Question: This is my last test, and i do not know the answer of 3.2.- 3.4.I would appreciate it if you could tell me the correct

This is my last test, and i do not know the answer of 3.2.- 3.4.I would appreciate it if you could tell me the correct answer and detail steps

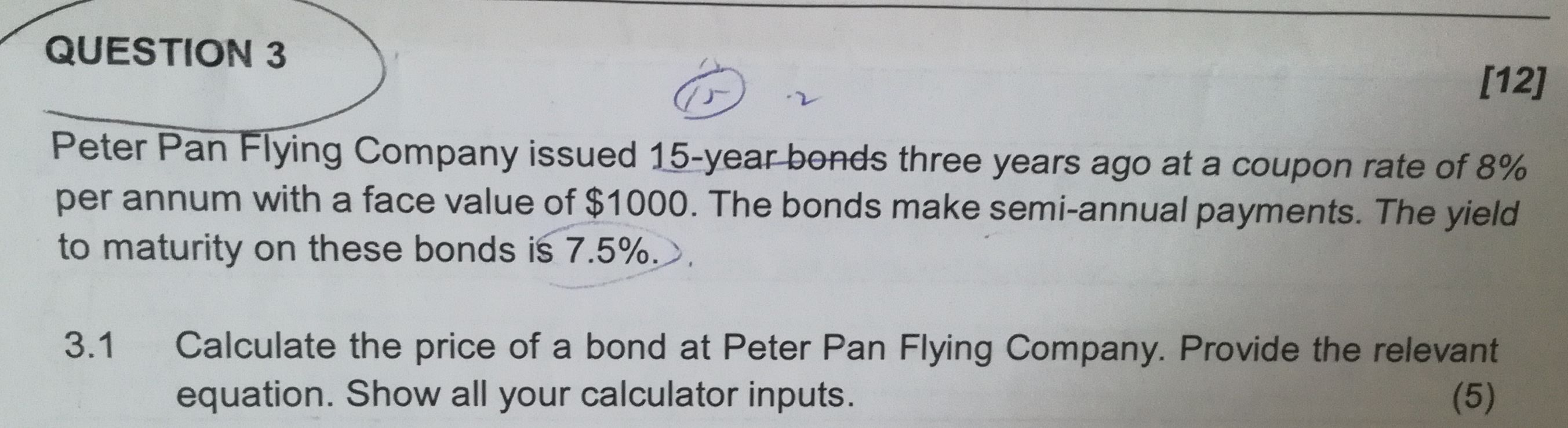

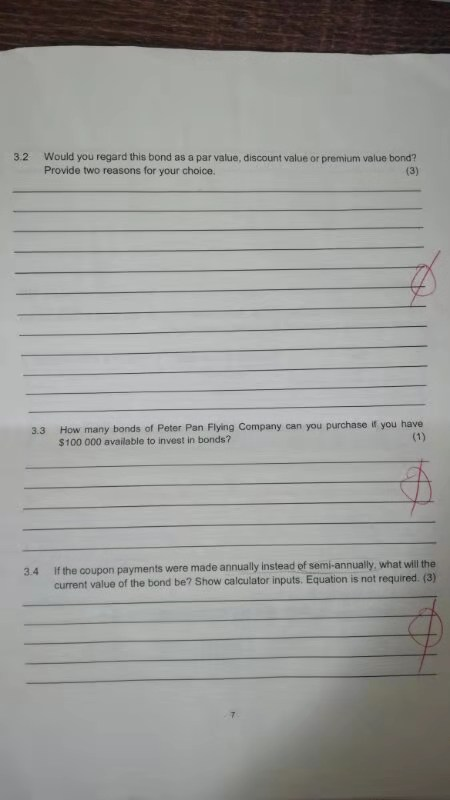

QUESTION 3 [12] Peter Pan Flying Company issued 15-year bonds three years ago at a coupon rate of 8% per annum with a face value of $1000. The bonds make semi-annual payments. The yield to maturity on these bonds is 7.5%.. 3.1 Calculate the price of a bond at Peter Pan Flying Company. Provide the relevant equation. Show all your calculator inputs. (5) 32 Would you regard this bond as a par value, discount value or premium value bond? Provide two reasons for your choice. (3) 3.3 How many bonds of Peter Pan Flying Company can you purchase if you have $ 100 000 available to invest in bonds? 3.4 If the coupon payments were made annually instead of semi-annually, what will the current value of the bond be? Show calculator inputs. Equation is not required. (3)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts