Question: This is all the information that was given!!! Please do not ask for more information!!! Questions about question 2, and the calculation of opportunity cost

This is all the information that was given!!! Please do not ask for more information!!!

Questions about question 2, and the calculation of opportunity cost (needed for calculating profit). To make things more straightforward, assume that any money from the $1000 that you don't invest in the particular options earns a 5% rate of return (with continuous compounding).

That way part (a) makes sense, and there's one opportunity cost for all the strategies. Otherwise, if you're investing slightly less than $1000 (because you can't *quite* spend the whole $1000 on the security in question) you'll have a different opportunity cost for your money for each of the strategies.

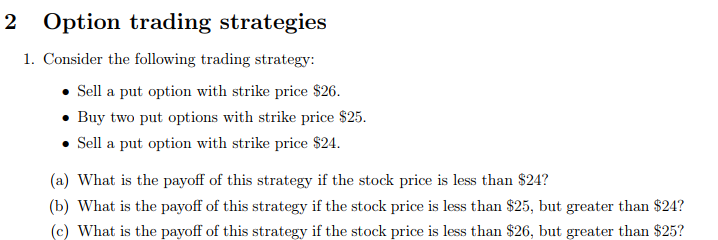

2 Option trading strategies 1. Consider the following trading strategy Sell a put option with strike price $26. Buy two put options with strike price $25. . Sell a put option with strike price $24. (a) What is the payoff of this strategy if the stock price is less than S24? b) What is the payoff of this strategy if the stock price is less than $25, but greater than $24? (c) What is the payoff of this strategy if the stock price is less than $26, but greater than $25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts