Question: THIS IS AN EXAMPLE FOR REFERENCE I POSTED THIS BEFORE AND THEY GAVE WRONG ANSWERS AND CHEGG NO LONGER GIVES THE OPTION TO COMMENT ON

THIS IS AN EXAMPLE FOR REFERENCE I POSTED THIS BEFORE AND THEY GAVE WRONG ANSWERS AND CHEGG NO LONGER GIVES THE OPTION TO COMMENT ON THINGS. THE ANSWERS ARE NOT 2400 OR 4200 FOR ANY PART OF THIS QUESTION.

I POSTED THIS BEFORE AND THEY GAVE WRONG ANSWERS AND CHEGG NO LONGER GIVES THE OPTION TO COMMENT ON THINGS. THE ANSWERS ARE NOT 2400 OR 4200 FOR ANY PART OF THIS QUESTION.

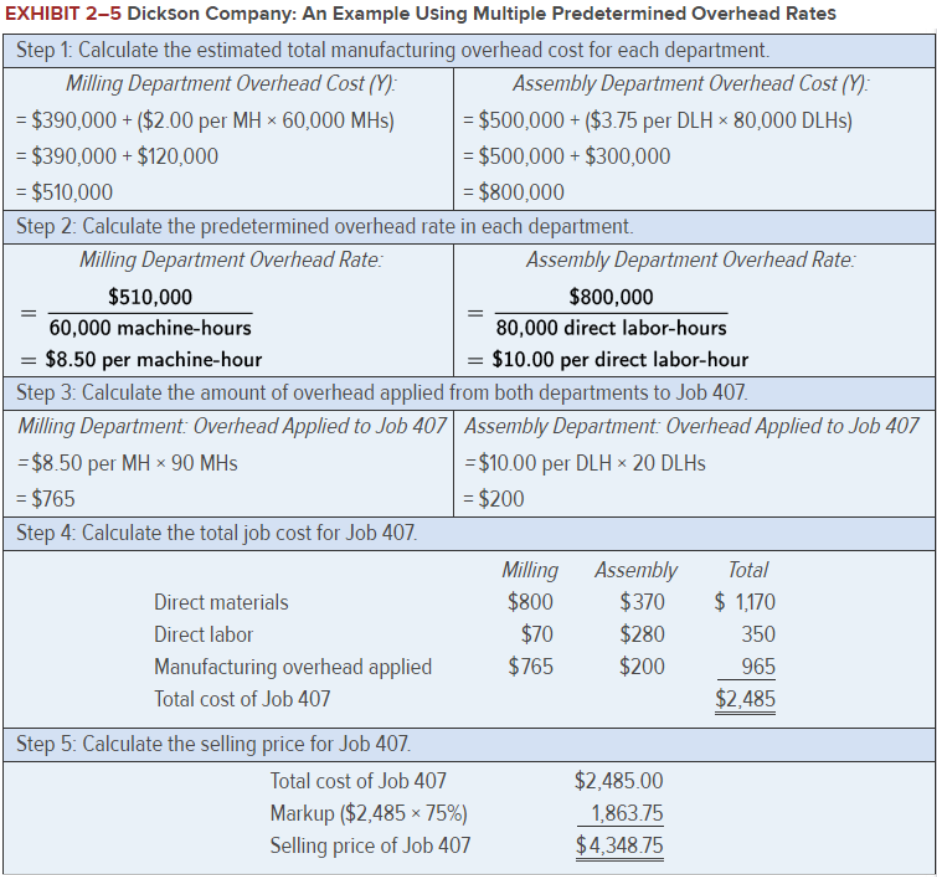

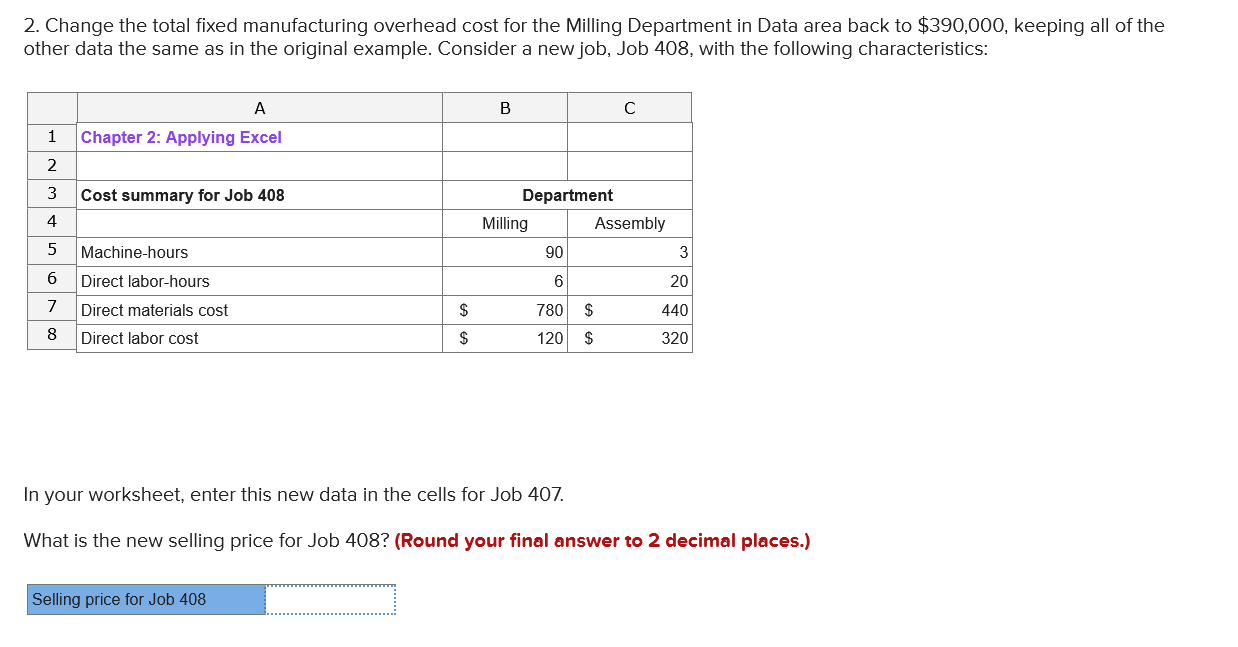

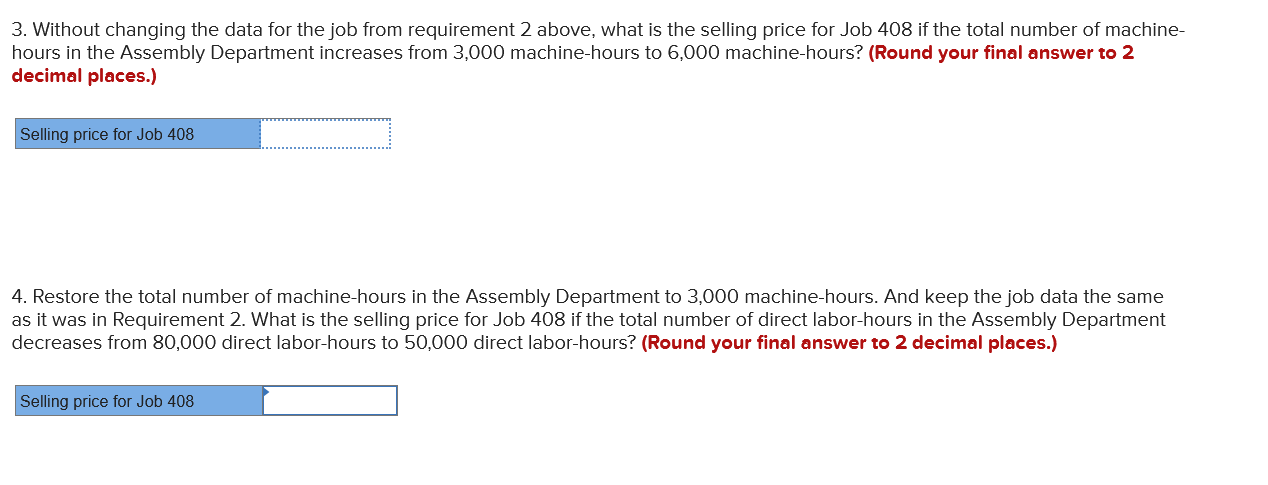

EXHIBIT 2-5 Dickson Company: An Example Using Multiple Predetermined Overhead Rates \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Step 1: Calculate the estimated total manufacturing overhead cost for each department. } \\ \hline=$390,000+($2.00 per MH60,000MHs) & \multicolumn{1}{|c|}{ Assembly Department Overhead Cost (Y)} \\ =$390,000+$120,000 & $500,000+($3.75 per DLH80,000DLHs) \\ =$510,000 & =$500,000+$300,000 \\ \hline \end{tabular} Step 2: Calculate the predetermined overhead rate in each department. \begin{tabular}{|c|c|} \hline Milling Department Overhead Rate: & Assembly Department Overhead Rate: \\ =60,000machine-hours$510,000 & =80,000directlabor-hours$800,000 \\ =$8.50 per machine-hour & =10.00 per direct labor-hour \\ \hline \end{tabular} Step 3: Calculate the amount of overhead applied from both departments to Job 407. \begin{tabular}{|l|l|} \hline Milling Department: Overhead Applied to Job 407 & Assembly Department: Overhead Applied to Job 407 \\ =$8.50 per MH90MHs & =$10.00 per DLH 20DLHs \\ =$765 & =$200 \end{tabular} Step 4: Calculate the total job cost for Job 407. \begin{tabular}{lccc} \hline & Milling & Assembly & Total \\ Direct materials & $800 & $370 & $1,170 \\ Direct labor & $70 & $280 & 350 \\ Manufacturing overhead applied & $765 & $200 & $2,485965 \\ Total cost of Job 407 & & 3 \\ \hline \end{tabular} Step 5: Calculate the selling price for Job 407. \begin{tabular}{llr} \hline & Total cost of Job 407 & $2,485.00 \\ & Markup ($2,48575%) & $4,348.751,863.75 \\ & Selling price of Job 407 \end{tabular} 2. Change the total fixed manufacturing overhead cost for the Milling Department in Data area back to $390,000, keeping all of the other data the same as in the original example. Consider a new job, Job 408 , with the following characteristics: In your worksheet, enter this new data in the cells for Job 407. What is the new selling price for Job 408 ? (Round your final answer to 2 decimal places.) 3. Without changing the data for the job from requirement 2 above, what is the selling price for Job 408 if the total number of machinehours in the Assembly Department increases from 3,000 machine-hours to 6,000 machine-hours? (Round your final answer to 2 decimal places.) 4. Restore the total number of machine-hours in the Assembly Department to 3,000 machine-hours. And keep the job data the same as it was in Requirement 2. What is the selling price for Job 408 if the total number of direct labor-hours in the Assembly Department decreases from 80,000 direct labor-hours to 50,000 direct labor-hours? (Round your final answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts