Question: This is all the information you need here. Problem 1: Suppose there are three risky assets (A, B, and C), with volatilities of 40,50 and

This is all the information you need here.

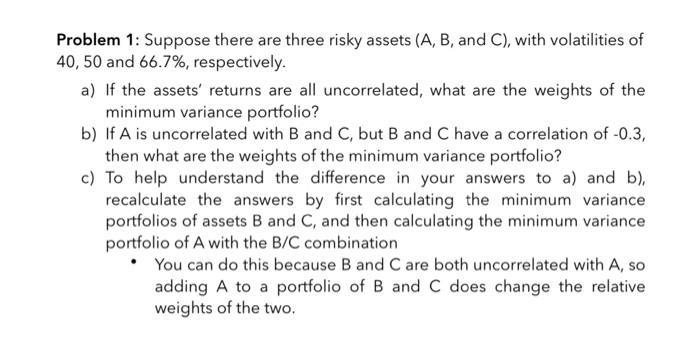

Problem 1: Suppose there are three risky assets (A, B, and C), with volatilities of 40,50 and 66.7%, respectively. a) If the assets' returns are all uncorrelated, what are the weights of the minimum variance portfolio? b) If A is uncorrelated with B and C, but B and C have a correlation of -0.3, then what are the weights of the minimum variance portfolio? c) To help understand the difference in your answers to a) and b), recalculate the answers by first calculating the minimum variance portfolios of assets B and C, and then calculating the minimum variance portfolio of A with the B/C combination You can do this because B and C are both uncorrelated with A, SO adding A to a portfolio of B and C does change the relative weights of the two

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts