Question: This is for a project through Quickbooks, and I'm not sure I did it correctly. Is this right so far? I feel like something is

This is for a project through Quickbooks, and I'm not sure I did it correctly. Is this right so far? I feel like something is probably wrong

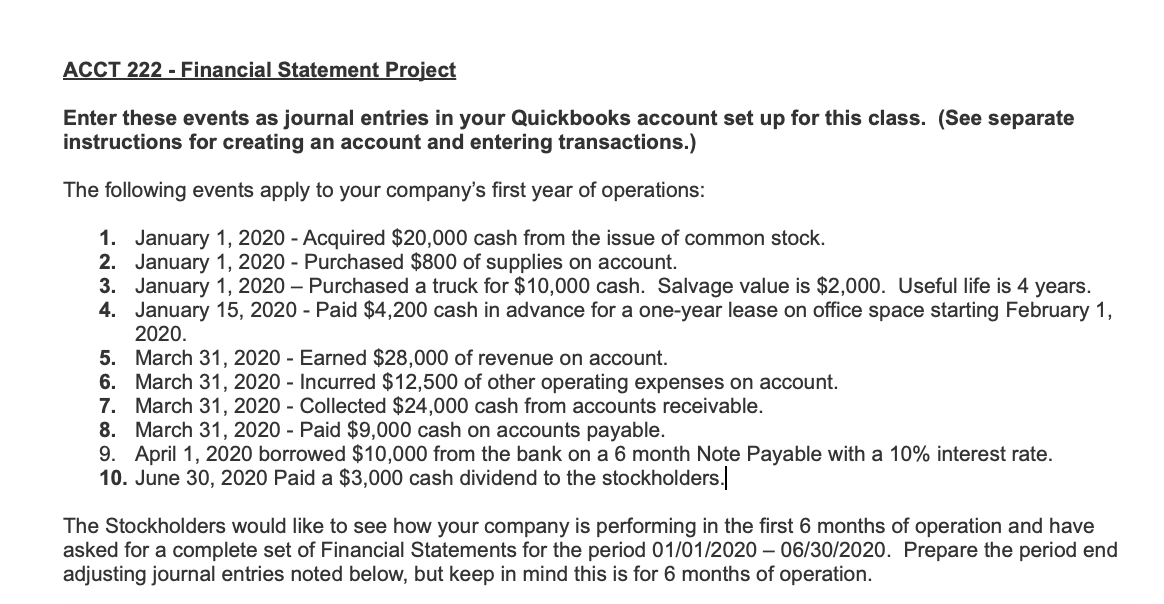

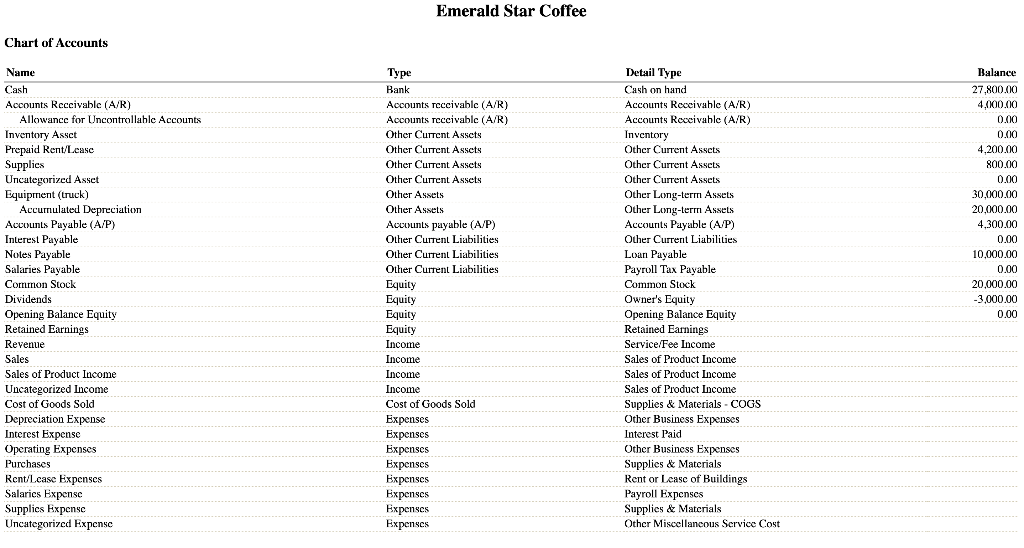

ACCT 222 - Financial Statement Project Enter these events as journal entries in your Quickbooks account set up for this class. (See separate instructions for creating an account and entering transactions.) The following events apply to your company's first year of operations: 1. January 1, 2020 - Acquired $20,000 cash from the issue of common stock. 2. January 1, 2020 - Purchased $800 of supplies on account. 3. January 1, 2020 - Purchased a truck for $10,000 cash. Salvage value is $2,000. Useful life is 4 years. 4. January 15, 2020 - Paid $4,200 cash in advance for a one-year lease on office space starting February 1, 2020. 5. March 31, 2020 - Earned $28,000 of revenue on account. 6. March 31, 2020 - Incurred $12,500 of other operating expenses on account. 7. March 31, 2020 - Collected $24,000 cash from accounts receivable. 8. March 31, 2020 - Paid $9,000 cash on accounts payable. 9. April 1, 2020 borrowed $10,000 from the bank on a 6 month Note Payable with a 10% interest rate. 10. June 30, 2020 Paid a $3,000 cash dividend to the stockholders./ The Stockholders would like to see how your company is performing in the first 6 months of operation and have asked for a complete set of Financial Statements for the period 01/01/2020 - 06/30/2020. Prepare the period end adjusting journal entries noted below, but keep in mind this is for 6 months of operation. Emerald Star Coffee Chart of Accounts Name Cash Accounts Receivable (A/R) Allowance for Uncontrollable Accounts Inventory Asset Prepaid Rent/Lease Supplies Uncategorized Asset Equipment (truck) Accumulated Depreciation Accounts Payable (A/P) Interest Payable Notes Payable Salaries Payable Common Stock Dividends Opening Balance Equity Retained Earnings Revenue Sales Sales of Product Income Uncategorized Income Cost of Goods Sold Depreciation Expense Interest Expense Operating Expenses Purchases Rent/Lease Expenses Type Bank Accounts receivable (A/R) Accounts receivable (A/R) Other Current Assets Other Current Assets Other Current Assets Other Current Assets Other Assets Other Assets Accounts payable (A/P) Other Current Liabilities Other Current Liabilities Other Current Liabilities Equity Equity Equity Equity Income Income Income Income Cost of Goods Sold Expenses Expenses Expenses Expenses Expenses Expenses Expenses Expenses Detail Type Cash on hand Accounts Receivable (A/R) Accounts Receivable (A/R) Inventory Other Current Assets Other Current Assets Other Current Assets Other Long-term Assets Other Long-term Assets Accounts Payable (A/P) Other Current Liabilities Loani Payable Payroll Tax Payable Common Stock Owner's Equity Opening Balance Equity Retained Earnings Service/Fee Income Sales of Product Income Sales of Product Income Sales of Product Income Supplies & Materials - COGS Other Business Expenses Interest Paid Other Business Expenses Supplies & Materials Rent or Lease of Buildings Payroll Expenses Supplies & Materials Other Miscellaneous Service Cost Balance 27,800.00 4,000.00 0.00 0.00 4,200.00 800.00 0.00 30,000.00 20,000.00 4,300.00 0.00 10,000.00 0.00 20,000.00 -3,000.00 0.00 Salaries Expense Supplies Expensc Uncategorized Expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts