Question: This is all the information provided Gomez is considering a $225,000 investment with the following net cash flows. Gomez requires a 15% return on its

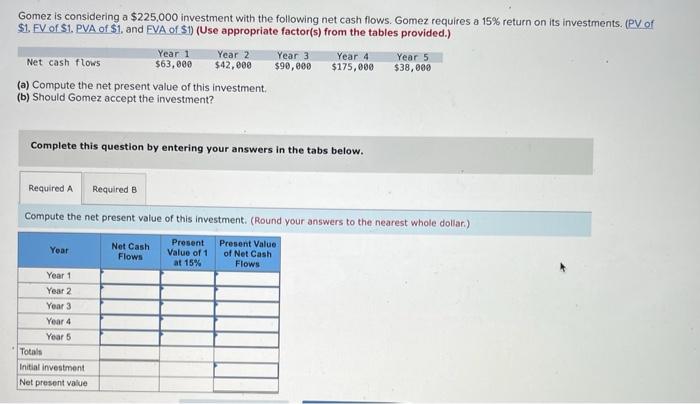

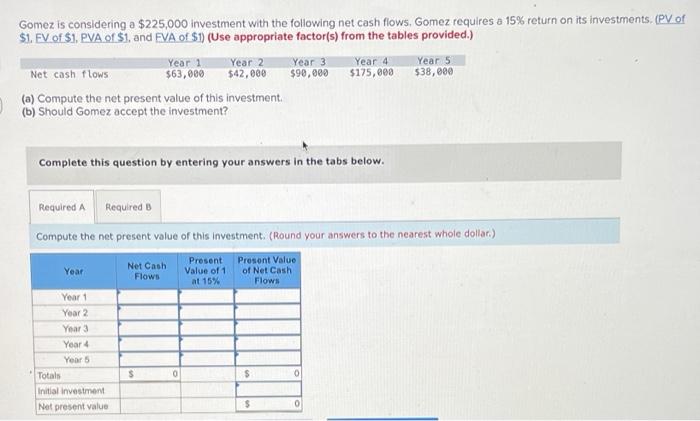

Gomez is considering a $225,000 investment with the following net cash flows. Gomez requires a 15% return on its investments. (PV of $1. FV of $1. PVA of $1. and FVA of S1) (Use appropriate factor(s) from the tables provided.) Year 1 Year 2 Year 3 Year 4 Year 5 Net cash flows $63,000 $42,000 $90,000 $175,000 $38,000 (a) Compute the net present value of this investment (b) Should Gomez accept the investment? Complete this question by entering your answers in the tabs below. Required A Required B Compute the net present value of this investment. (Round your answers to the nearest whole dollar.) Yoar Net Cash Flows Present Value of 1 at 15% Present Value of Net Cash Flows Year 1 Year 2 Year 3 Year 4 Year 5 Totals Initial investment Net present value Gomez is considering a $225.000 investment with the following net cash flows. Gomez requires a 15% return on its investments. (PV of $1. FV of $1. PVA of $1. and EVA of $1) (Use appropriate factor(s) from the tables provided.) Year 1 Year 2 Year 3 Year 4 Year 5 Net cash flows $63,000 $42,000 $90,000 $175,000 $38,000 (a) Compute the net present value of this investment (b) Should Gomez accept the investment? Complete this question by entering your answers in the tabs below. Required A Required B Should Gomez accept the investment? Should Gomez accept the investment? Yes No Gomez is considering a $225,000 investment with the following net cash flows. Gomez requires a 15% return on its investments (PV of $1. FV of S1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) Year 1 Year 2 Year 3 Year 4 Year 5 Net cash flows $63,000 $42,000 $90,000 $175,000 $38,000 (a) Compute the net present value of this investment (6) Should Gomez accept the investment? Complete this question by entering your answers in the tabs below. Required A Required Compute the net present value of this investment (Round your answers to the nearest whole dollar.) Year Net Cash Flows Present Value of 1 at 15% Present Value of Net Cash Flows Year 1 Year 2 Year 3 Year 4 Year 5 Totals Initial investment Net present value $ $ 0 $ 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts