Question: This is for Accounting. For this Question, Please answer part a), part b) & part c). Please answer all parts in the comment section. When

This is for Accounting. For this Question, Please answer part a), part b) & part c). Please answer all parts in the comment section. When answering. Please put Part A). (insert answer).... Part B) (insert answer) and so on. Thanks!

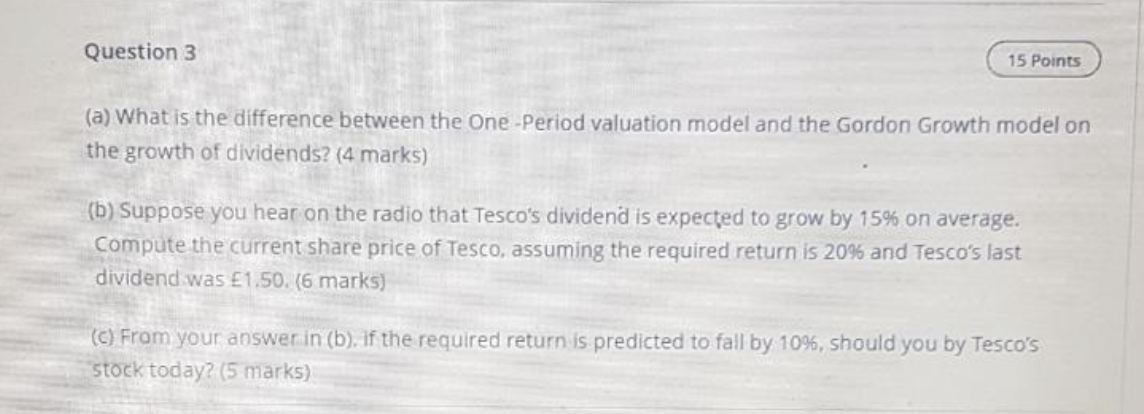

Question 3 15 Points (a) What is the difference between the One-Period valuation model and the Gordon Growth model on the growth of dividends? (4 marks) (b) Suppose you hear on the radio that Tesco's dividend is expected to grow by 15% on average. Compute the current share price of Tesco, assuming the required return is 20% and Tesco's last dividend was 1.50. (6 marks) (c) From your answer in (b). If the required return is predicted to fall by 10%, should you by Tesco's stock today? (5 marks) Question 3 15 Points (a) What is the difference between the One-Period valuation model and the Gordon Growth model on the growth of dividends? (4 marks) (b) Suppose you hear on the radio that Tesco's dividend is expected to grow by 15% on average. Compute the current share price of Tesco, assuming the required return is 20% and Tesco's last dividend was 1.50. (6 marks) (c) From your answer in (b). If the required return is predicted to fall by 10%, should you by Tesco's stock today

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts