Question: This is example 33 --------------------------------------------------------------- This is Problem 29 (required is in the 2nd photo) ----------------------------------------------------------- This is Problem 35 Selected data for two companies

This is example 33

---------------------------------------------------------------

This is Problem 29 (required is in the 2nd photo)

-----------------------------------------------------------

This is Problem 35

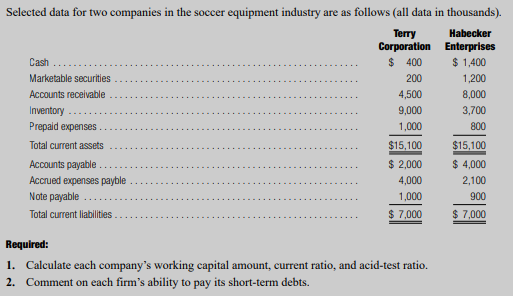

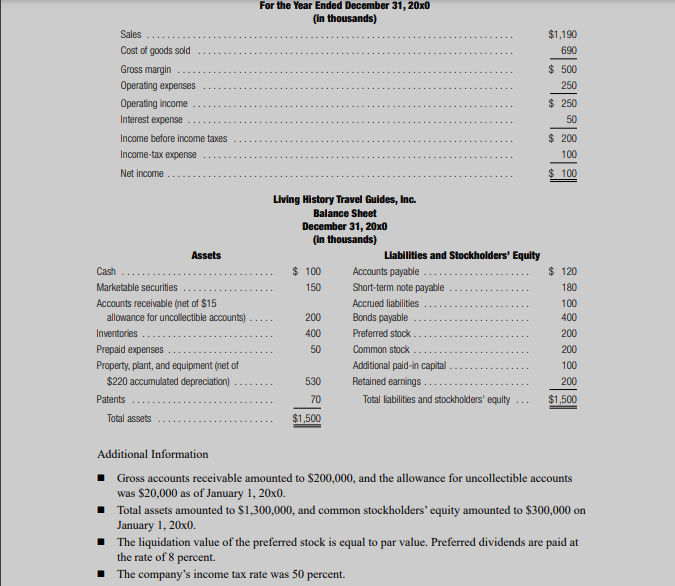

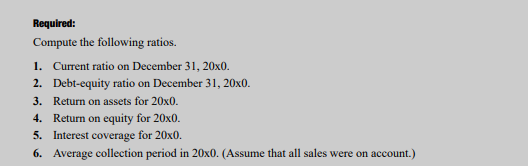

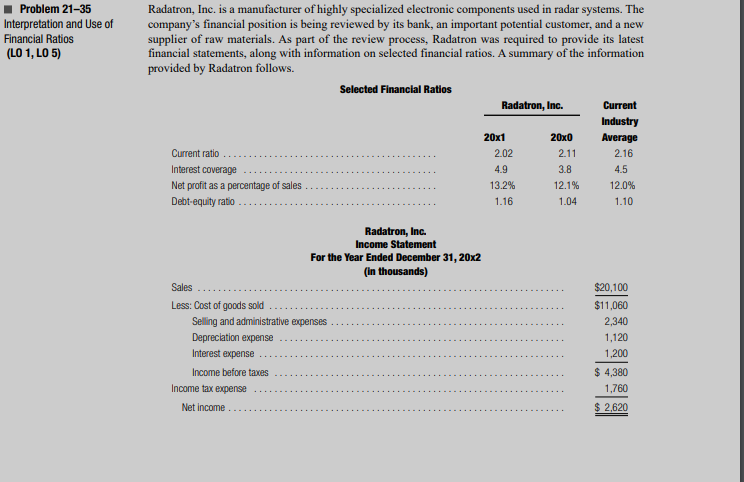

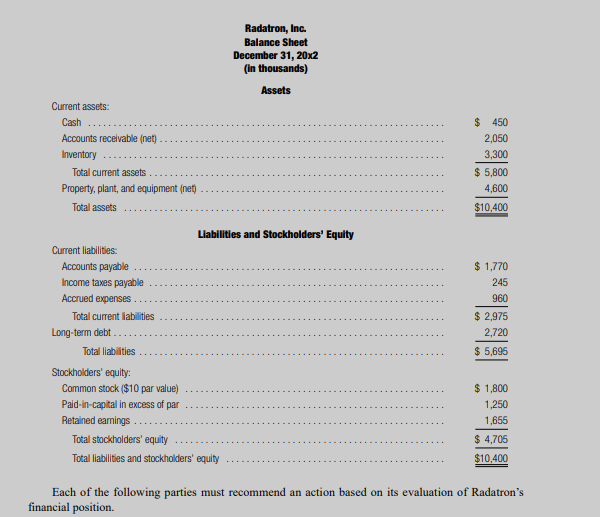

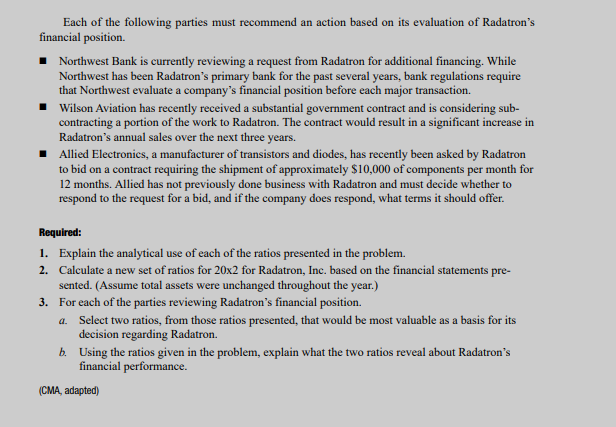

Selected data for two companies in the soccer equipment industry are as follows (all data in thousands). Required: 1. Calculate each company's working capital amount, current ratio, and acid-test ratio. 2. Comment on each firm's ability to pay its short-term debts. Additional Information Gross accounts receivable amounted to $200,000, and the allowance for uncollectible accounts was $20,000 as of January 1,20x0. - Total assets amounted to $1,300,000, and common stockholders' equity amounted to $300,000 on January 1,20x0. - The liquidation value of the preferred stock is equal to par value. Preferred dividends are paid at the rate of 8 percent. The company's income tax rate was 50 percent. Required: Compute the following ratios. 1. Current ratio on December 31,200. 2. Debt-equity ratio on December 31,20x0. 3. Return on assets for 20x0. 4. Return on equity for 20x0. 5. Interest coverage for 20x0. 6. Average collection period in 200. (Assume that all sales were on account.) Problem 21-35 Radatron, Inc. is a manufacturer of highly specialized electronic components used in radar systems. The Interpretation and Use of company's financial position is being reviewed by its bank, an important potential customer, and a new Financial Ratios supplier of raw materials. As part of the review process, Radatron was required to provide its latest (L0 1, L0 5) financial statements, along with information on selected financial ratios. A summary of the information Each of the following parties must recommend an action based on its evaluation of Kadatron's financial position. Each of the following parties must recommend an action based on its evaluation of Radatron's financial position. - Northwest Bank is currently reviewing a request from Radatron for additional financing. While Northwest has been Radatron's primary bank for the past several years, bank regulations require that Northwest evaluate a company's financial position before each major transaction. - Wilson Aviation has recently received a substantial government contract and is considering subcontracting a portion of the work to Radatron. The contract would result in a significant increase in Radatron's annual sales over the next three years. - Allied Electronics, a manufacturer of transistors and diodes, has recently been asked by Radatron to bid on a contract requiring the shipment of approximately $10,000 of components per month for 12 months. Allied has not previously done business with Radatron and must decide whether to respond to the request for a bid, and if the company does respond, what terms it should offer. Required: 1. Explain the analytical use of each of the ratios presented in the problem. 2. Calculate a new set of ratios for 202 for Radatron, Inc. based on the financial statements presented. (Assume total assets were unchanged throughout the year.) 3. For each of the parties reviewing Radatron's financial position. a. Select two ratios, from those ratios presented, that would be most valuable as a basis for its decision regarding Radatron. b. Using the ratios given in the problem, explain what the two ratios reveal about Radatron's financial performance. (CMA, adapted)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts