Question: This is my last test, and I do not know the answer , I would appreciate it if you could tell me the correct answer

This is my last test, and I do not know the answer , I would appreciate it if you could tell me the correct answer and detail steps

You can use excel sheet or hands writing to answer the question which makes you comfortable. Thanks

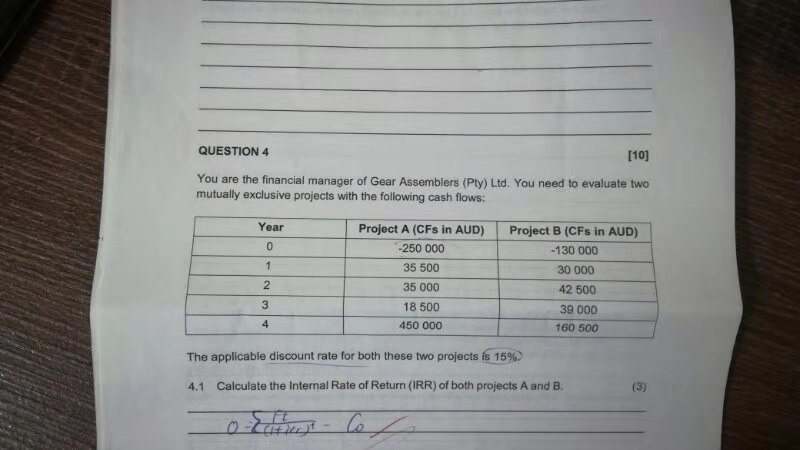

QUESTION 4 [10] You are the financial manager of Gear Assemblers (Pty) Ltd. You need to evaluate two mutually exclusive projects with the following cash flows: Year 0 Project A (CFs in AUD) -250 000 35 500 35 000 18 500 450 000 Project B (CFs in AUD) -130 000 30 000 42 500 39 000 160 500 The applicable discount rate for both these two projects is 15% 4.1 Calculate the Internal Rate of Return (IRR) of both projects A and B. of the Co 4.2 Based only on the IRR criterion, which project would you select? Motivate your answer. (2) 4.3 Explain what it means to evaluate mutually exclusive projects. BrSROLT przew 44 Financial managers ofterfuse more than one investment chterion/technique to evaluate capital budgeting opportunities or projects. Discuss three reasons why it is important to make well-informed and accurate capital investment decisions. (3)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts