Question: THIS IS AN EXAMPLE FOR REFERENCE I POSTED THIS BEFORE AND THEY GAVE WRONG ANSWERS AND CHEGG NO LONGER GIVES THE OPTION TO COMMENT ON

THIS IS AN EXAMPLE FOR REFERENCE I POSTED THIS BEFORE AND THEY GAVE WRONG ANSWERS AND CHEGG NO LONGER GIVES THE OPTION TO COMMENT ON THINGS. THE ANSWERS ARE ***NOT*** 2400, 4200, OR 4594 FOR ANY PART OF THIS QUESTION.

I POSTED THIS TWICE BEFORE AND THEY GAVE WRONG ANSWERS AND CHEGG NO LONGER GIVES THE OPTION TO COMMENT ON THINGS. THE ANSWERS ARE ***NOT*** 2400, 4200, OR 4594 FOR ANY PART OF THIS QUESTION.

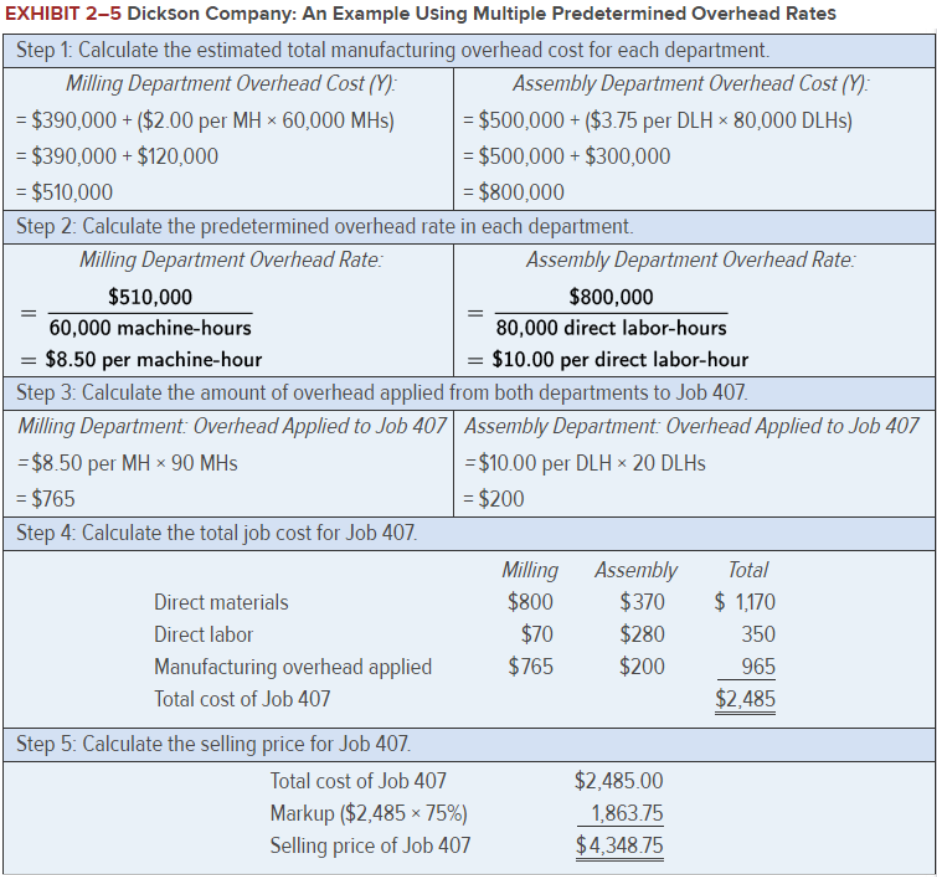

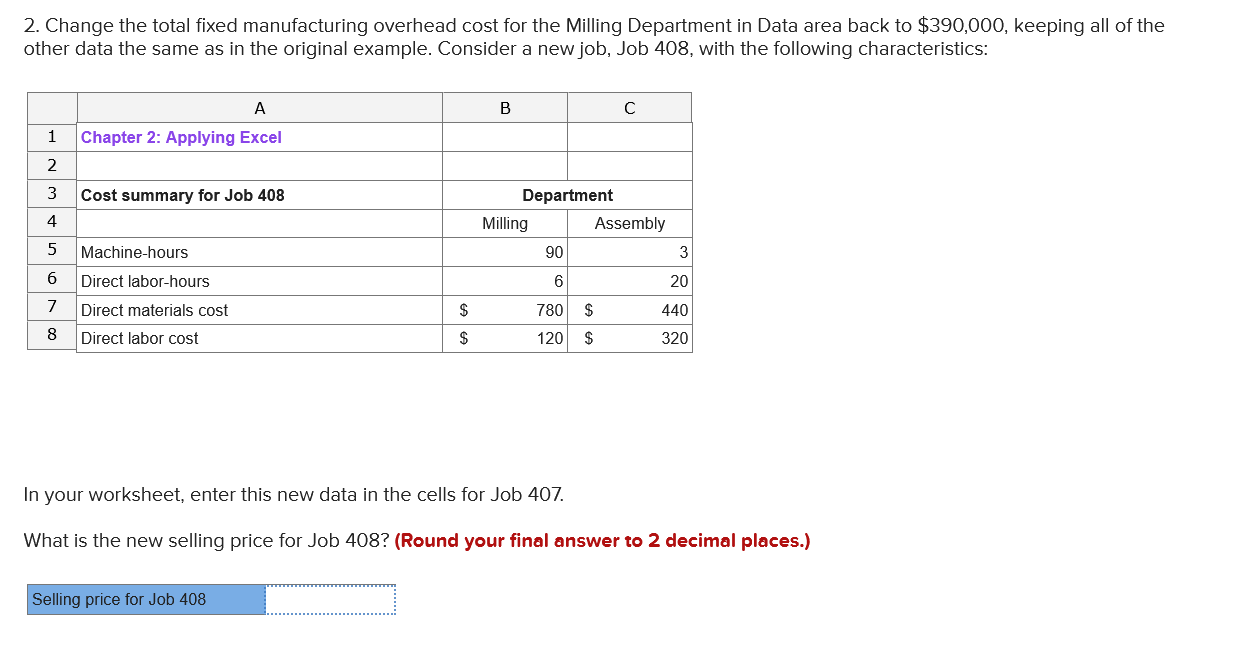

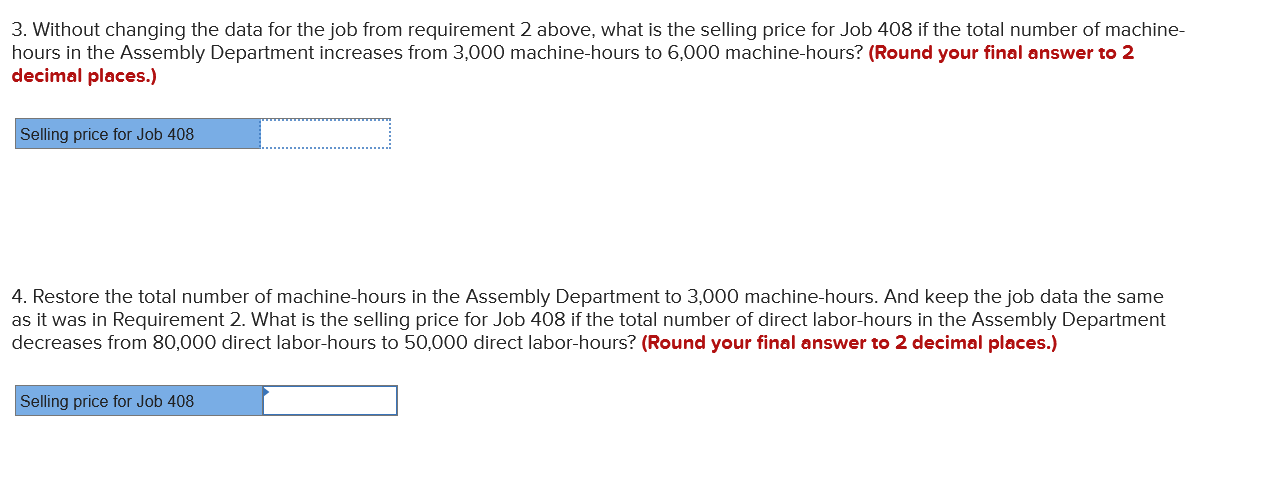

EXHIBIT 2-5 Dickson Company: An Example Using Multiple Predetermined Overhead Rates \begin{tabular}{|l|l|} \hline \multicolumn{2}{|c|}{ Step 1: Calculate the estimated total manufacturing overhead cost for each department. } \\ \hline=$390,000+($2.00 per MH60,000MHs) & \multicolumn{1}{|c|}{ Assembly Department Overhead Cost (Y)} \\ =$390,000+$120,000 & $500,000+($3.75 per DLH80,000DLHs) \\ =$510,000 & =$500,000+$300,000 \\ \hline \end{tabular} Step 2: Calculate the predetermined overhead rate in each department. \begin{tabular}{|c|c|} \hline Milling Department Overhead Rate: & Assembly Department Overhead Rate: \\ =60,000machine-hours$510,000 & =80,000directlabor-hours$800,000 \\ =$8.50 per machine-hour & =10.00 per direct labor-hour \\ \hline \end{tabular} Step 3: Calculate the amount of overhead applied from both departments to Job 407. \begin{tabular}{|l|l|} \hline Milling Department: Overhead Applied to Job 407 & Assembly Department: Overhead Applied to Job 407 \\ =$8.50 per MH90MHs & =$10.00 per DLH 20DLHs \\ =$765 & =$200 \end{tabular} Step 4: Calculate the total job cost for Job 407. \begin{tabular}{lccc} \hline & Milling & Assembly & Total \\ Direct materials & $800 & $370 & $1,170 \\ Direct labor & $70 & $280 & 350 \\ Manufacturing overhead applied & $765 & $200 & $2,485965 \\ Total cost of Job 407 & & 3 \\ \hline \end{tabular} Step 5: Calculate the selling price for Job 407. \begin{tabular}{llr} \hline & Total cost of Job 407 & $2,485.00 \\ & Markup ($2,48575%) & $4,348.751,863.75 \\ & Selling price of Job 407 \end{tabular} 2. Change the total fixed manufacturing overhead cost for the Milling Department in Data area back to $390,000, keeping all of the other data the same as in the original example. Consider a new job, Job 408 , with the following characteristics: In your worksheet, enter this new data in the cells for Job 407. What is the new selling price for Job 408 ? (Round your final answer to 2 decimal places.) 3. Without changing the data for the job from requirement 2 above, what is the selling price for Job 408 if the total number of machinehours in the Assembly Department increases from 3,000 machine-hours to 6,000 machine-hours? (Round your final answer to 2 decimal places.) 4. Restore the total number of machine-hours in the Assembly Department to 3,000 machine-hours. And keep the job data the same as it was in Requirement 2. What is the selling price for Job 408 if the total number of direct labor-hours in the Assembly Department decreases from 80,000 direct labor-hours to 50,000 direct labor-hours? (Round your final answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts