Question: This is from starting out with Visual Basic 2012 boom . I am using Visual studio to try and create this . report listing the

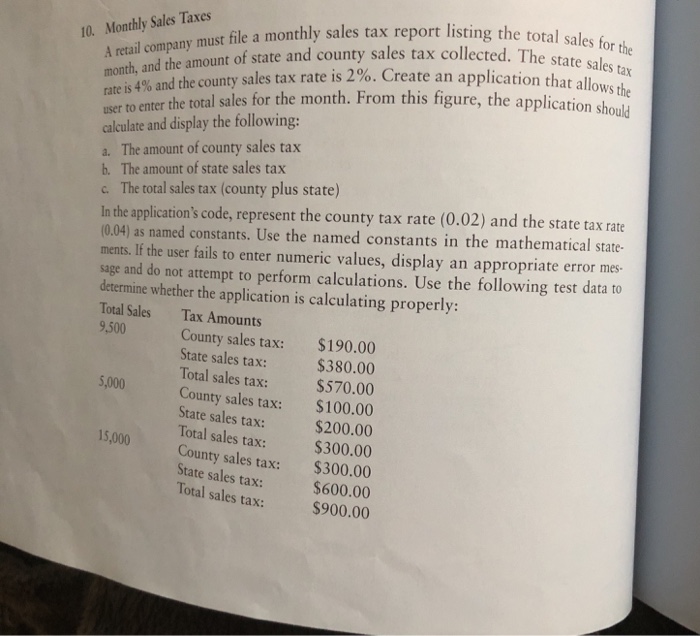

report listing the total sales for the The state sales tax that allows the 10. Monthly Sales Taxes A retar month, and the amount of state and county sales tax collected 64% and thecounty sales tax rate is 2%. Create an application tos for the month. From this figure, the application shc calculate and display the following: rate is user to enter the tota a. The amount of county sales tax b. The amount of state sales tax c The total sales tax (county plus state) In the application's code, represent the county tax rate (0.02) and the state tax rate 0.04) as named constants. Use the named constants in the mathematical state- ments. If the user fails to enter numeric values, display an appropriate error mes- sage and do not attempt to perform calculations. Use the following test data to determine whether the application is calculating properly: Total Sales 9,500 Tax Amounts County sales tax: State sales tax: $190.00 Total sales tax: County sales tax: State sales tax: $380.00 $570.00 $100.00 5,000 $200.00 15,000 Total sales County sales tax: State sales tax: $300.00 $300.00 $600.00 $900.00 Total sales tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts