Question: this is mulit part - question it follows cheggs rules The risk-free rate is 2.20% and the market risk premium is 7.03%. A stock with

this is mulit part - question it follows cheggs rules

The risk-free rate is 2.20% and the market risk premium is 7.03%. A stock with a of 1.16 just paid a dividend of $2.31. The dividend is expected to grow at 24.84% for three years and then grow at 3.31% forever. What is the value of the stock?

The risk-free rate is 3.53% and the market risk premium is 5.49%. A stock with a of 1.48 just paid a dividend of $1.40. The dividend is expected to grow at 22.60% for five years and then grow at 4.22% forever. What is the value of the stock?

Caspian Sea Drinks needs to raise $71.00 million by issuing additional shares of stock. If the market estimates CSD will pay a dividend of $2.52 next year, which will grow at 3.05% forever and the cost of equity to be 10.85%, then how many shares of stock must CSD sell?

Suppose the risk-free rate is 2.07% and an analyst assumes a market risk premium of 6.45%. Firm A just paid a dividend of $1.48 per share. The analyst estimates the of Firm A to be 1.31 and estimates the dividend growth rate to be 4.58% forever. Firm A has 256.00 million shares outstanding. Firm B just paid a dividend of $1.68 per share. The analyst estimates the of Firm B to be 0.89 and believes that dividends will grow at 2.73% forever. Firm B has 185.00 million shares outstanding. What is the value of Firm A?

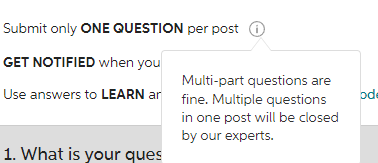

Submit only ONE QUESTION per post GET NOTIFIED when you Multi-part questions are Use answers to LEARN ar fine. Multiple questions in one post will be closed by our experts. 1. What is your ques

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts