Question: This is for question 2. Jane McDonald, a financial analyst for Carroll Company, has prepared the following sales and cash disbursement estimates for the period

This is for question 2.

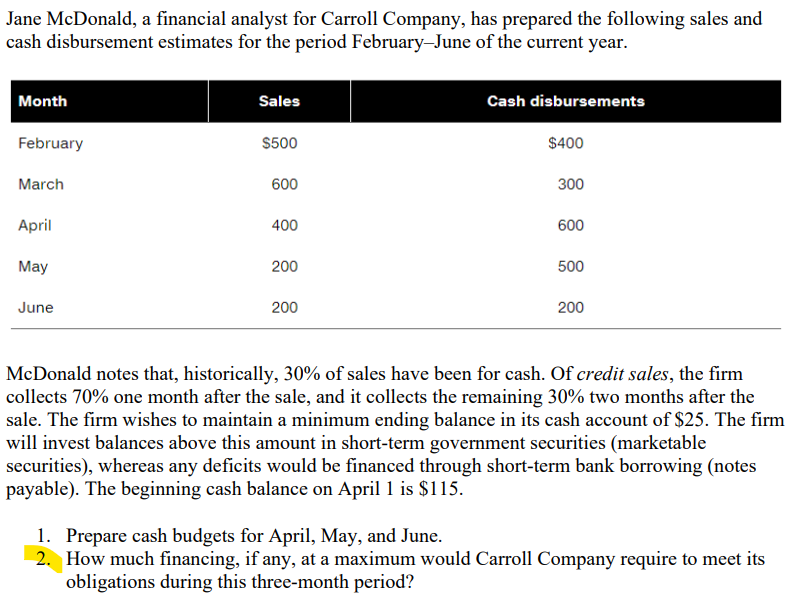

Jane McDonald, a financial analyst for Carroll Company, has prepared the following sales and cash disbursement estimates for the period February-June of the current year. McDonald notes that, historically, 30% of sales have been for cash. Of credit sales, the firm collects 70% one month after the sale, and it collects the remaining 30% two months after the sale. The firm wishes to maintain a minimum ending balance in its cash account of $25. The firm will invest balances above this amount in short-term government securities (marketable securities), whereas any deficits would be financed through short-term bank borrowing (notes payable). The beginning cash balance on April 1 is $115. 1. Prepare cash budgets for April, May, and June. 2. How much financing, if any, at a maximum would Carroll Company require to meet its obligations during this three-month period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts