. paid capital gains, dividend, and income tax on all investment gains on an annual basi each year throughout the forty years. QUESTION 3 During the time frame of the study: O a. the investors practiced tactical asset allocation. O b. the investors practiced dynamic asset allocation. O c. the investors practiced multi-strategic asset allocation. O d. the investors did not practice asset allocation QUESTION 4 Findings of the study showed that: O a. in the time period, the GIC portfolio was the superior choice. O b. in the time period, stocks outperformed bonds. c. in the study time period, bonds outperformed stocks. O d. in the time period, cash was king. QUESTION 5 The study concluded that: O a. the MPT portfolio served the average couple by providing for adequate retirement income. Ob the MPT portfolio did not serve the average couple, in that it did not by provide for an adequate retirement income. O c. the MPT portfolio served the average couple for the first 20 years of the study, but failed to do so in the final 20 years. O d. the MPT portfolio served the average couple by providing for an early retirement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts