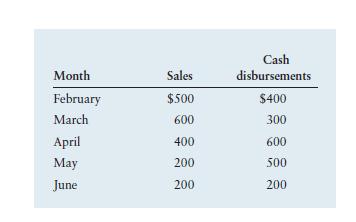

Jane McDonald, a financial analyst for Carroll Company, has prepared the following sales and cash disbursement estimates

Question:

Jane McDonald, a financial analyst for Carroll Company, has prepared the following sales and cash disbursement estimates for the period February–June of the current year.

McDonald notes that, historically, 30% of sales have been for cash. Of credit sales, 70% are collected 1 month after the sale, and the remaining 30% are collected 2 months after the sale. The firm wishes to maintain a minimum ending balance in its cash account of $25. Balances above this amount would be invested in short-term government securities (marketable securities), whereas any deficits would be financed through short-term bank borrowing (notes payable). The beginning cash balance at April 1 is $115.

a. Prepare cash budgets for April, May, and June.

b. How much financing, if any, at a maximum would Carroll Company require to meet its obligations during this 3-month period?

c. A pro forma balance sheet dated at the end of June is to be prepared from the information presented. Give the size of each of the following: cash, notes payable, marketable securities, and accounts receivable.

Step by Step Answer:

Principles Of Managerial Finance

ISBN: 9781292018201

14th Global Edition

Authors: Lawrence J. Gitman, Chad J. Zutter