Question: this is mulit part - question it follows cheggs rules A stock just paid a dividend of $1.03. The dividend is expected to grow at

this is mulit part - question it follows cheggs rules

A stock just paid a dividend of $1.03. The dividend is expected to grow at 24.70% for two years and then grow at 3.31% thereafter. The required return on the stock is 14.73%. What is the value of the stock?

The risk-free rate is 2.22% and the market risk premium is 6.21%. A stock with a of 1.08 will have an expected return of ____%.

The risk-free rate is 1.79% and the expected return on the market 8.52%. A stock with a of 1.20 will have an expected return of ____%.

A stock has an expected return of 18.00%. The risk-free rate is 1.73% and the market risk premium is 9.49%. What is the of the stock?

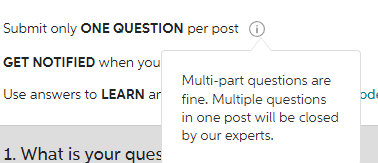

Submit only ONE QUESTION per post GET NOTIFIED when you Multi-part questions are Use answers to LEARN ar fine. Multiple questions in one post will be closed by our experts. 1. What is your ques

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts