Question: this is decision analytics 23.37 learning.up.edu C 1.0.f.2 Decision Analysis Homework - Spring 2020 Name your word document with the solution as follows: your last

this is decision analytics

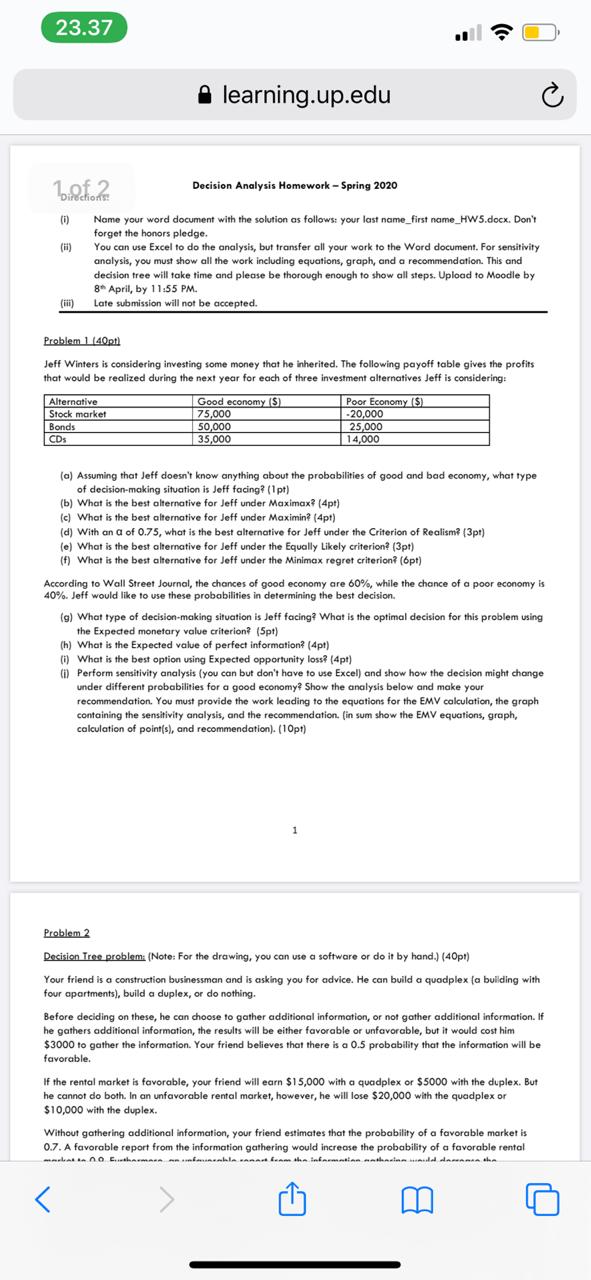

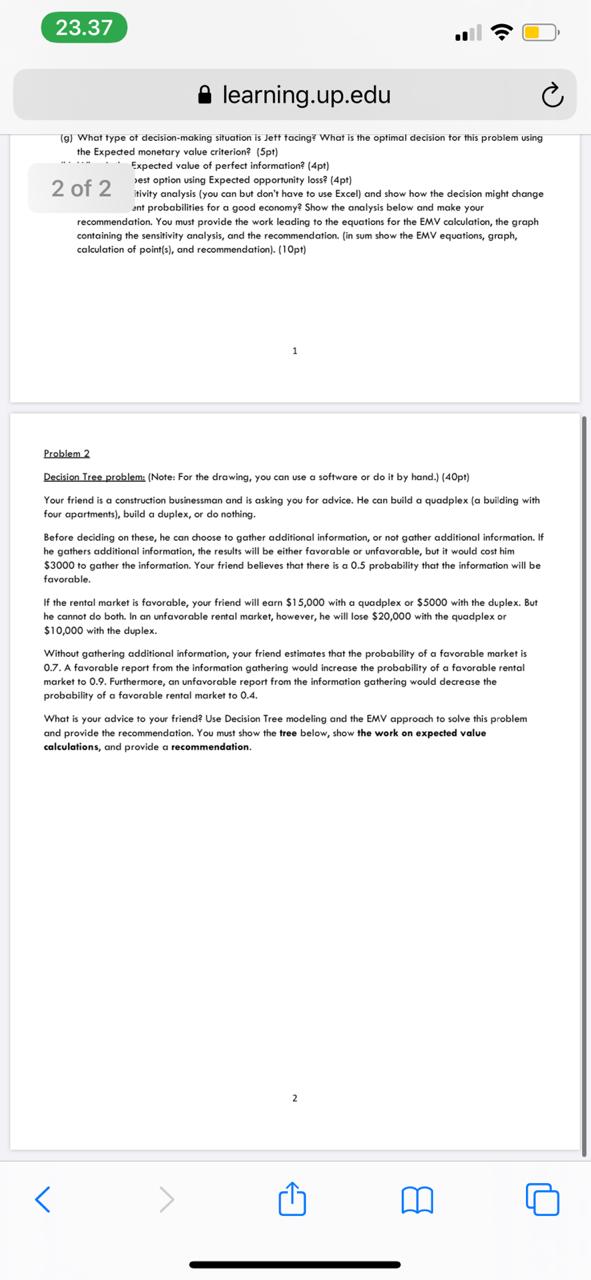

23.37 learning.up.edu C 1.0.f.2 Decision Analysis Homework - Spring 2020 Name your word document with the solution as follows: your last name_first name_HW5.docx. Don't forget the honors pledge. You can use Excel to do the analysis, but transfer all your work to the Word document. For sensitivity analysis, you must show all the work including equations, graph, and a recommendation. This and decision tree will take time and please be thorough enough to show all steps. Upload to Moodle by 8* April, by 11:55 PM. Late submission will not be accepted. Problem 1 (40pt Jeff Winters is considering investing some money that he inherited. The following payoff table gives the profits that would be realized during the next year for each of three investment alternatives Jeff is considering: Alternative Good economy (S Poor Economy ($) Stock market 75,000 -20,000 Bonds 50,000 25,000 CDs 35,000 14,000 (a) Assuming that Jeff doesn't know anything about the probabilities of good and bad economy, what type of decision-making situation is Jeff facing? (1pt) (b) What is the best alternative for Jeff under Maximax? (4pt) (c) What is the best alternative for Jeff under Maximin? (4pt) (d) With an a of 0.75, what is the best alternative for Jeff under the Criterion of Realism? (3pr) (e) What is the best alternative for Jeff under the Equally Likely criterion? (3pr) (f) What is the best alternative for Jeff under the Minimax regret criterion? (opt) According to Wall Street Journal, the chances of good economy are 60%, while the chance of a poor economy is 40%. Jeff would like to use these probabilities in determining the best decision. (g) What type of decision-making situation is Jeff facing? What is the optimal decision for this problem using the Expected monetary value criterion? (5pt) (h) What is the Expected value of perfect information? (4p!) (i) What is the best option using Expected opportunity loss? (4pt) (1) Perform sensitivity analysis (you can but don't have to use Excel) and show how the decision might change under different probabilities for a good economy? Show the analysis below and make your recommendation. You must provide the work leading to the equations for the EMV calculation, the graph containing the sensitivity analysis, and the recommendation. (in sum show the EMV equations, graph, calculation of point(s), and recommendation). (10p!) Problem 2 Decision Tree problem: (Note: For the drawing, you can use a software or do it by hand.) (40p!) Your friend is a construction businessman and is asking you for advice. He can build a quadplex (a building with four apartments), build a duplex, or do nothing. Before deciding on these, he can choose to gather additional information, or not gather additional information. If he gathers additional information, the results will be either favorable or unfavorable, but it would cost him $3000 to gather the information. Your friend believes that there is a 0.5 probability that the information will be favorable. If the rental market is favorable, your friend will earn $15,000 with a quadplex or $5000 with the duplex. But he cannot do both. In an unfavorable rental market, however, he will lose $20,000 with the quadplex or $10,000 with the duplex. Without gathering additional information, your friend estimates that the probability of a favorable market is 0.7. A favorable report from the information gathering would increase the probability of a favorable rental m23.37 learning.up.edu C (g) What type of decision-making situation is Jett facing? What is the optimal decision for this problem using the Expected monetary value criterion? (5pt) Expected value of perfect information? (4pt) 2 of 2 best option using Expected opportunity loss? (4p!) tivity analysis (you can but don't have to use Excel) and show how the decision might change ant probabilities for a good economy? Show the analysis below and make your recommendation. You must provide the work leading to the equations for the EMV calculation, the graph containing the sensitivity analysis, and the recommendation. (in sum show the EMV equations, graph, calculation of point(s), and recommendation). (10pt) Problem 2 Decision Tree problem: (Note: For the drawing, you can use a software or do it by hand.) (40p!) Your friend is a construction businessman and is asking you for advice. He can build a quadplex (a building with four apartments], build a duplex, or do nothing. Before deciding on these, he can choose to gather additional information, or not gather additional information. If he gathers additional information, the results will be either favorable or unfavorable, but it would cost him $3000 to gather the information. Your friend believes that there is a 0.5 probability that the information will be favorable. If the rental market is favorable, your friend will earn $15,000 with a quadplex or $5000 with the duplex. But he cannot do both. In an unfavorable rental market, however, he will lose $20,000 with the quadplex or $ 10,000 with the duplex. Without gathering additional information, your friend estimates that the probability of a favorable market is 0.7. A favorable report from the information gathering would increase the probability of a favorable rental market to 0.9. Furthermore, an unfavorable report from the information gathering would decrease the probability of a favorable rental market to 0.4. What is your advice to your friend? Use Decision Tree modeling and the EMV approach to solve this problem and provide the recommendation. You must show the tree below, show the work on expected value calculations, and provide a recommendation. N <

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts