Question: This is all the information provided Chapter 9: Transaction Exposure 1. Italian Account Receivable Tek wishes to hedge a 4,000,000 account receivable arising from a

This is all the information provided

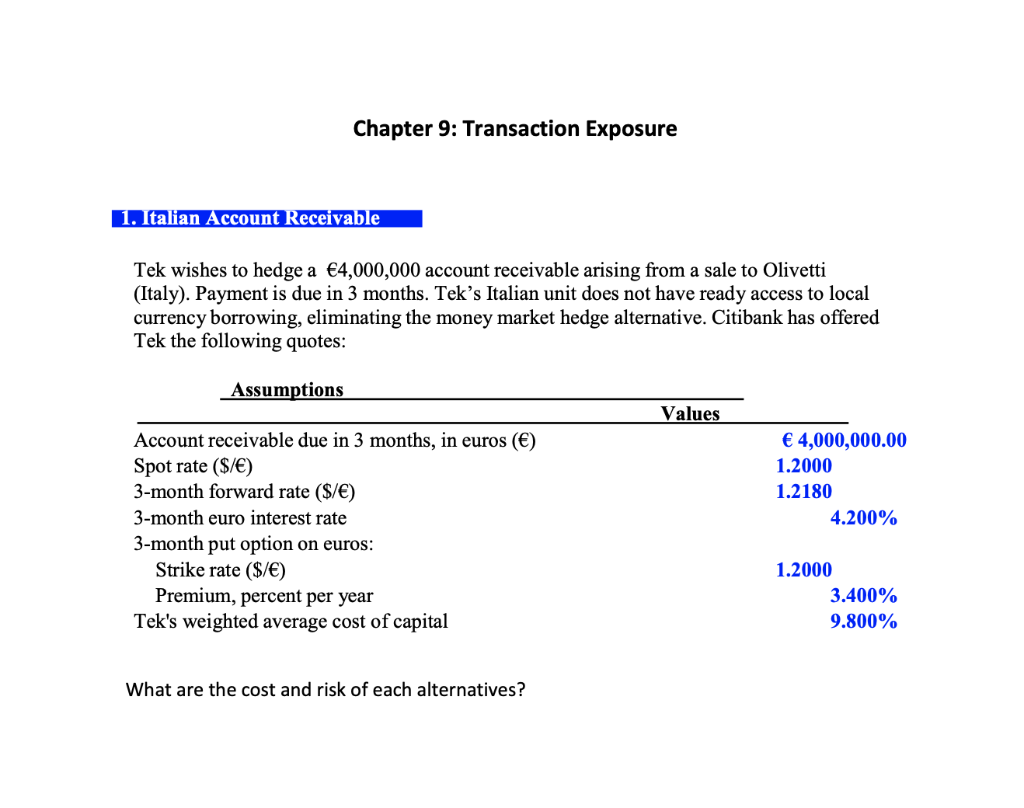

Chapter 9: Transaction Exposure 1. Italian Account Receivable Tek wishes to hedge a 4,000,000 account receivable arising from a sale to Olivetti (Italy). Payment is due in 3 months. Tek's Italian unit does not have ready access to local currency borrowing, eliminating the money market hedge alternative. Citibank has offered Tek the following quotes: Assumptions Values 4,000,000.00 1.2000 1.2180 4.200% Account receivable due in 3 months, in euros () Spot rate ($/) 3-month forward rate ($/) 3-month euro interest rate 3-month put option on euros: Strike rate ($/) Premium, percent per year Tek's weighted average cost of capital 1.2000 3.400% 9.800% What are the cost and risk of each alternatives? Chapter 9: Transaction Exposure 1. Italian Account Receivable Tek wishes to hedge a 4,000,000 account receivable arising from a sale to Olivetti (Italy). Payment is due in 3 months. Tek's Italian unit does not have ready access to local currency borrowing, eliminating the money market hedge alternative. Citibank has offered Tek the following quotes: Assumptions Values 4,000,000.00 1.2000 1.2180 4.200% Account receivable due in 3 months, in euros () Spot rate ($/) 3-month forward rate ($/) 3-month euro interest rate 3-month put option on euros: Strike rate ($/) Premium, percent per year Tek's weighted average cost of capital 1.2000 3.400% 9.800% What are the cost and risk of each alternatives

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts