Question: this is all the instruction that has been given Instructions: 1. For each problem, please come up with a LP formulation (decision variables, objective function,

this is all the instruction that has been given

this is all the instruction that has been given

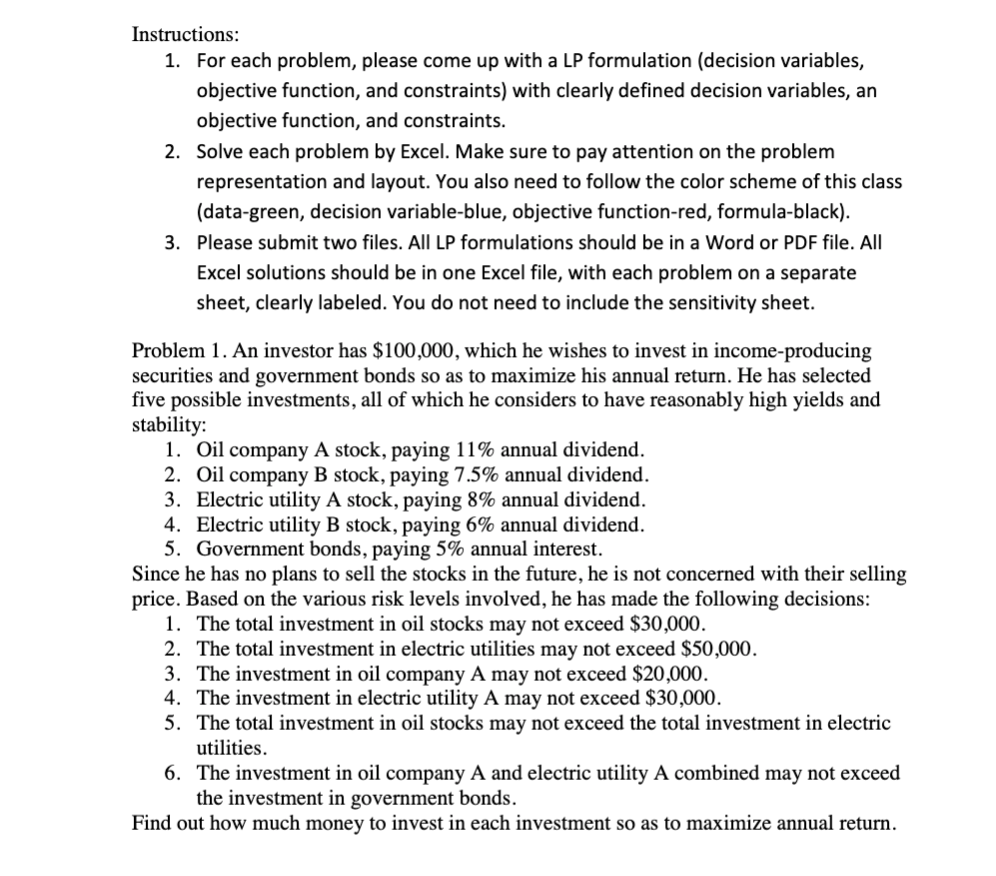

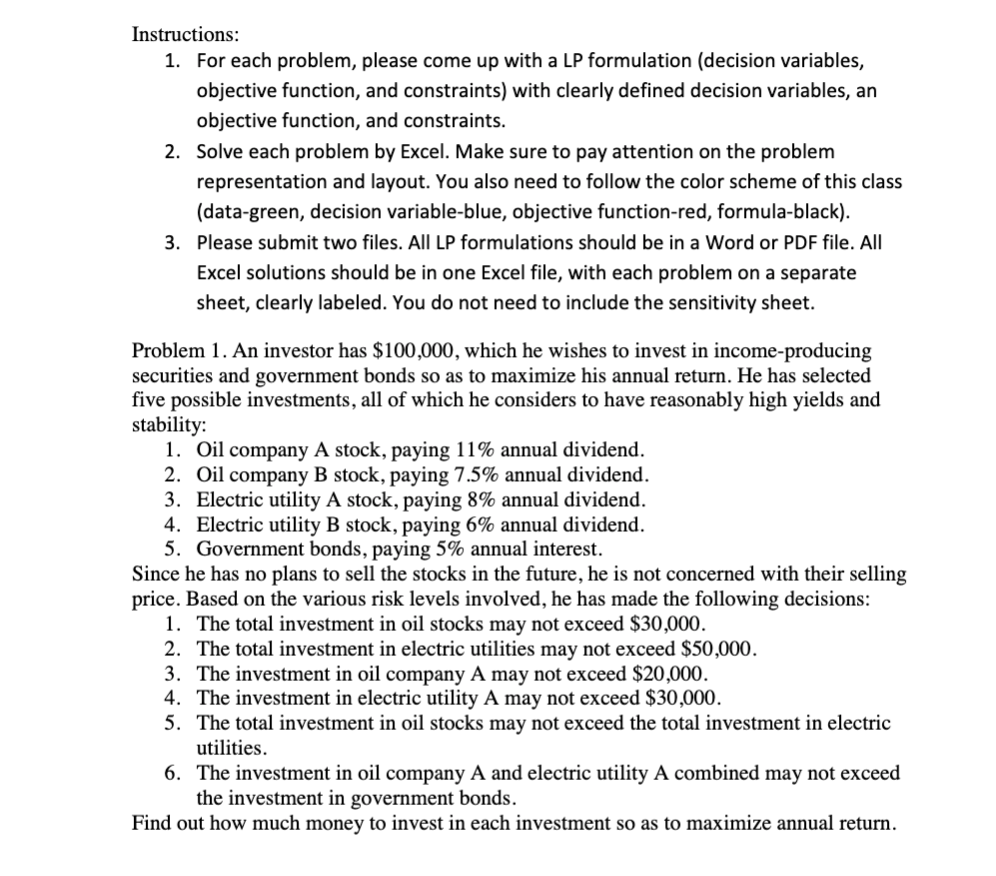

Instructions: 1. For each problem, please come up with a LP formulation (decision variables, objective function, and constraints) with clearly defined decision variables, an objective function, and constraints. 2. Solve each problem by Excel. Make sure to pay attention on the problem representation and layout. You also need to follow the color scheme of this class (data-green, decision variable-blue, objective function-red, formula-black). 3. Please submit two files. All LP formulations should be in a Word or PDF file. All Excel solutions should be in one Excel file, with each problem on a separate sheet, clearly labeled. You do not need to include the sensitivity sheet. Problem 1. An investor has $100,000, which he wishes to invest in income-producing securities and government bonds so as to maximize his annual return. He has selected five possible investments, all of which he considers to have reasonably high yields and stability: 1. Oil company A stock, paying 11% annual dividend. 2. Oil company B stock, paying 7.5% annual dividend. 3. Electric utility A stock, paying 8% annual dividend. 4. Electric utility B stock, paying 6% annual dividend. 5. Government bonds, paying 5% annual interest. Since he has no plans to sell the stocks in the future, he is not concerned with their selling price. Based on the various risk levels involved, he has made the following decisions: 1. The total investment in oil stocks may not exceed $30,000. 2. The total investment in electric utilities may not exceed $50,000. 3. The investment in oil company A may not exceed $20,000. 4. The investment in electric utility A may not exceed $30,000. 5. The total investment in oil stocks may not exceed the total investment in electric utilities. 6. The investment in oil company A and electric utility A combined may not exceed the investment in government bonds. Find out how much money to invest in each investment so as to maximize annual return

this is all the instruction that has been given

this is all the instruction that has been given