Question: This is full question. Mainly part 2 i don'y fully understand 7. Given a two-factor economy. Asset A, B, C and D are well-diversified portfolios.

This is full question.

Mainly part 2 i don'y fully understand

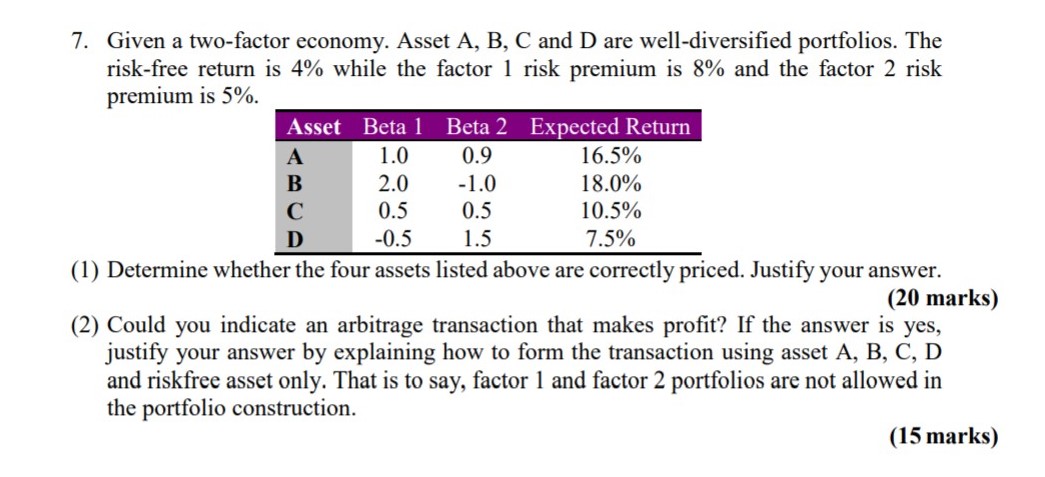

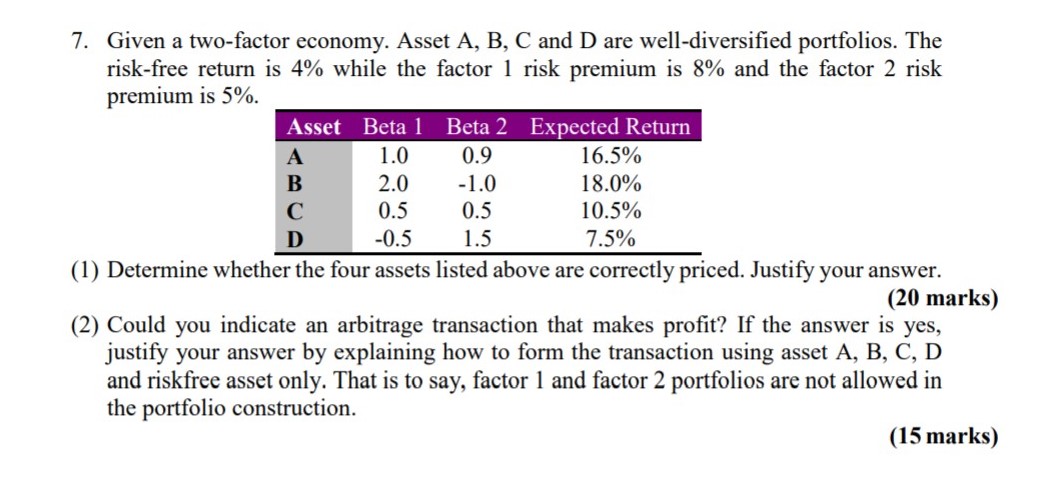

7. Given a two-factor economy. Asset A, B, C and D are well-diversified portfolios. The risk-free return is 4% while the factor 1 risk premium is 8% and the factor 2 risk premium is 5%. Asset Beta 1 Beta 2 Expected Return A 1.0 0.9 16.5% B 2.0 -1.0 18.0% 0.5 0.5 10.5% D -0.5 1.5 7.5% (1) Determine whether the four assets listed above are correctly priced. Justify your answer. (20 marks) (2) Could you indicate an arbitrage transaction that makes profit? If the answer is yes, justify your answer by explaining how to form the transaction using asset A, B, C, D and riskfree asset only. That is to say, factor 1 and factor 2 portfolios are not allowed in the portfolio construction. (15 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts